Data is everywhere – and not just on spreadsheets.

And more and more, the brands with which we interface are supplying us with more and more data to help us better understand our interactions with their products. And along the way, perhaps we learn something about ourselves.

If you’ve bought an Apple Watch yet, a competing product, a Fitbit, or similar wearable, you are now in the process of tracking your steps, your workouts, your activities. A visit to most modern health clubs reveals not just machine, but performance trackers that help you keep pace with your workouts and activity. Fitness classes allow you not only see your own metrics, but those of the entire group. Data has spurred competition.

If you’ve bought an Apple Watch yet, a competing product, a Fitbit, or similar wearable, you are now in the process of tracking your steps, your workouts, your activities. A visit to most modern health clubs reveals not just machine, but performance trackers that help you keep pace with your workouts and activity. Fitness classes allow you not only see your own metrics, but those of the entire group. Data has spurred competition.

Of course, Apple is also tracking usage of your iPhone in their Screen Time feature, designed to provide insights about how often you use your phone, apps, and other interesting (and scary) data that illustrates just how addicted you really are to your smartphone.

If you subscribe to Netflix, you receive regular emails that compile your data, apply their algorithms, and direct you to other shows and programs on the platform. Their “You might enjoy” missives contain trailers, capsule summaries, and other come-ons designed to increase your use of Netflix. And more often than not, they do a good job of targeting your tastes.

Amazon, of course, has been in the “suggestion” business for years, summing up your purchases, your searches, your “Wish List,” and other on site data to compile recommendations, sales offers, and other “gift ideas” designed to amp up your activity, all made simpler by the ease of Amazon Prime.

Every automaker we have connected with over the past five years has made robust investments in data, convinced that consumer behavior behind the wheel – from location to radio listening – will reap marketing gold once they figure out how to use and deploy it. Many are actively engaged in the creation of programs that combine driver and passenger data with GPS, shopping information, and the power of AI to stitch together huge opportunities for monetizaiton. Yes, that’s what radio does, too.

And then there’s the most personal information of all – your DNA. This holiday season, one of the gifts that looks like it will be especially popular is  the “23 And Me” kit, along with other competitors in the space. These companies will tell you about your ancestry, your roots, and if you believe the marketing, more inside historic info about who you really are, where you came from, and why that matters.

the “23 And Me” kit, along with other competitors in the space. These companies will tell you about your ancestry, your roots, and if you believe the marketing, more inside historic info about who you really are, where you came from, and why that matters.

Your American Express summary at the end of the year shows your purchase activity over the past 12 months, conveniently categorized by category to help you better understand how you’re spending your money.

And then there’s Spotify. Their Wrapped feature, which most likely landed in your email box  earlier this month, cleverly compiles your listening behavior over the past year, and does it with panache and a wink. It as if Spotify’s data designers sat through too many boring PowerPoint data presentations. Wrapped is a holiday present to their users – a delightful, insightful way to visualize your music consumption.

earlier this month, cleverly compiles your listening behavior over the past year, and does it with panache and a wink. It as if Spotify’s data designers sat through too many boring PowerPoint data presentations. Wrapped is a holiday present to their users – a delightful, insightful way to visualize your music consumption.

And it contains a true look at he type of music you enjoy. jacapps COO Bob Kernen is constantly listening to music and like many Spotify subscribers, loves the way the brand uses data to stimulate and entertain.

As he explains, “Seeing any particular behavior that one engages in reduced to a raw number always stops you in your tracks. My listening on Spotify came out to 11,655 minutes in 2018 – that was almost 200 hours on average each week. Now I listen a lot at work, so that made sense to me, but it was still surprising to see it reduced to one five-digit number.”

To engage you, Spotify’s 11-slide presentation of your music usage also contains different data arrays to draw you in, learning more and more about your music listening patterns and tastes. From quiz questions to revealing the astrological signs of the artists you listened to most, Wrapped is a brilliant, engaging use of data.

The Atlantic’s Haley Weiss summed up the impact of this data collection activities in a recent story, “Why People Love Spotify’s Annual Wrap-Ups.”

“People love Spotify Wrapped. We love the stories that the thousands of hours of music we listened to this year tell about us. We love the embarrassing revelation of a guilty pleasure, or the reinforcement of a cultivated musical identity when the bands at the top of the list match the T-shirt collection in our drawers.”

And of course, many “socialize” their Wrapped results on the Facebook, Instagram, and other sharing outlets – happily showing friends, family, and colleagues what they’re about musically.

For Spotify, Weiss points out how Wrapped “is a masterful coup of free advertising and in impressive display of consumer trust at a moment when our faith in tech companies is historically low.”

For Spotify, Weiss points out how Wrapped “is a masterful coup of free advertising and in impressive display of consumer trust at a moment when our faith in tech companies is historically low.”

And that privacy issue is at the other end of the fulcrum, as consumers weigh the balance between companies personalizing their data with insights and invasions and incursions that threaten our welfare.

That said, imagine what a radio programmer could do with this information about station audiences. But now the average Spotify user knows all about the new stuff, oldies, and “guilty pleasures” they listen to all year round.

Spotify Wrapped and these other examples go well beyond data. They’re truly about personalization. Weiss points out that in the introduction is a reminder that “no one else listened exactly like you.”

Retailers around the world are getting the message, investing heavily in data, AI, and insights to better understand and serve their customers. A story in eMarkter Retail last week, “Why Retailers Are Racing To Crack The Personalization Code” by Andria Cheng, quotes a Boston Consulting Group survey of corporate execs who estimate that using data to offering personalized experiences will lead to revenue increases of 6-10%.

That’s not chump change.

Starbucks’ President/CEO, Kevin Johnson, told company investors that “personalization is the biggest driver of improved spend per customer.”

Cheng quotes Nike CEO Mark Parker who’s also on board the data wagon to better personalize the company’s brand engagement:

“We are aligning all of our firepower against the consumer experience.”

And Walmart’s new technology incubator, Store No. 8, is heavily investing in new technologies that provide greater insights into customer personalization.

So, where does radio fit into the equation?

As we know from our conversations about attribution, most broadcasters have fallen behind the curve when it comes to connecting the dots between advertising, consumers, and purchasing behavior.

But an even greater deficit is the database marketing activities that too few radio stations and the companies that own them have instituted over the past two decades or so.

Trusted radio stations brands have a truly unique opportunity to capture, aggregate, and strategically use this data to delight customers, assist their advertisers, and learn more about the people who carry around diaries and meters.

But as we learn every year around this time as Techsurvey is about to launch, many stations are simply in the Dark Ages when it comes to database marketing, data collection, and strategic application of these tools.

Not surprisingly, the companies that have invested heaviest in mobile – iHeart and NPR – have the most insights, thanks in no small part to the iHeartRadio and NPR One platforms. And we’re not talking just about how consumers use their apps, but more to the point, how they listen to radio, music, news, podcasts, and other audio content.

How they share this information with both listeners and marketers goes to the heart and soul of how the radio broadcasting industry must evolve in order to keep pace.

All the metrics lead to the reality that Vilfredo Pareto was spot on when he coined his eponymous principle, better known as “The 80:20 Rule.” It applied to Italian landowners in the early 20th century, and today to consumers who are known as “high value.”

All the metrics lead to the reality that Vilfredo Pareto was spot on when he coined his eponymous principle, better known as “The 80:20 Rule.” It applied to Italian landowners in the early 20th century, and today to consumers who are known as “high value.”

Boston Consulting’s Mark Abraham affirms these special consumers drive 70% or more of the value for companies that cater to them – close to Pareto’s threshold.

And yet, many companies – not just radio broadcasters – struggle to get their arms around the data and figure out how to use it. Cheng says nearly six in ten companies are struggling in the data measurement department.

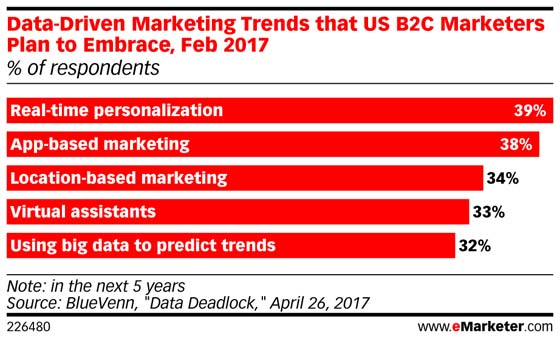

And she quotes a survey by BlueVenn conducted last year that shows – among other things – that fewer than 40% of marketers are enthusiastically embracing “real time personalization” any time soon.

For radio broadcasters, this is another “heavy lift” on an increasingly long list of investments, ventures, and initiatives revolving around “Keeping up with the media Joneses.”

But using the data broadcasters already own to create audience profiles for content creation, distribution, and sales/marketing are increasingly becoming essential to success in both programming and sales.

How’s your data?

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Leave a Reply