The audio renaissance just gets bigger, broader, and bolder with each passing week. After years of audio being essentially limited to just AM/FM radio and personal music collections, it’s no longer accurate to refer to it as a “space.” It has truly become a massive, expanding universe unto itself with many different tentacles that are seemingly sprouting up every time we turn around.

Of course, there’s still good old broadcast radio – as more and more brands attempt to tack the “R-word” onto their logos and positioning statements. Podcasting continues to be in the center ring, despite lousy metrics, a glut of really mediocre content, and an overall lack of accountability. (“How do we know it works? We just do.”)

Mobile apps that focus on audio entertainment and information are all over our smartphones and desktops – including iHeartRadio, Spotify, and TuneIn, along with thousands and thousands of apps for individual radio stations and shows throughout the U.S. and the world.

We’ve discussed audio signatures and branding several times in this blog during the past year, as companies as diverse as Nationwide Insurance, McDonald’s, and Netflix are working feverishly to embed their sonic ditties into our brains.

There’s audio hardware and software, too, as turntables and vinyl have made their respective comebacks. Audio in the home has become a high quality pursuit, thanks to brands like Sonos, Bose, and others.

Our smartphones – and now our smart TVs – also provide the ability to punch up a broad variety of audio information and entertainment with just a touch on a screen or a voice command.

And speaking of which, there’s the smart speaker/voice phenomenon, showing up on nightstands, kitchen islands, and car dashboards seemingly everywhere. Our words  now conjure up our audio choices. Amazon and Google are in a drag race, trying to scarf up as much voice real estate as they can (before Apple wakes up).

now conjure up our audio choices. Amazon and Google are in a drag race, trying to scarf up as much voice real estate as they can (before Apple wakes up).

When consumers can get Alexa in their cars via the new Echo Auto after-market product for the low low price of $25, you know we’re in the midst of a revolution that shows no sign of stopping.

Now don’t be alarmed – I didn’t leave out pureplay streamers like Spotify and Pandora. While it seems like they’ve been on the scene forever, they are each in serious expansion/pivot mode. Spotify’s foray into podcasts has vaulted it into the #2 position behind Apple. This is smart brand diversification, bringing Spotify into the spoken word and podcast arenas, while also providing the company with a content/monetization play that involves no music royalty penalties.

Meantime, it sure looks like Pandora was snatched up by SiriusXM at just the right time. Clearly, the folks that brought us the “Music Genome Project” were running out of bullets. Especially among younger generations of consumers, Spotify had already made serious inroads, despite Pandora’s “first-in” position. That left Pandora in a…well, box. Losing share to Spotify, complicated by onerous streaming expenses, and simply falling out of favor, integration into the SiriusXM family was a godsend for Pandora…and an opportunity for both brands to get stronger by combining forces and assets. In short, synergy.

SiriusXM is a fascinating audio brand. It’s been around (starting with XM) for longer than most of the aforementioned audio content platforms. And yet, it is often overlooked by analysts and pundits, especially in and around the broadcast radio industry. But the moves SiriusXM have made in just the past year or so make it an imperative to understand the impact of satellite radio on the broadcast radio ecosystem.

We’ve been tracking SiriusXM’s progress in Techsurvey since Year One, going all the way back to 2005. After the growth spurt Sirius experienced following the hiring of Howard Stern, satellite radio’s growth trajectory has been slow, but steady. Clearly, technologies like smartphones, smart speakers, and pureplay streaming platforms have had more dramatic growth, greatly overshadowing satellite radio’s aura.

So, where is SiriusXM today, and should radio broadcasters care? I have been accused by some of starting 4-alarm radio fires with this blog post. But in the case of SiriusXM, the numbers and their innovations speak for themselves. We should all be smelling smoke.

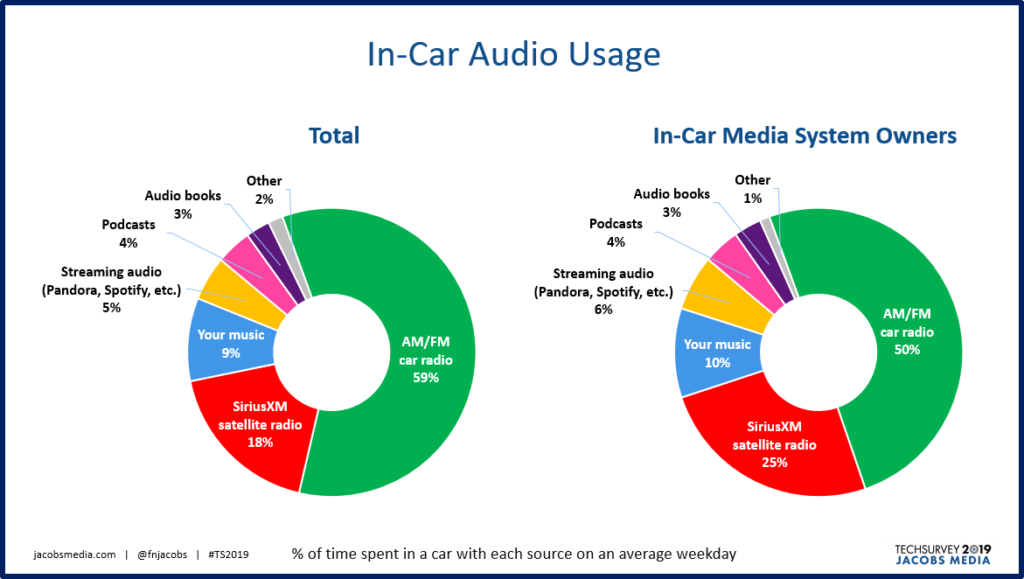

Our Techsurveys have shown that when most consumers buy or lease a new car with connectivity, SiriusXM becomes the main beneficiary of tune-in, often at the expense of broadcast radio. You can see that in the two pie charts below. The left side is the state of all in-car listening among our radio-centric sample. On the right, it’s the same data among people who have vehicles equipped with in-car media systems.

What explains this? Why don’t Spotify or podcasts show a big leap when drivers get behind the wheel of a connected car. Part of the explanation is that most new cars come with a free trial of SiriusXM, and that usually means months and months when consumers pig out on satellite radio. And the other fact is that in most cars, it is as easy to discover and preset SiriusXM channels as it is to punch up Z100 or WTOP.

But the SiriusXM brain trust is well aware that its growing in-car presence will only get the platform so far. That’s why in the past year, they’ve integrated Amazon Alexa technology into their channel lineup, enabling millions of consumers to listen to The Bridge or Howard 100 in their homes or offices – wherever there’s an Echo or a Dot.

SiriusXM’s purchase of Pandora in 2018 was met with many raised eyebrows. But the reality is that it opens the door for strong mobile phone and tablet presence – an environment where Pandora has historically excelled. SiriusXM has had an app, but its influence has been limited by its design and its accessibility.

Until now.

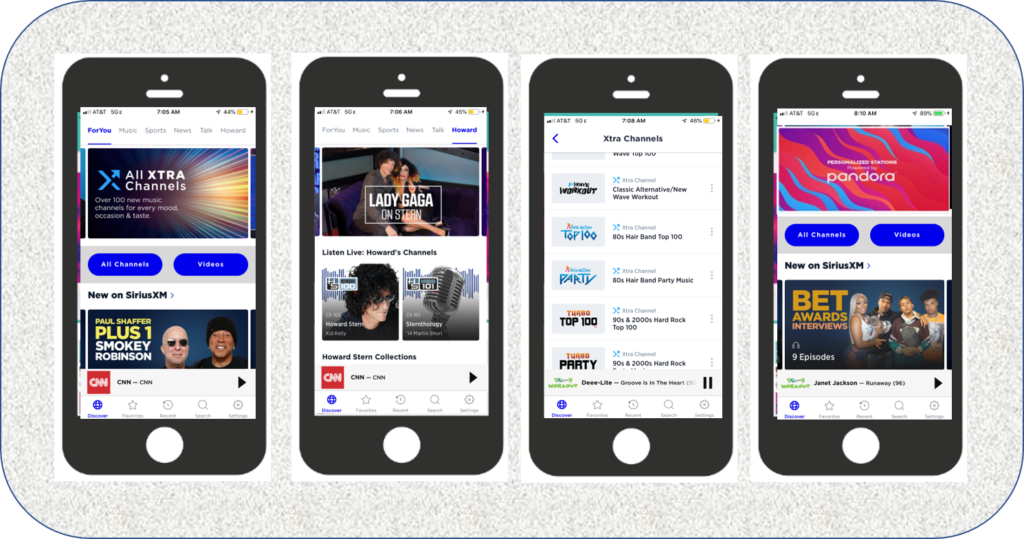

Late last week, SiriusXM launched their new app – and as importantly, made it available to all of their subscribers. After installing and playing with it over the weekend, I can tell you it’s a nice piece of work. And to that point, it provides a strong mobile interface that showcases the growing lineup of content on SiriusXM. There’s a video portal, as well as Howard Stern’s content (Howard has his own tab on the nav bar, as it should be). But there’s also the new roster of what they call “Xtra Channels” – where it seems like some of the choices are as granular as “Alternative Rock For Your College Reunion.”

But the application (within the app) that may be most noteworthy is its Pandora integration, which you can see on the far right. The ability to create your own music channels is a new innovation for SiriusXM, leveraging their acquisition of the popular pureplay.

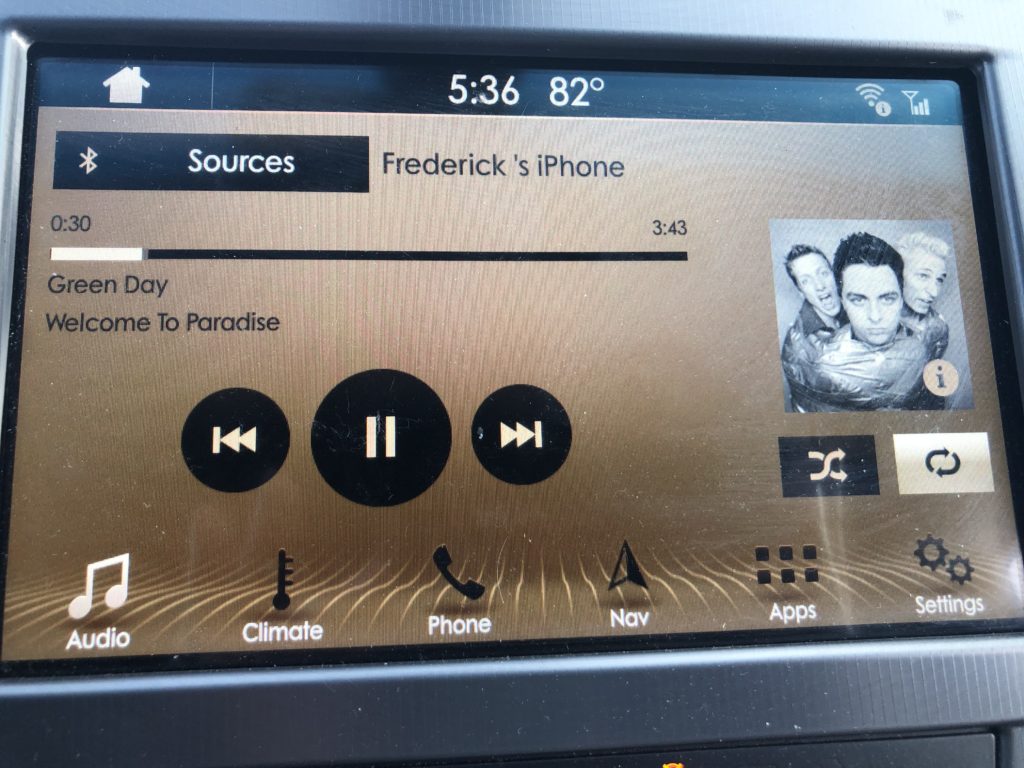

In short, there’s a lot here, it’s easy to use, it looks good, and it opens up a whole new window of opportunity for the satcaster. I even tried the app in my car, where the dashboard visuals were better than when listening to SiriusXM through my system.

In short, it feels like they thought of everything. And it’s a sign SiriusXM plans on being big players in the audio entertainment and information landscape well beyond cars.

And one last thing – they are marketing the hell out of the app on their own “air.” Turn on any SiriusXM channel and it’s all about this app. And justifiably so. The best, most efficient way for them to promote downloads is to go right to their subscribers to ask for the order.

So, what are the action steps here for broadcasters?

They’re obvious, but also difficult. Especially for operators that have fallen behind.

First, stations (and the companies that own them) need a coherent, researched, and thoughtful content and distribution strategy. Notice I’m not calling it a “digital strategy.”

Second, on that same note, it’s another reminder broadcast radio stations compete with everybody. That graphic at the top of today’s post is only a partial illustration of the audio ecosystem. Those days when radio operators were up against the other Country station down the dial or that cluster of stations across town are rapidly coming to an end. Operators need to determine what their stations provide that isn’t available on SiriusXM, Spotify, podcasts, and the potpourri of other audio offerings.

Third, it’s an imperative radio broadcasters have a coherent mobile strategy in place with apps that are clean, easy to use, and well-designed. They need to have Apple CarPlay and Android Auto integration, and they need to directly reflect the essence of the brand. The days of cookie-cutter apps have come to an end.

Fourth, radio broadcasters need a marketing strategy for their mobile app program (as well as their other key content assets). Too often, stations buy an app, promote it when it goes live, and then move on to promoting the $1,000 national contest. It is obvious to me, as it will be to you, that SiriusXM has a marketing plan in place for their app – and it’s aggressive.

Fifth, radio broadcasters need to teach their audiences how to listen to their stations in an ever-expanding universe of options. How and where to access streams, downloading and using the app, accessing the station on smart speakers, and where to find podcasts and on-demand audio – we should take nothing for granted.

Most competitors in the audio space have gotten smarter and more strategic. They’re doing their homework, analyzing their data, and boldly pursuing opportunities in a fast-changing environment.

To stay relevant and vital, radio broadcasters will need to do the same in order to keep pace.

Fasten your seat belts.

Special thanks to Scott Jameson.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Leave a Reply