After a year like 2020, an economic rebound in the business world was expected – and prayed for. For most media outlets, it’s not hard to beat last year’s numbers. As Westwood One/Cumulus luminary, Pierre Bouvard, reminds, “You can’t fall off the floor.”

That’s a good thing. And as we approach “halftime” in 2021, it looks like that upturn we all hoped for is well underway. Wall Street is trying to get an accurate read on where the money flow is headed – the hot companies, industries, platforms, and startups that we’ll all be talking about at year’s end.

As many industries begin their return to “normal” – restaurants, concerts, sports, travel – companies are chomping at the marketing bit, trying to determine the best, fastest, most cost-effective way to get the word out. And we’re seeing that media frenzy playing out now, as advertisers and marketers jockey for position.

So, who are the winners, the losers, the dark horses, and the comeback kids in the world of media?

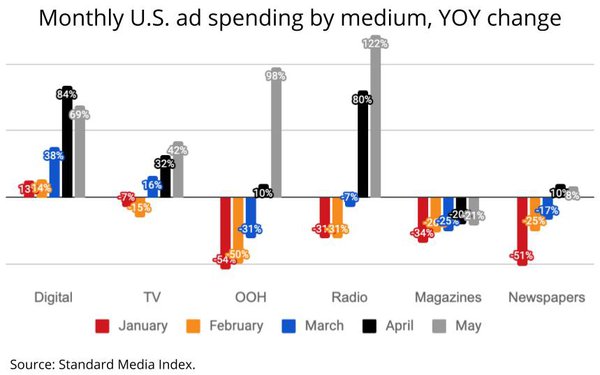

For guidance, we turn to the Standard Media Index, courtesy of MediaPost’s Joe Mandese. Not surprisingly, ad spending in the U.S. is heading straight up year-over-year. In May, it shot up 56%, the best month of the year so far.

But where are those ad dollars being deployed?

When the analysts broke the numbers down by medium and looked across the first six months of this year, the good news is that most were up – except for magazines. Newspapers looked tepid, lending credence to just how far print’s efficacy as an advertising medium has fallen.

Looking back over the last five months, digital looks very strong. While it showed small increases earlier this year when all other media was down, YOY growth in May was an impressive 69%.

Broadcast television was also on the rise, although not nearly as much. It has had three “up” months in a row, culminating with 42% since May of last year – not too shabby.

But then there are the big winners: “out of home” (billboards) and radio, up 98% and a whopping 122% respectively.

What is that about?

Mandese reports that out-of-home behavior – notably, people spending more time in cars – has been the catalyst. And that squares with the effectiveness of billboards and radio, both of which thrive when there’s more traffic. The data indicate the return to “The Great Outdoors” could signal a bullish period for grassroots media that consumers see and hear as they become more mobile.

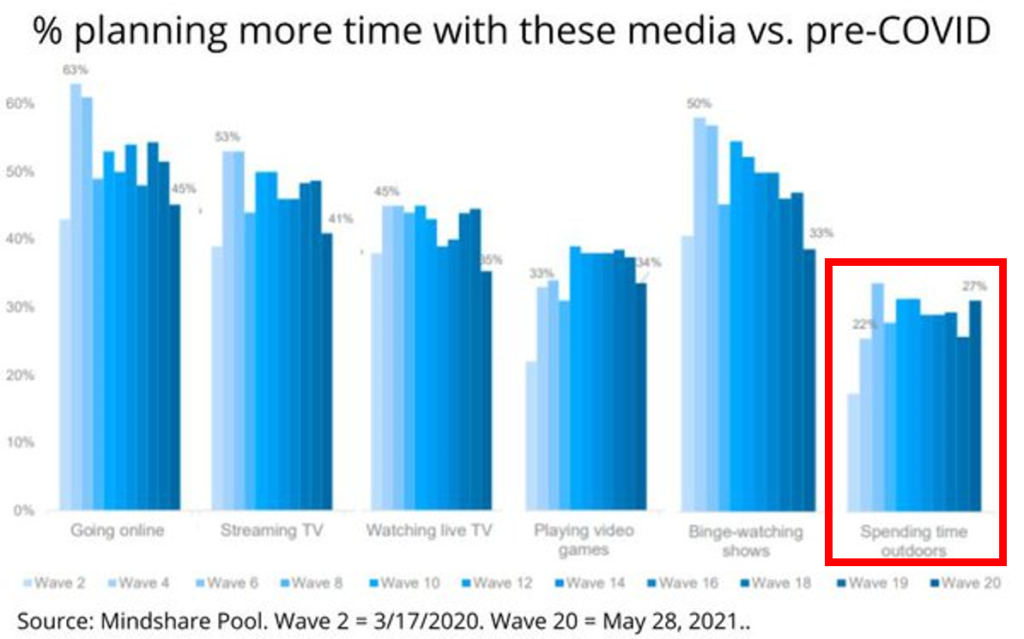

But this isn’t the only study that shows this trend, and that’s a key factor in providing confidence these numbers are reliable. He points to an unrelated tracking study from Group M’s Mindshare that shows a similar trend.

While “spending time outdoors” is trending up, several stay at home activities revolving around TV viewing and time-spent online are all heading south. Mandese concludes these are “findings that bode well for media consumed out-of-home, especially outdoor, place-based media, and radio.”

And radio.

To get an informed view from someone who has her finger on the pulse of media marketing, I checked in with Erica Farber, President/CEO of the RAB. Here’s her take:

“Advertisers are absolutely recognizing the importance of audio within their media mix and are understanding that radio is the backbone/centerpiece of the audio universe. There are lots of reasons for this including it’s an immersive experience for listeners, screen fatigue is driving increased listening and people are finally out of their COVID cocoons.

understanding that radio is the backbone/centerpiece of the audio universe. There are lots of reasons for this including it’s an immersive experience for listeners, screen fatigue is driving increased listening and people are finally out of their COVID cocoons.

“People are being reintroduced to radio and listening levels are almost at where they were prior to COVID. Advertisers are hearing the news and with Americans acquainted again with audio/radio, it is positive news for radio all around.”

After an intensely difficult year for radio broadcasters, the data and the trends appear to be making an important turn. Increasingly, people are back in their cars, traffic congestion is returning, and entertainment, sports, events, and dining are all experiencing a rapid comeback. As key advertising categories for radio, this activity bodes well for the rest of 2021 – and beyond.

Notably advertisers are shifting their resources to media that’s on the ground – outdoor and radio – where they’ve witnessed direct and rapid results over the years. The business world is in a hurry to bounce back, and “windshield media” appear to have the pole position heading into the summer.

This could be a very interesting “second half.”

Group M offers strong data about post-pandemic activities and trends. Access it here.

The RAB’s Tammy Greenberg just published an expansive look at the post-pandemic audio landscape, loaded with great data and observations. You can access it here.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Leave a Reply