In any other year, the pressure to outperform in the fourth quarter is always intense. Everyone’s trying to salvage what’s left of the budget, make up for earlier quarters that weren’t so great, and just finish the year strong. In radio, January is typically a slow month with less demand on inventory, so the last push of the year is always of paramount importance.

In any other year, the pressure to outperform in the fourth quarter is always intense. Everyone’s trying to salvage what’s left of the budget, make up for earlier quarters that weren’t so great, and just finish the year strong. In radio, January is typically a slow month with less demand on inventory, so the last push of the year is always of paramount importance.

This year, you can throw out the radio history books, because none of us knows what this holiday season will look like.

A fiercely fought election – nationally, regionally, and locally – is adding to radio’s coffers in so-called “battleground states” and in highly contested races. While the television airwaves and social media sites are cluttered with political ads, it’s looking like broadcast radio will look back on the election of 2020 as a generally positive event.

And of course, that cues up the holiday shopping season. Halloween is already looking to be subdued. Just as parents all over America have had to scramble to deftly handle the school year, Halloween poses its own unique set of problems.

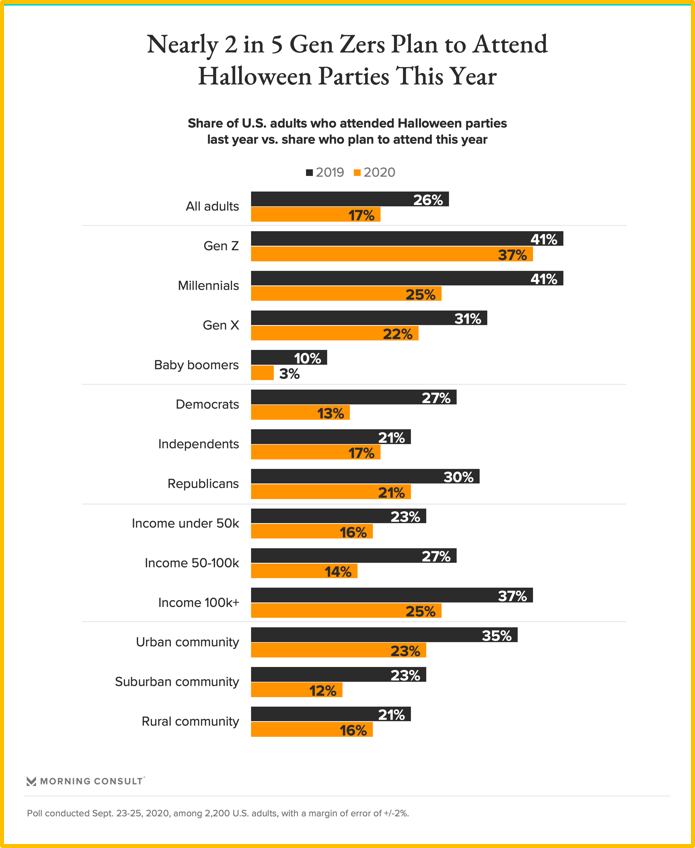

This year, many people will likely sit out trick-or-treating, opting instead for safer activities that put no one at risk. A newly released Morning Consult survey conducted late last month confirms those fears.

The group with the most aggressive All Hallows’ Eve party plans this year are Gen Zs. (And perhaps their parents haven’t yet informed them their Spiderman, Mulan, and Mandalorian masks won’t protect them from the coronavirus.)

Even still, teen Halloween party planning is off from last year, as it is in every other demographic group. What has become a vibrant holiday, featuring lots of local ad spend (parties, haunted houses, etc.), Halloween in 2020 is shaping up to be a downer:

But what about the December holidays – Christmas, Hannukah, office parties, and other festive gatherings?

Here’s what we know. According to Brandwatch journalist, Leia Reid, social media “noise” for Christmas is higher than last year, kicking into gear this summer and remaining well ahead of last year’s mentions.

That’s a positive sign, suggesting strong consumer sentiment for the warmth, comfort, and nostalgia of the holidays. It’s not surprising, especially in this tumultuous, chaotic year.

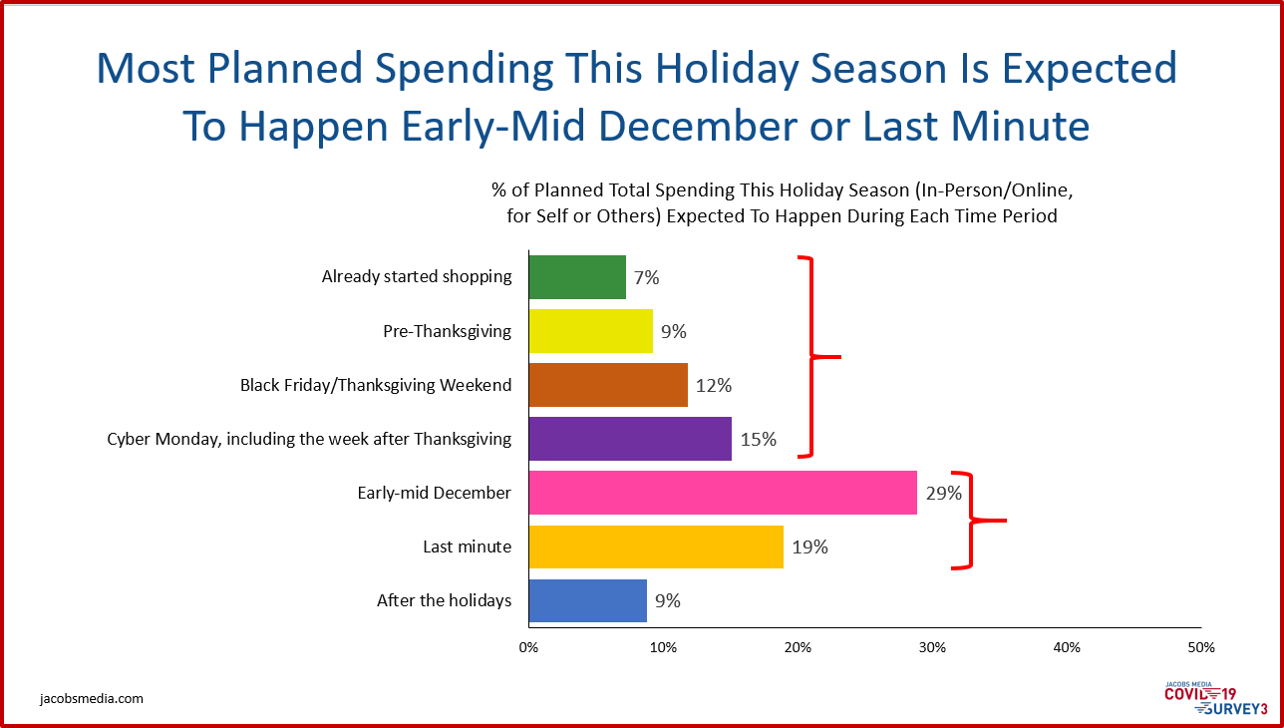

And sure enough, a new COVID 3 study we fielded last week confirms that while a large share of shopping will take place in December (including “the last minute”), many consumers have already started their gift buying activities.

Waiting in line overnight for stores to open on Black Friday may be subdued this year (more on that when we present the data), but the “pregame show” this year may be more robust than usual:

But does this promise of early shopping translate to higher projected spending – on gifts, as well as other expenses revolving around the holidays?

That was part of the mission our company undertook last month when we announced COVID 3 – the third wave in a series we began in late March to help the radio broadcasting industry navigate this crisis.

This new study is especially focused on consumerism, shopping, and the audience’s mindset about the coronavirus and the holidays. Can the one offset the other?

Today, I’m presenting the survey to our 350 radio station “stakeholders” in the U.S. and Canada. Interest is this study was especially strong heading into Q4. And now we have 27,000 core radio listeners to learn from, making it possible to better understand how the holidays might play out.

It will be a challenge.

That’s because while the Christmas spirit may indeed come early this year (including on the radio), consumers appear apprehensive about their spending levels. That’s precisely what Brandwatch learned in their Qriously survey, conducted in August across Australia, China, France, Germany, Italy, Spain, the UK, and here in America.

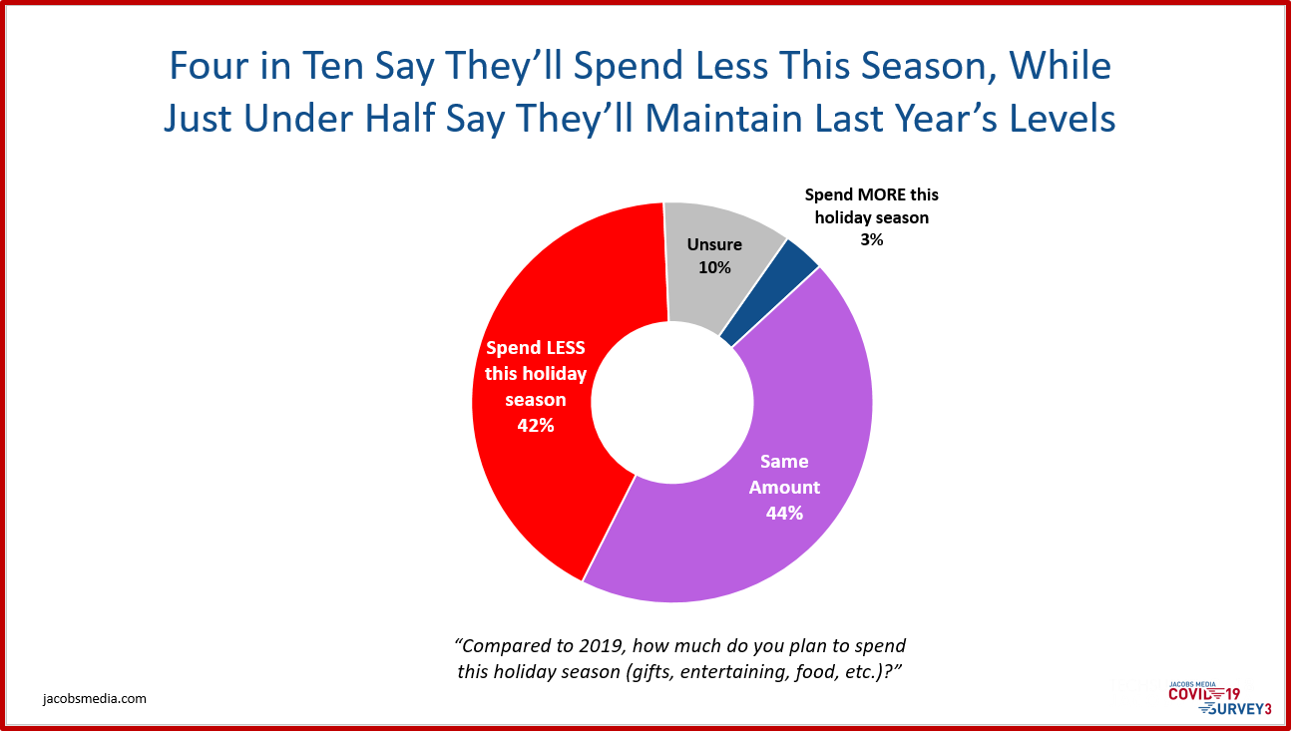

The news is not great. That’s because a majority of respondents (54%) say they’ll spend less this year than in 2019 – a challenging sign for marketers, retailers, and other businesses especially dependent on the holidays.

OK, but that’s from a study conducted last summer from all around the world. What about here in the U.S. and Canada?

Sadly, it’s the same old song.

We learned this early on in our new study. Similar to Brandmark’s findings (although not quite as dour), more than four in ten say their year’s holiday shopping expenditures this year will be lower than 2019’s levels.

We’ve got our work cut out for us. But it’s been that kind of year anyway.

But we persevere. And our COVID 3 study is loaded with data that will help every sales manager and rep negotiate these sand traps and speed bumps. We’ve got timely information across all demographic groups, including 14 radio formats, as well as information about what clients can do to make their holiday seasons brighter – and greener.

The study includes information about Black Friday and Cyber Monday, spending by category, and how in-store shopping can be more attractive by adhering to expected health and safety standards.

If there’s a kernel of good news, it’s that pet owners seem more open to spending money on their dogs, cats, ferrets, and parakeets than perhaps they are on their families and themselves.

I warned you it wasn’t going to be easy.

There’s time to forge a plan, to use this data to help shape your sales strategy. My radio sales alter-ego, Paul Jacobs, will join me for the analysis and presentation of this study. He’ll be loaded up with great ideas to help make the most of a challenging situation this season.

Let us know how we can help.

We’ll be presenting COVID 3 in partnership with the RAB, Monday, October 12 at 1pm ET. It is free to all RAB members. Registration info here.

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

Leave a Reply