Long after the pandemic is thankfully in our rear-view mirror, marketers and scholars will be analyzing the tectonic economic impact of 2020, especially on key business sectors. Travel, leisure, and retail have all experienced epic downturns, putting scores of well-known brands out of business.

But there’s always a flip-side – the sectors and companies that found themselves in the right place at the right time. Virtual meeting brands – yes, Zoom – continue to make their fortunes due to the restrictions from the pandemic, connected with the tidal wave of people working from home.

And then there are the brands that have capitalized on our “down time” – SVODs or streaming video on-demand brands. Our three COVID studies in 2020 among core radio listeners revealed the big media winner was entertainment juggernauts like Netflix, Amazon Prime, and Hulu.

Disney+ had the good fortune of launching three months before the pandemic hit. Armed with a trusted, iconic brand and fabulous content, many believe Walt Disney’s streaming company will surpass Netflix in global membership in just a few short years.

But lately, there are signs things may be souring for the biggest SVODs, based on Netflix’s first quarter performance. You can read the writing on the wall. The blue bars on the chart below show first quarter performance each year. Netflix’s growth is slowing down to the point where the company is predicting just one million new subscribers in Q2 – where we are right now. That’s a significant comedown.

The culprits? The wind down of COVID, as well as less compelling content being offered by Netflix.

Does this signal a crashing end to the fortunes of companies like Netflix, or the entire SVOD category? Not even close.

Consider this fun fact:

There are now more SVOD subscriptions in the U.S. than there are people.

Television Business International (TBI) reports that subscription contracts surpassed the 340 million mark, as it roars past the total American population.

They quote Ampere Analytics who reports that over one-fourth of Internet users in the U.S. subscribe to five or more SVOD platforms.

Ampere analyst Toby Holleran says that “service stacking” – paying for more than one service (in this case, SVODs) has become even more common. New services like Paramount+ and Discovery+ are contributing to this trend.

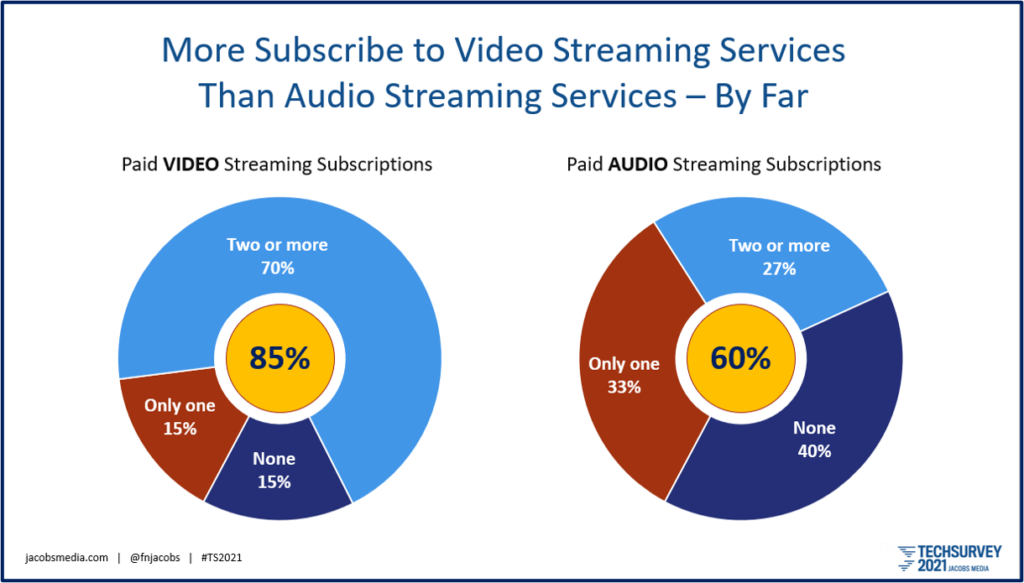

Techsurvey 2021 stakeholders aren’t surprised. Our study of more than 42,000 core radio listeners shows that well more than eight in ten subscribe to at least one SVOD service. And there’s no shortage of “service stacking” as most subscribers are paying for multiple video on-demand platforms.

While audio streaming platforms are well behind, it’s noteworthy that six in ten respondents are paying for a service like Spotify, Pandora, or Apple Music.

That means most Americans are not only willing to pay for content, they’re also becoming more used to enjoying it without commercials.

That has implications on the basic ways in which people are consuming content – their expectations and their standards.

And for commercial broadcasters – TV and radio – the comparisons become even more obvious to consumers becoming increasingly comfortable with paying for the privilege of not having their favorite programming interrupted by Kars-For-Kids, erectile dysfunction, and sports betting ads.

It is also a reminder that radio’s competition is increasingly not other radio stations. The more satellite radio and streaming audio subscribers there are, the more likely these inevitable content and experience comparisons are taking place.

But there may be some good news – and the Netflix earnings report may be a positive sign:

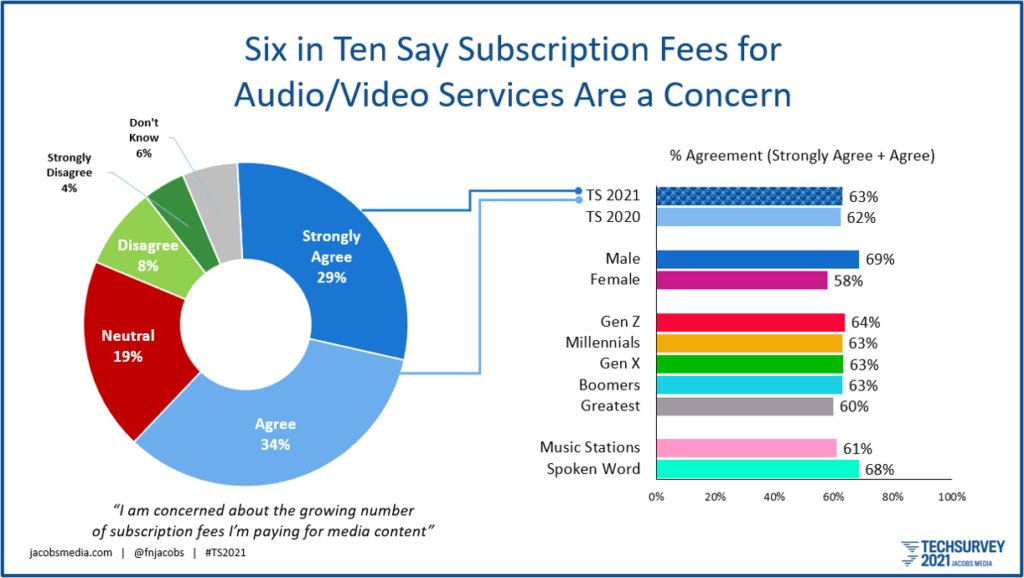

Consumers are increasingly becoming concerned about the number of content services they’re paying for:

The demographic subgroups tell an important story. The rising number of subscription fees is a financial concern whether you’re 17 or 77 years-old.

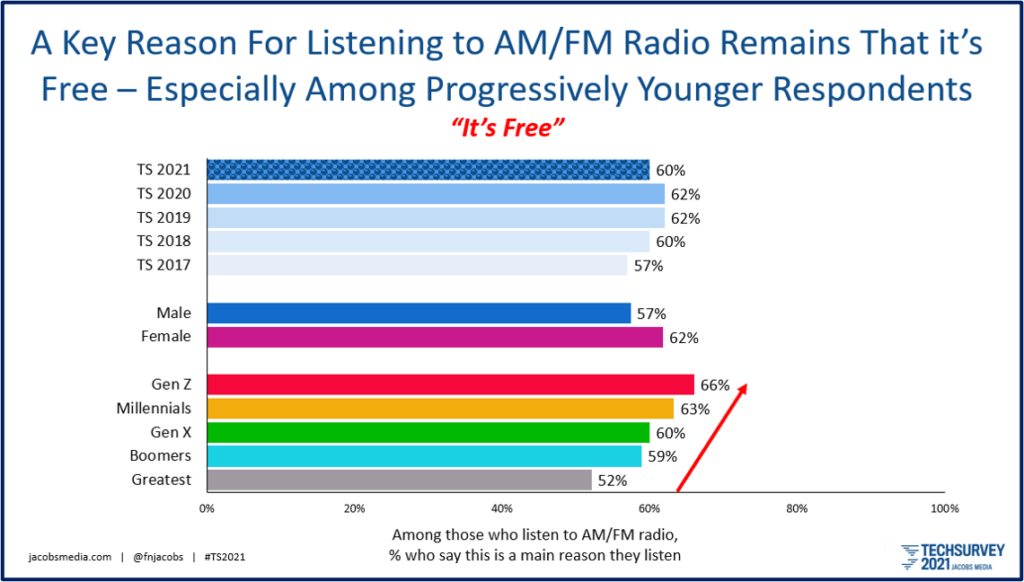

And that leads me to one more Techsurvey chart – the one that describes the foundation of why radio fans are still very much listening to radio. When we break down those main reasons why broadcast radio is still in the entertainment and information game, we learn that six in ten respondents embrace a simple two-word explanation that speaks volumes about radio’s past, present, and perhaps its future:

It’s free.

The vast majority of radio listeners are on the same page, especially those in younger generations. That says a lot about who is impacted most by overt and incessant advertising, and also where strategic messaging might be even more effective.

Maybe public radio has had it right all along. Instead of subscribing to WNYC, it’s about membership. The exchange of dollars nets out the same, but perhaps the perception among supporters has a better more inclusive ring to it.

And similarly for commercial radio, there are many benefits to listening to its diverse variety of formats, its local brands, the fun giveaways, “Second Date Update,” and all those great personalities.

But let’s not forget one of the most important stealth benefits:

A radio subscription won’t show up on your credit card bill at the end of the month.

In 2021, that might prove to be a home run.

Join me today at noon ET for our exclusive Techsurvey 21 presentation at the All Access Audio Summit. Info here.

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

- I Read The (Local) News Today, Oh Boy! - April 15, 2025

Really, Fred? My credit card monthly statement shows dollars going to at least four OTA radio broadcasters and a couple of stream-onlys. But, in my defense, they did ask for them.

John, that’s the nature of non-com’s, which is what I’m assuming we’re talking about. At least, they don’t play much in the way of commercials.