As many of you know, I’m from Detroit, and continue to make my home in the Motor City. For my entire life, it’s been about “The Big Three” – GM, Ford, and Chrysler. In Motown, they are the straw that stirs the Stroh’s.

But there’s a new triumvirate in town – not just in Detroit but across America and all over the globe. Tech now overshadows every other sector in business and industry.

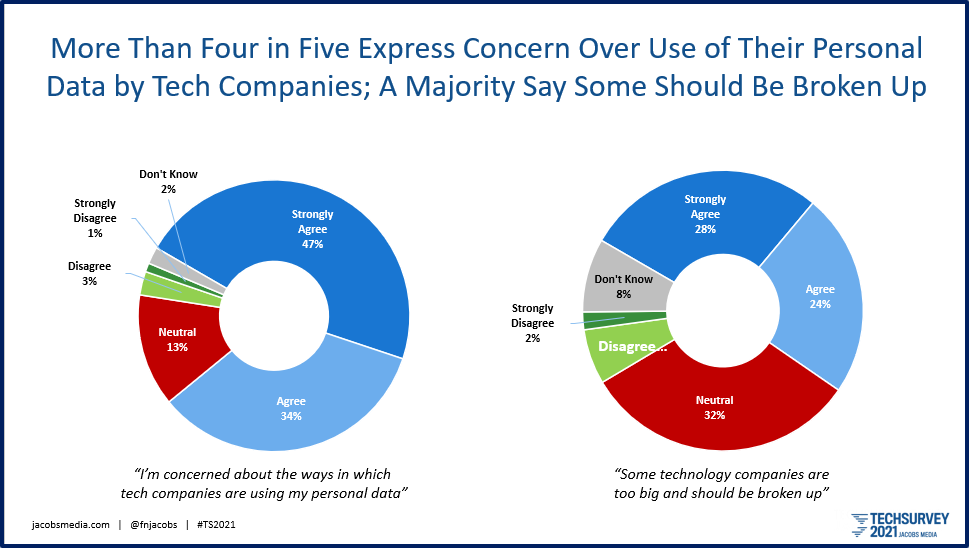

In our past few Techsurveys, we have been investigating the symbiotic issues of privacy and trust – especially when it comes to tech. A handful of companies control much of the entire ecosystem. As they say, “With great power comes great responsibility.” When it comes to the biggest of them all, many consumers are understandably skeptical.

The giants of tech are referred to as the “FAANG” companies: Facebook, Apple, Amazon, Netflix, and Google. If you invested $100 in each of the stocks a decade or two ago, you likely have enough money to buy radio stations and even market them – assuming that’s what you want to do with your money.

As we’ve seen in other phases of American history, outrage over companies that have gotten “too big” has been levels at many industries, from banking to oil. At one point or another, investigations take place, questionable business practices are exposed, and (sometimes) legislative controls are put into place.

One of the problems with the tech relationship with government is that most of the people in positions of power in Congress don’t know enough about technology to post a status update or join a Zoom meeting. How can they ask the captains of the tech industry the poignant and relevant questions that need answers?

One of the problems with the tech relationship with government is that most of the people in positions of power in Congress don’t know enough about technology to post a status update or join a Zoom meeting. How can they ask the captains of the tech industry the poignant and relevant questions that need answers?

The end result is that while most of us use and depend on these companies, we have deepening concerns about how they’re doing business.

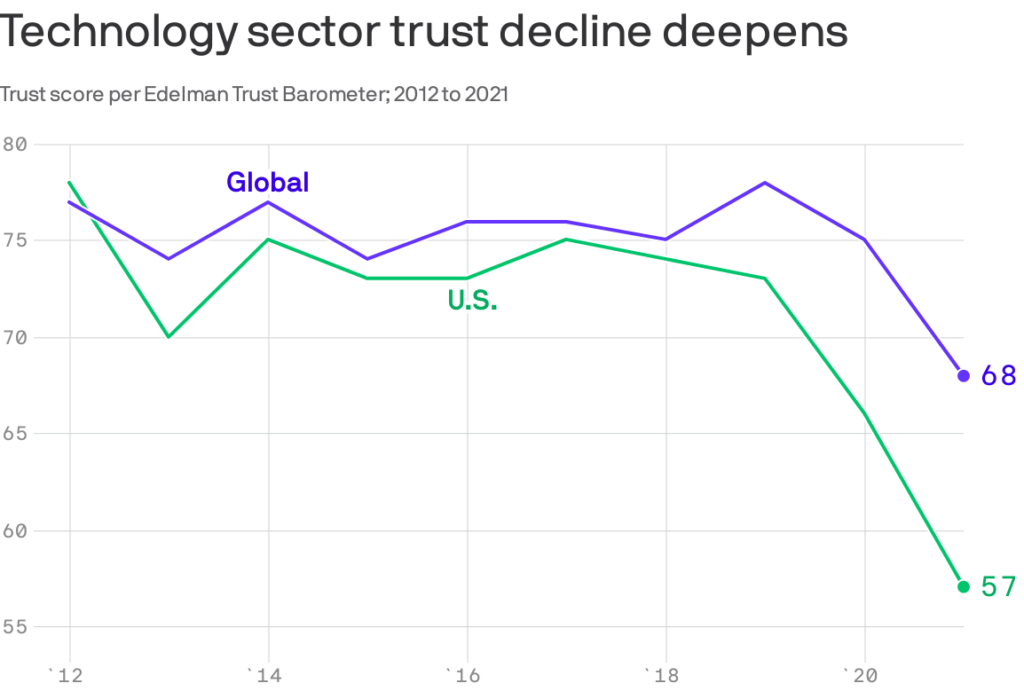

As Mike Allen reported earlier this week in an Axios story, “Trust In Tech Craters,” new research by Edelman confirms this. Their Trust Barometer is a robust survey of 31,000 respondents from 27 countries around the globe.

Last year, record lows were reached in 17 of these countries, including the U.S., along the U.K., France, China and Japan. Given our divided country, it’s not a surprise to see America’s scores lagging behind Edelman’s international sample.

Because tech is the core of Techsurvey, we’ve been checking some of these same perceptions. And two of our agree/disagree statements speak volumes about how core radio fans increasingly view tech monoliths. They very much confirm these Edelman findings:

In just one year, our 40,000+ Techsurvey respondents are even warier of “Big Tech.” Fewer than four in ten agreed that some should be broken up in last year’s survey, fielded just before the COVID outbreak changed everything.

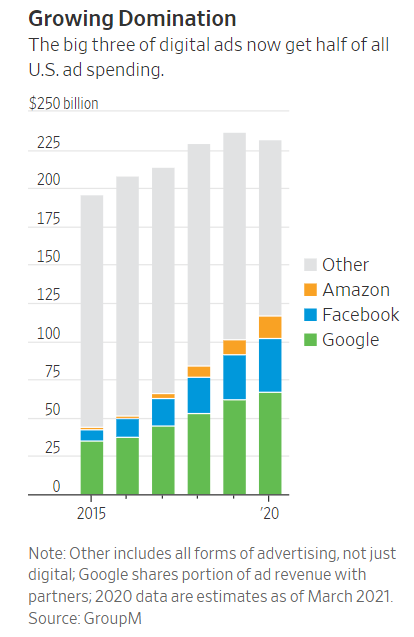

But the issues surrounding how these mega-companies operate transcends consumer trust, and dovetails into commerce. We all know some of the biggest of these gigundous companies are making enormous amounts of revenue on advertising.

That won’t quite hit home until you consider a story that recently appeared in the Wall Street Journal that puts the pandemic’s effect on ad dollar allocation. The headline by Keach Hagey and Suzanne Vranica says it all:

“How COVID-19 Supercharged the Advertising “Triopoly’ of Google, Facebook, and Amazon”

The sub-head reinforces the article’s gist – these three companies take in more than half of all advertising spent in the U.S.

Think about that.

Think about that.

Last week, we highlighted how Oreo’s parent, Mondelēz International, redeployed their ad spending in order to connect with consumers. It turns out they tripled their marketing with Facebook.

The WSJ story lists other examples of massive shifts in advertising revenue now going to “The Big Three of Digital Advertising” – Google, Facebook, and Amazon.

Part of these strategic moves were designed to “meet consumers where they are.” During COVID, that meant sitting at home, staring at their computer screens.

But the appeal of ad tech is also about AI, data, targeting, ROI, and measuring results – all advantages over advertising in magazines, on cable news, or on the radio.

And while COVID may have spiked this data, the trajectory toward “The Big Three” has been in place for years.

The WSJ quotes Nicole Perrin, eMarketer principal analyst who notes, “The pandemic zapped us two years into the future on the commerce side.”

Will this trend abate as the world of advertising and media returns to some semblance of “normal?”

Most experts in the space don’t think so.

Suzy Batiz, a small business owner who routinely worked with Bed, Bath & Beyond on event and coupon promotions for her line of products put it bluntly:

“This is our future. I don’t think we will ever go back.”

That puts this dilemma right where many don’t want it to go: Under the Dome. That is, Congress.

Our representatives in D.C. will be tasked with untangling this pandemic-fueled mess. And talk of break-ups and new regulation will likely take place.

How all of that will effect broadcast radio’s tenuous advertising future is anybody’s guess. The radio business has overwhelmingly supported deregulation over the past few decades for its own holdings. And many radio owners feel that looser government shackles is the only way they can compete moving forward.

But free market capitalism is what has gotten us to this point where three tech giants are riding the big revenue wave, sucking up more than 50¢ of every ad dollar.

But free market capitalism is what has gotten us to this point where three tech giants are riding the big revenue wave, sucking up more than 50¢ of every ad dollar.

Will traditional media companies that own TV stations, newspapers, and radio stations actively lobby to put the reins on “The Big Three” and other tech juggernauts? Their collective future as viable media businesses is on the line.

Will radio broadcasters come to terms with the fact that limiting their efforts to “radio dollars stunts their growth and hurts their ability to survive and thrive? Will they pivot and transform themselves into strong, local platforms that effectively deliver consumers across multiple channels?

Will consumers step up to protest the use of their data and related privacy concerns? Will they care enough to push back against algorithms and AI, and how they’re deployed?

We got our wish – we indeed live in interesting times.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

We all need to stop thinking that radio needs to get back to normal.

Because that “normal”—

Isn’t back there anymore.

That would seem to be the main message in the WSJ story. Next….