Yesterday’s post – “Can Radio Broadcasters Navigate The Digital Divide?” – elicited some on-point comments from a number of readers about the optimal ways in which radio broadcasters might actually be successful in the digital space. And to their credit, Townsquare’s strategy received kudos, not just because they are reaping the benefits, but especially because of the unique ways in which they’re doing it.

Paul and I spend much time looking over other legacy media players, studying their successes and failures, thinking about how radio might embraced – or reject them. As many of you know, I have been a fan of Pareto’s Principle – better known as “The 80/20 Rule” for some time now. A focus on the core – not to the exclusion of all others – but to embrace active fans who are still very much engaged with the product is a sound philosophy more than a century after the Italian landowner for whom it is named came up with the idea.

Our Techsurveys lean on the principle, primarily because our sample is largely comprised of fans, many of whom are members of a station’s database. (By the way, results of Techsurvey 2023 will start being released soon, so please stay tuned.) By knowing what your core audience is thinking and feeling, radio broadcasters stand a better chance of reinforcing their base – the ones who show up at car dealerships and concerts and also those most apt to consent to carry around a diary or a meter.

But like any strategy, a media brand can focus on it to a fault. That’s what the brain trust at Nieman Marcus appears to be doing. Like radio stations, department stores are feeling the full force of disruption, especially from e-commerce behemoths, starting with Amazon. The failure of Macy’s, Sears, J.C. Penney’s and others to adapt to online purchases has severely set them back, usually leading to pain and in some cases, going out of business altogether.

So why not try something different, a la Townsquare, perhaps turning the traditional retail model on its head. A story in Retail Wire puts the dilemma in question form:

“Is Neiman Marcus right to focus on the top two percent of its customers?”

You’re reading that right. The legacy retailer is essentially narrowing its efforts on what might be redefined as “The 2/40 Rule.” Neiman’s CEO, Geoffroy van Raemdonck told Fortune earlier this year the store will be focused on a small – highly wealthy – group of shoppers.

might be redefined as “The 2/40 Rule.” Neiman’s CEO, Geoffroy van Raemdonck told Fortune earlier this year the store will be focused on a small – highly wealthy – group of shoppers.

While the logic here is obvious, the strategic sense of this plan is highly questionable – especially demographically.

High spenders at a store brand like Nieman Marcus are likely older. And just as concerning, what about “future millionaires?” If these stores don’t establish purchasing patterns when consumers are still “up and coming,” is there really hope to attract them later in their spending lives?

The New York Times is proving to be a much better example for traditional media platforms – like broadcast radio, for example. The “old, gray lady” as the newspaper is often called has been executing a smart strategy for several years now, leaning into other tastes and interests of their readers.

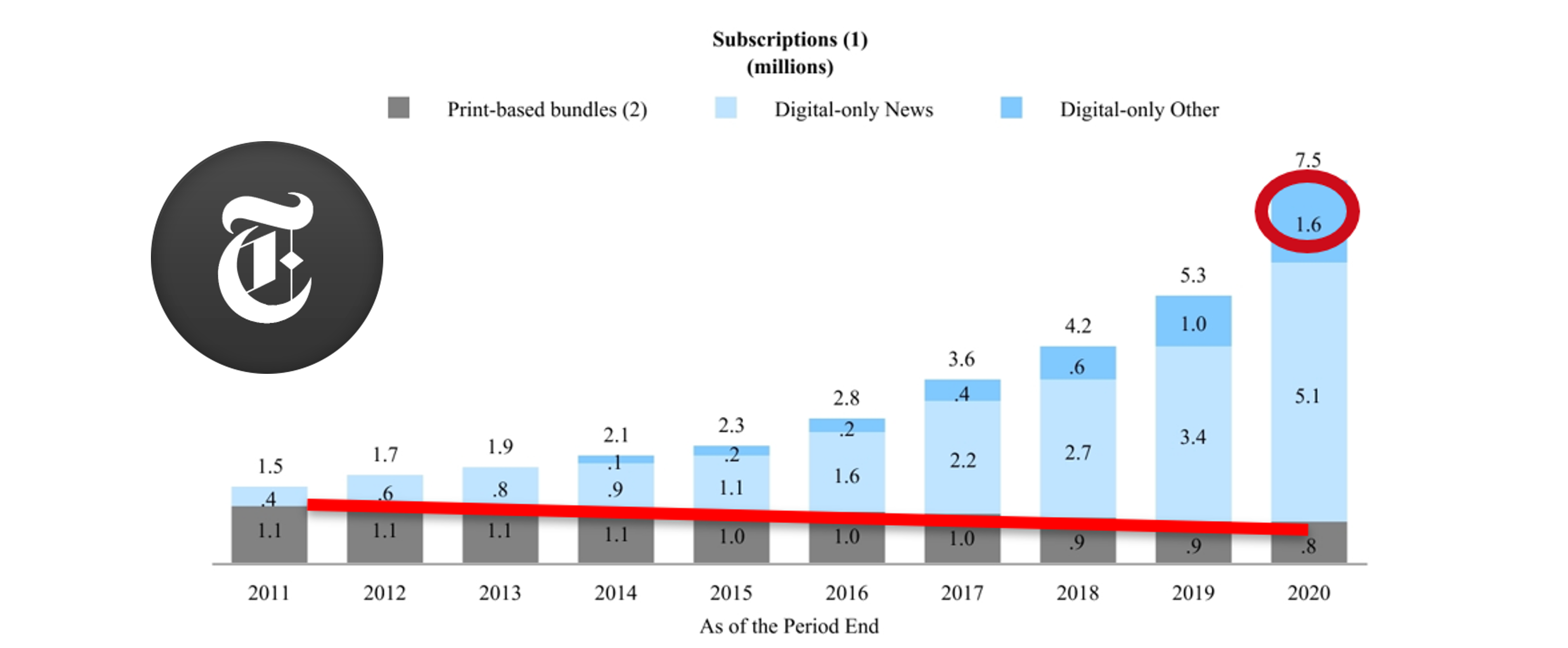

Like radio’s near flat-line on radio revenue, the Times’ ability to generate growth on its readership has slowed considerably (dark gray in the chart below). But its growth in digital (light blue segments) has been dramatic.

Even more impressive is the Times’ “near-adjacent” strategy (dark blue segments), adding to the top and bottom lines, often without adding a great deal of expenses in content creation. By leaning into the habits and lifestyles of their readers – especially cooking and word games – the Times is now expanding into other verticals that bring new audiences to the brand.

These ventures represent millions of subscribers to new content categories, as well as millions more dollars in revenue for areas in which the company already had assets. Will Shortz, the “puzzle master,” has become an institution at the Times, as well as a personality on NPR.

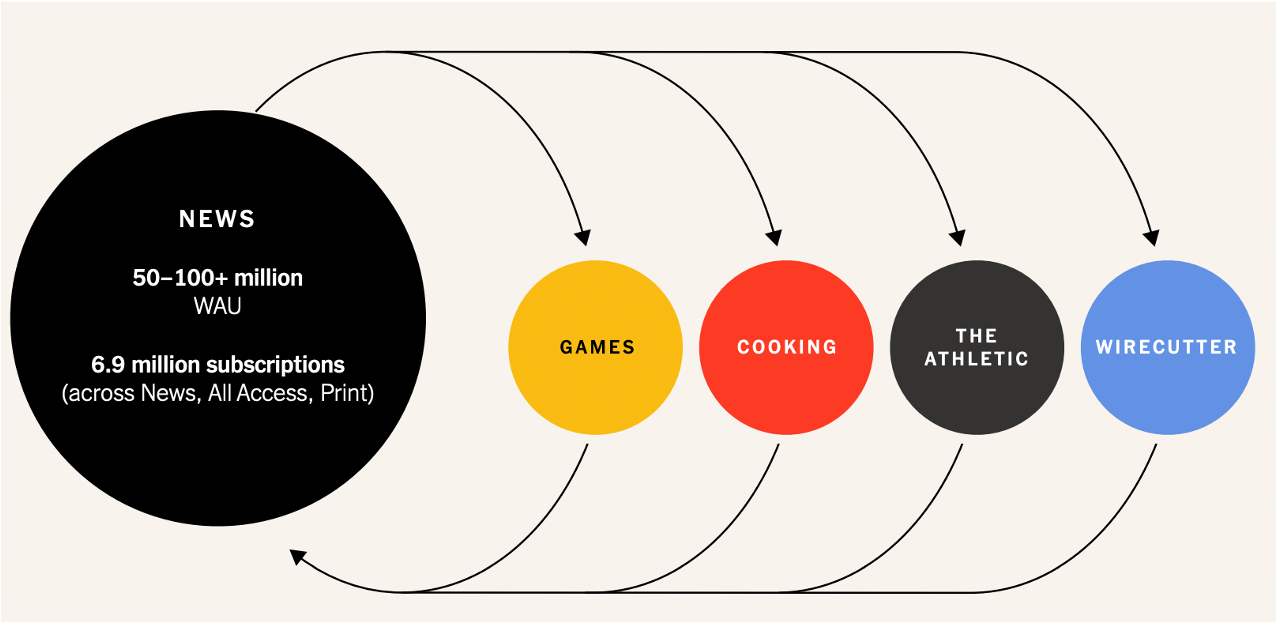

More importantly, the Times is seeing strong indications that this influx of new consumers to these verticals stimulates growth in other content silos. Once they’re in the Times’ family (think like cuming a station in the cluster), there’s the opportunity to market other products to them. You can see that “cross flow” on the chart below, especially as new centers of content are created in “near-adjacent” interest areas:

Cooking and games were a natural for the Times. But sports? Not so much.

Over the decades, the Times’ coverage of sports has been pedestrian at best, mediocre at worst. To the chagrin of its readers interested in scores, commentaries, trades, and drafts, the paper traditionally mailed it in.

That was until the Times purchased The Athletic early last year for the impressive sum of $550 million. The platform is still losing money, but is adding revenue – and subscribers – to the company’s portfolio of content.

Historically, sports as a category doesn’t test well. If you’re not a sports radio station and you’ve conducted your research across your cume, chances are sports ranks near the bottom of the heap. But that doesn’t account for how a unit like The Athletic covers it.

Whether it’s the fate of Aaron Rodgers, the retirement of Coach Jim Boeheim, or Brittney Greiner’s ordeal, the biggest stories of the year that move us typically go beyond any scoreboard. They touch our hearts and our souls. The Times knows this drill well.

These are the moments where typical Q&A audience research falls short. Think about NPR’s iconic show, “Car Talk.” Had you conducted a research survey to test interest levels in auto repair among Public Radio listeners, the topic itself would have generated virtually no appetite. But the show, produced and created by the great Doug Berman, was truly about a couple of wise-ass Boston brothers who loved to interact with people and talk about cars – and families, relationships, food, fun, and life. And laugh. A lot.

These are the moments where typical Q&A audience research falls short. Think about NPR’s iconic show, “Car Talk.” Had you conducted a research survey to test interest levels in auto repair among Public Radio listeners, the topic itself would have generated virtually no appetite. But the show, produced and created by the great Doug Berman, was truly about a couple of wise-ass Boston brothers who loved to interact with people and talk about cars – and families, relationships, food, fun, and life. And laugh. A lot.

In short, it was entertainment for a furiously loyal audience. Public radio could use a “near-adjacent” hit show like “Car Talk” right now.

It means thinking like a content company – not a radio station. Too often, the digital efforts of broadcasters have taken the form of yet another repurposed piece of content – a podcast that’s a time-shifted radio show, the station’s website or app, social media posting.

They may be strong efforts, but they are all derivative of “the mothership” – the radio station.

The Times sees itself as a media entertainment and information company. The newspaper may be its core foundation, but “near-adjacent” content stands on its own. They cross-promote their verticals, but The Athletic, the Games subscription with the recently-acquired addictive hit, Wordle, and Wirecutter, a tech advice and review source are their own entities.

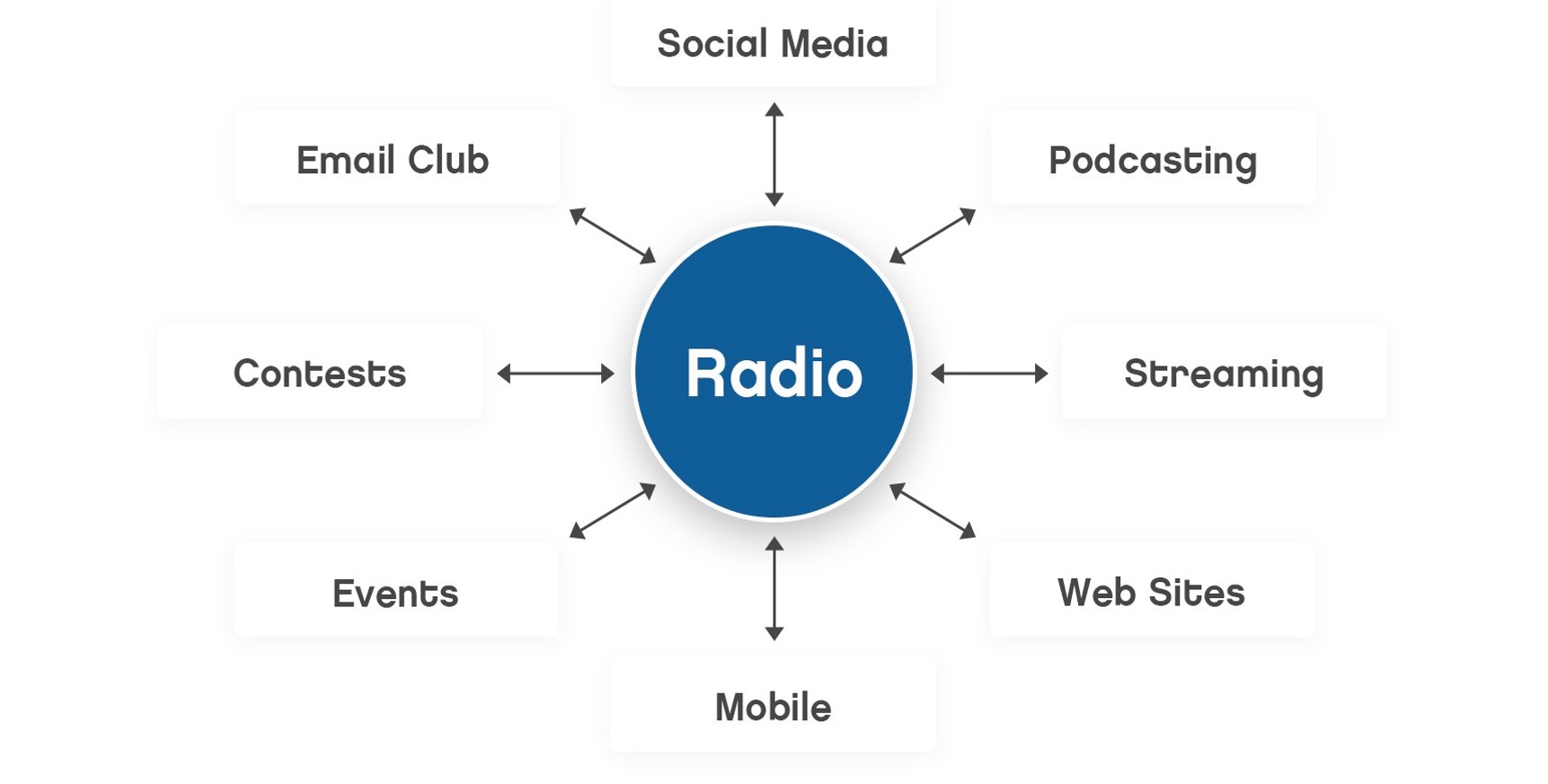

Their model looks more like the reimagined radio concept depicted below:

In this strategic model, the radio station is one of many content verticals. The other platforms are just examples of what radio broadcasters might create, many of which might have little to do with the core product of music, personalities, and promotions.

And this is where radio’s “superpower” comes in. Unlike other traditional media, radio stations have the ability to move the audience around the content platform, driving the audience to an event, to download a podcast or an app.

Townsquare’s strategy with call centers and local events and festivals is similar in many ways to this model.

But the problem is that these strategic spinoffs require considerable research and investment. The Times didn’t acquire Wordle or The Athletic on a whim. Townsquare didn’t hire 600 people in Charlotte for the hell of it. They made the call these “near-adjacent” products could fill a key need and stand on their own. And their ability to create a “cross flow” with other assets is the cherry on top.

Part of the challenge for radio lies in the decision of whether it makes more sense to “buy or build” these “near-adjacent” plays. Again, research and a whole lotta due diligence are central to success. The lack of them are almost always a path down the road of failure.

Part of the challenge for radio lies in the decision of whether it makes more sense to “buy or build” these “near-adjacent” plays. Again, research and a whole lotta due diligence are central to success. The lack of them are almost always a path down the road of failure.

None of this is to suggest that “near-adjacent” endeavors must be different than the core product. The big Country station in town buying (or building) a Country bar might be a smart play in a lot of markets.

Much of the determination comes down to researching your audience’s interests, above and beyond your core format, whether it’s music or spoken word. What else are they “into,” where else do they spend their money, what are their true passions? And how can the company tap into those opportunities with products that work?

You can see it in the way both Townsquare and the Times have constructed their “near-adjacent” frameworks. Nothing is “recession-proof,” of course, but when you have content centers across different verticals with diverse audiences, your chances are a whole lot better.

None of this is to suggest a “near-adjacent” model is an easy one or one that will start cash flowing by Q3. As noted, the Times is still wrestling with The Athletic, and may continue to for the foreseeable future.

This strategy is an investment in a media company’s future.

Not a bad idea, right?

Yesterday’s blog post, “How Radio Broadcasters Can Navigate The Digital Divide,” can be accessed here.

- The Hazards Of Duke - April 11, 2025

- Simply Unpredictable - April 10, 2025

- Flush ‘Em Or Fix ‘Em?What Should Radio Do About Its Aging Brands? - April 9, 2025

Once again, great thinking by The J. Team! RADIO is the original content provider. Now with more ways to listen more often on excellent sounding receivers.

Thank you, Clark!

Excellent view of radio’s important place in driving content and verticals.

Its role is critical and changing and understanding that, is the start of of building a winning strategy.

As always, Fred is a thought-leader for our industry.

Most appreciated, Tom.