We can throw the 93% number around all we like, but the bottom line is that radio listening levels vary depending on the group you’re looking at.

In a recent series of posts, we’ve talked about the concerning radio problem centering on lost youth – specifically, the notion that the medium has lost a generation of listeners over the past decade or so.

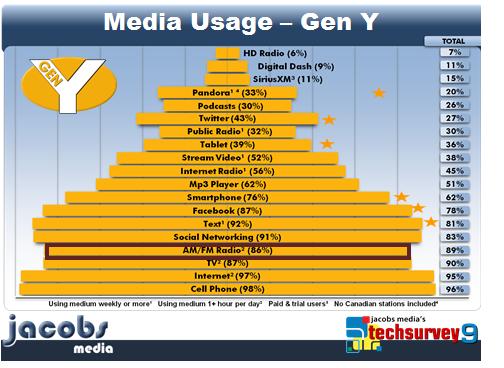

Some might argue that we’re actually talking about two generations that are simply not as engaged with radio as their parents. Gen Y – or Millennials – is a case in point. Here’s their Media Usage Pyramid from Techsurvey9. A look at the black bar below indicates that 86% of these twenty and thirtysomethings listen to radio an hour a day or more. That’s below the study average of 89%.

And this pattern intensifies when we examine Gen Z – those 20 and younger. Only 78% of them listen to broadcast radio for that one hour minimum a day.

This may not be an issue for radio today – or even a year or two from now – but the assumption that they’ll be back someday is not a logical one. Habits, patterns, desires, and tastes are formed when we’re young. The less that new generations of consumers experience radio, the less they’ll be connected to the medium as they mature.

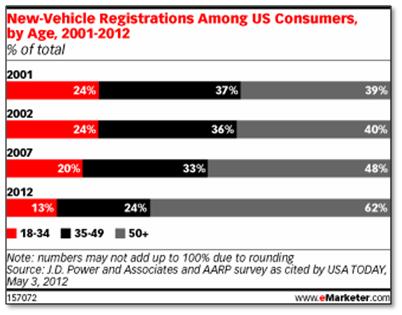

The auto companies know this only too well and radio would be smart to watch their moves carefully. A recent eMarketer report outlines the problem – 18-34 year-olds are simply not buying new vehicles like they used to. In just the last decade, the industry has experienced precipitous drops in new car registrations:

If this looks similar to ratings trends you’ve seen, the challenges facing both the automobile and radio industries when it comes to Millennials ought to be obvious.

And it’s not just the automotive sector. A recently released generation study commissioned for MTV has renewed their energy for digging back in and reconnecting with 12-34 year-olds. Unlike other entertainment brands, MTV cannot rely on aging with its audience. In fact, the president of MTV, Stephen Friedman, notes in a recent New York Times article, “Candidly, we were hanging onto Gen Xers a little too long.”

At Netflix, a new initiative is geared directly at kids (and, of course, their parents). They recently announced a partnership with DreamWorks to create 300 hours of original programming that Netflix can stream to kids all over the planet. As we saw in Techsurvey9, Generation Z is a savvy, smart forward-leaning audience that can pay residuals well down the road – if they get into the habit while they’re young.

So for the automakers – and radio – what’s the answer?

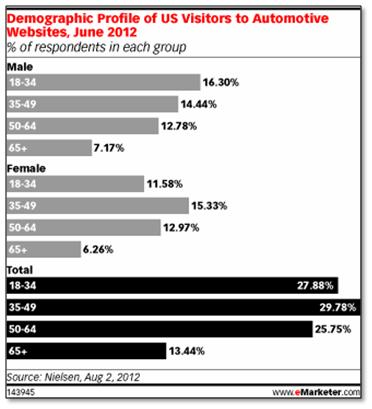

The OEMs are researching the problem and attacking it both strategically and tactically. eMarketer talks about a Ford partnership with Zipcar on select college campuses, along with social media initiatives designed to engage students. Digital campaigns via mobile and social are considered the gateways to connecting with Generation Y. And for the OEMs, the good news is that these young consumers are visiting their websites, according to Nielsen data:

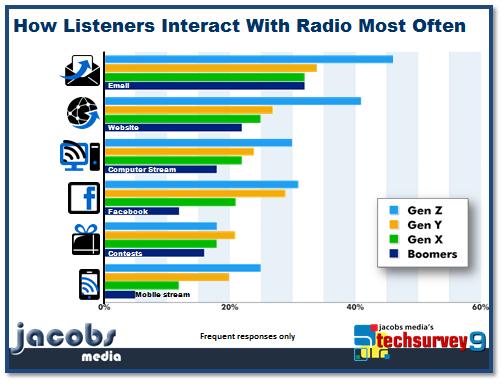

And we see this in our Techsurvey, too. While Generations Y and Z may not be consuming as much radio, they are connecting with stations in a myriad of different ways. The notion that broadcasters are getting more “digital traffic” from them than their older brothers and parents is encouraging.

But it boils down to what happens when they arrive at these digital portals – the experience, the content, the value. And that’s where broadcasters need to make a concerted effort to commit and appeal to younger listeners:

Generation Y (gold) is more likely to connect with stations via their websites, Facebook, and mobile. And a look at the next generation – Gen Z (light blue) – an even stronger propensity to connect digitally on all these portals that barely existed five or ten years ago.

So even if radio hasn’t built it yet, they’re coming. What happens when they get there may tell an important story about radio’s future.

Generation Next or Generation Lost?

Why Gen Y?

Ask any major brand manager and they’ll be more than happy to tell you.

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

Very good blog. First listening is still pretty high all things considered. As Television has been getting Digital and Social better and better hopefully Radio will follow. The notion that “content” is so important on Digital and Social still seems to be relatively unscratched surface so that leaves lots of upside. There is a lot of new technology that may make DJ’s really, really valuable coming out…of course it would require change…so don’t hold your breath quite yet.

Thanks for the insights, Dave. The need to teach radio DJs the in’s and out’s of social is a mission that Lori has taken on. And we agree – the payoffs could be great.

I wonder if the drop in new car buying by gen x and y is more financial than conceptual. They are living with their parents longer, paying off huge student loans, facing a lousy job market and delaying things like marriage and kids because they just can’t afford them. It follows that things like new cars don’t make the cut in that realm.

Radio stopped investing in the future a long time ago and that’s what gen y and melennials are. Its not just platform, it’s content too. If there isn’t a big change in thinking and strategy, radio is likely to find itself laregly irrelevant to those people when they are 25-54. It will be too late to get them back then if they’ve moved on. FWIW, the numbers in your tech survey and from PPM are much more favorable to radio than what I hear anecdotally from gen y and milennials. I wouldn’t be surprised if one day radio found itself falling off a cliff with them and wondering what happened.

Bob, I thought that financial considerations were a big factor, too, but the other piece of this is that teens are even delaying getting their drivers licenses, which suggests the problem and the lack of passion for cars runs deeper.

Regarding radio, our study is going to be more favorable to the medium because the vast majority of our respondents come out of station databases. That does suggest that when you includes P3s, P4s, and those who aren’t listening to the radio, the dilemma becomes greater.

Thanks for chiming in.