There’s been something afoot in radio programing in this new year. It may have just a little to do with Nielsen’s PPM methodology change that now give stations credit for a full quarter hour if a meter panelist is listening during any three-minute segment in that same 15-minute period. Radio veterans know the old rule—in place for decades and decades—mandated five minutes of listening in the quarter-hour. The change went into effect during the January numbers.

To those of you who haven’t spent much time analyzing radio ratings in your careers, the distinction sounds miniscule. But it is anything but. The reduced crediting requirements has led to a general uplift in the ratings overall. But the gains—as is always in the case with ratings—are not across the board. Instead, not every station in the 48 PPM markets is celebrating. While some have truly enjoyed a substantial brand lift, others have remained flat or even down since Nielsen changed the game earlier this year.

The result of these checkered results have some broadcasters enjoying this moment, while others are truly angst-ridden as a result of this rule change. While the ratings may not be as big a determinant of revenue as they once were, they are still the only true report cards most broadcasters can communicate to clients and agencies. We may not always know great streaming numbers when we see them, but we sure know what a sagging cume looks like or mediocre time-spent listening.

While there have been murmurs over the last several weeks since these changes went into effect, they hit a crescendo a couple weeks ago when one of the most venerable Classic Rock brands in the country—KQRS in Minneapolis/St. Paul started stunting a coming format change. When this kind of thing happens to an also-ran brand, it’s just another day in Radioville. But when a station of KQ’s time in grade and long-term success starts making noise about a change of direction, it didn’t just impact thousands of Minnesotans—it sent a shiver throughout the radio broadcasting industry in America.

For more than four decades, KQ had been the preeminent Classic Rock station in the Twin Cities. Its long-running program director, the legendary Dave Hamilton, was the guy who chose the Classic Rock path for KQ in 1986. I should know—I was his consultant.

Thanks in no small part to Hamilton, the brilliant and enigmatic Tom Barnard, and an owner (ABC Radio) that trusted these guys to do the right thing, KQRS had remarkable ratings and even more remarkable success. There were some speed bumps—there always are—but in the main, Hamilton fended off a slew of competitors, while Barnard held onto his dominant position in morning drive in the face of the old neighbor, WCCO, many excellent stations representing all sorts of formats from AC to Triple A, and even a full frontal assault by Howard Stern before he left for the world of over the air broadcasting for the friendlier unregulated confines of Sirius. All the while, Hamilton, Barnard, and KQ ruled.

But things began to change when KQ and its cluster were sold to Citadel in 2007, merging with Cumulus in 2011. I left not long after that, and over the next few years, first Hamilton and then Barnard exited their long-time radio home for other ventures. Meantime in recent years, the station’s coveted 25-54 adult dominance eroded, the demographic profile of the audience aged, and as a result, the good times were more in the station’s rearview mirror.

At the heart of the problem was KQ’s 35-64 numbers—truly impressive, but not particularly marketable. And for a station—and a sales staff—accustomed to 25-54 leadership, the slide was difficult to endure. Perhaps even ironically, KQ’s junior partner—93X—which eventually adopted the Active Rock format to protect KQ on the young end of the rock spectrum—grew up to become a ratings giant on its own. Its once fledgling a.m. drive show, the well-named “Half-Assed Morning Show,” grew in stature and ratings at KQ struggled.

So when news of the “Under Construction” stunt hit the radio trades, it probably didn’t come as a total shock to market observers. Cumulus VP of Alternative, Triple A, and Classic Rock, James Kurdziel, engineered the operation to morph KQ into a gold-based format aimed squarely at Gen Xers.

So when news of the “Under Construction” stunt hit the radio trades, it probably didn’t come as a total shock to market observers. Cumulus VP of Alternative, Triple A, and Classic Rock, James Kurdziel, engineered the operation to morph KQ into a gold-based format aimed squarely at Gen Xers.

Kurdziel has shifted KQ’s emphasis to incorporate the 90s/00s while still featuring Classic Rock that “is still cool.”

Mike Stern, a Jacobs Media veteran consultant interviewed Kurdziel for Barrett Media. You can read their entire conversation here.

As you might imagine, I’ve had more than a few people ask me over the last week what I think of this move and do I feel it will work.

You may be better off asking me how the stock market’s going to do today. And when I say that, I’m not hedging or being coy.

There are a lot of moving parts here, and a lot that Kurdziel and his team know that we don’t know. We are not privy to their audience research nor do we know what level of pressure their sales department is under with a station that was once among the market leader in billing. And then there’s the dynamic with brother station 93X.

Perhaps rather than trying to decide whether the new KQ will be successful with its new music treatment, we’d be better rolling back the tape on how the station handled its aging process as more of its listeners cascaded over that dreaded “demographic cliff.”

It’s notable Kurdziel and company not only retained the call letters, but also the traditional logo using the very retro blippo or balloon font. Those signature yellow letters outlined in black have been heavily promoted over the years. Hamilton loved bus sides and bus backs. For many years, KQ owned that outdoor medium in the market.

So, will it work? And is that the question we should be asking ourselves?

Does it make more sense for radio broadcasters to find a way to teach salespeople how to sell demos that don’t fit neatly into the 25-54 box OR continue blowing up successful radio stations and formats?

I know some of you are already shaking your head at the suggestion because the salespeople just won’t change. Or that even if they bought in, they wouldn’t be able to convince agency people to look at the world through a different lens.

But that assumes most radio business is still coming from big agencies when in fact, more and more sales are coming directly from local businesses where results are everything.

A look at the cable news channels shows that products aimed at seniors are a large part of their ad mix. It’s not just pharmaceuticals, but home improvement, investing, insurance, and of course, Proctor & Gamble.

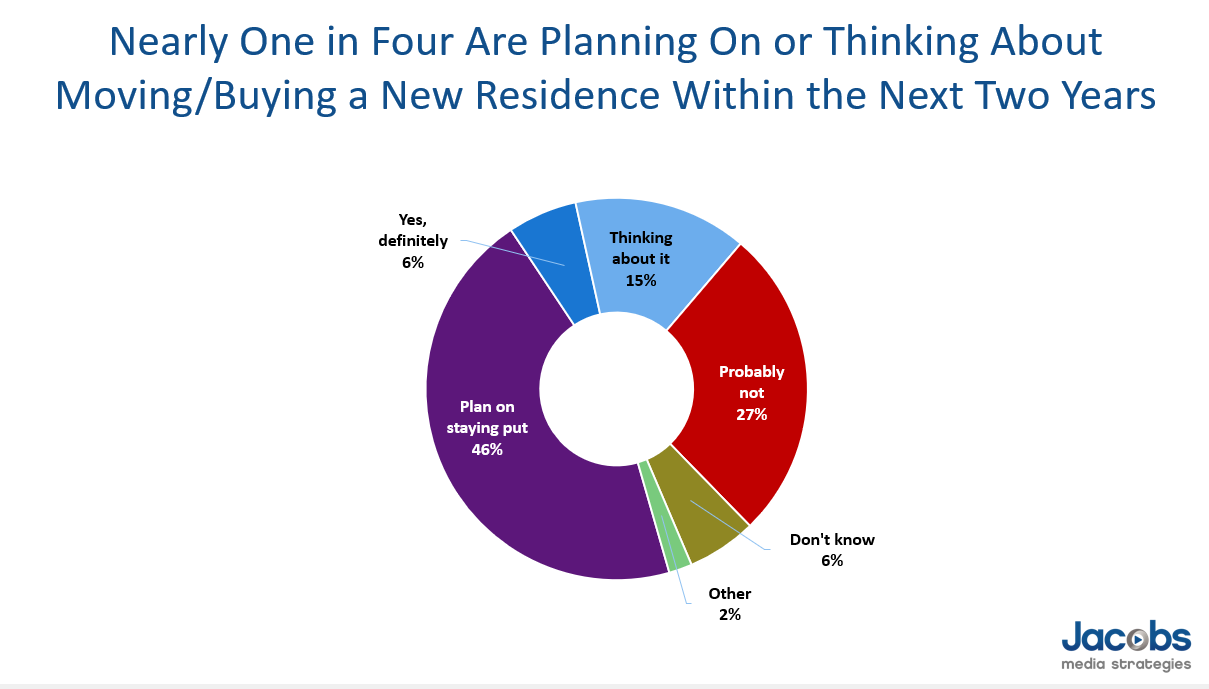

In the past couple years, Jacobs Media has been working with radio clients (commercial and public) to develop “intent to purchase” research studies using station databases as the sample frame. By asking about key categories where sales needs “research ammunition,” we work with salespeople to help them tell key stories about their brand and its audience.

The chart below is a masked example from one of these surveys, showing the percentage of the station’s core audience that is definitely/thinking about buying a new residence in the next two years. For a local realtor, this information has more actionable value than knowing the station average rating among 25-54 year-old adults in prime.

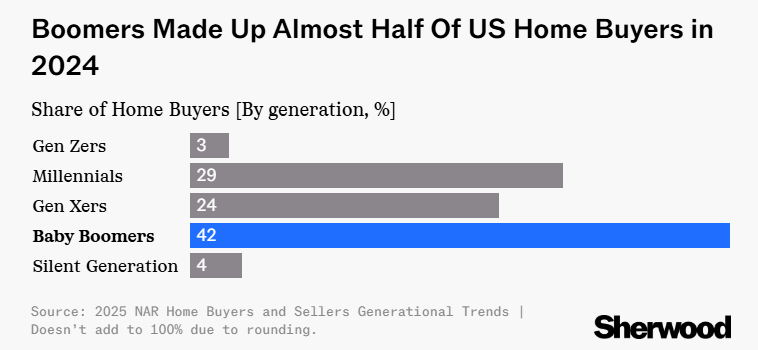

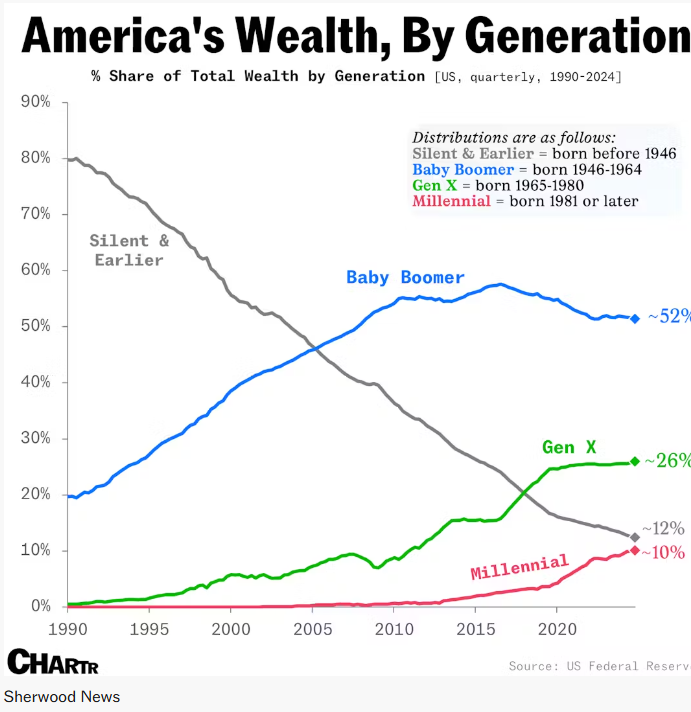

And here’s the reality: a story in Sherwood News last week carries this headline:

“Baby boomer bought more homes than millennials did last year”

And as it pertains to KQ’s new demo target, Boomers also outdid Gen Xers in the home real estate market, too.

sherwood news home sales by gen 2024

Even with compelling data like this, does it require some selling to help clients connect the dots? Of course. But when you compare the costs of blowing up a station in the cluster in the hope the next format fares better, it might suggest there’s a better ROI in figuring out how to market a station’s audience to the advertising community. For decades now, radio has been willing to take the path of least resistance—giving up on an existing station whose demos are no longer in the “sweet spot,” rather than looking for ways to actually sell the station’s virtues and values to the ad community.

I wish James Kurdziel, his team, and Cumulus well with their new iteration of KQ. He may be onto something, and if so, lots of radio people are going to be paying attention to the station’s next several books.

But to the rest of you grappling with similar dilemmas with your aging stations, maybe it’s finally time to think twice before giving up on a franchise brand.

Maybe this is the moment radio begins to look in the mirror and accept the aging process for what it is.

And find ways to make it work.

One last piece of data from the same Sherwood News story for those of you “stuck with” trying to sell Baby Boomers:

OK, Boomers.

- For Radio, The Perils Of Rebranding - May 30, 2025

- There’s No Failure In Radio - May 29, 2025

- It’s Not An Innovation If You Can’t Make It Work – And Last - May 28, 2025

Two thoughts:

1. I’ve always thought that a sales person would love to be able to walk into, say, A Ford dealership and say, “According to our research, there are 850 new F150 sales in our audience over the next 12 months. How many of them would you like to get?” That’s the kind of audience research that should be done and valued. Does it really matter if the station is number one in Persons 25-54? Even if you’re number 25 in a market, your audience will pay the same $50,000 for an F150 as the number one station’s audience. Which $50,000 buys more stuff?

2. Stations and their owners would do well to invest in making the sure the commercials they run are as good and listenable, if not more so, than the programming that surrounds them (and by the way, I doubt AI will cut it in that regard). After all, if commercials account for eight, ten, twelve, fifteen minutes of the the air time each hour, they also account for the same amount of airtime of programming. The commercials you allow on your air should be at a minimum listenable and interesting, if not actively sought after, by listeners (years ago, my mother used to go up and down the dial looking for Dick and Bert spots, “you know, that guy!” Orkin in particular is a major reason why I gravitated to the prod room instead of the air studio). I know in my own experience it’s happened more that once that listeners would call the studio wondering when the next ad for a campaign I had produced was going to run, or walk into a client’s place of business and the first words out of the listener’s mouth were, “I love your ads!” That’s pretty heartening and ego-boosting to a guy who makes radio ads for a living. All that to say, why shortchange the client, why shortchange the audience on the very thing that generates the revenue?

Peter, I like the way you think on both the idea of using first party data to provide “intent to purchase” insights. As for the quality of commercials, even casual listeners know how bad it’s become. And that’s why a well-produced spot stands out and has a great chance of working?

Thanks Fred. I’ll spend the day with them, from Denver. I’m Gen-X, and a programmer, with a little creative mojo left. Amazing, really, after all the bicycle crashes as a kid, riding fast with only my head as a helmet.

Steve, you’re still making sense. Thanks for the comment. And please wear a helmet!

There’s a pretty good list of stations who’ve updated their sound without really changing their “brands” as it work. K-Earth 101, 12 years ago started incorporating a raft of 80s music in the former 60s and 70s playlist-and soared to #1. Today they’ve added 90s and 00’s songs. KOLA in Riverside blazes the trail every day. KXSN (“Sunny”) in San Diego was “Light”, then “AC” then “Classic Hits”-updating that brand. Magic 92.5 has done two surface changes-the music and the positioning. The rest of the station is virtually where it was in 2017. Seems that staying with the flow of your audience is a very good thing. The term “growing pains” isn’t just an old cliche. Then when it comes to sales and creative -wonder again-whatever happened to Dick and Bert?

I think that this was a good move. KQ traditionally has been more of a heritage station with strong personalities that also just happened to have a Classic Rock playlist.

Likewise, the move was likely influenced by some quirks elsewhere on the Twin Cities dial. This includes: Cities 97.1 now being essentially Modern AC (or a Triple A/Hot AC hybrid); having both a successfully modernized Classic Hits station (Kool 108) and a truly competing Variety Hits station (104.1 Jack FM); and the continued success of The Current. Indeed, some of the new KQ staff came from Cities and The Current–which both still have locally focused positioning.

Eric, I think other industry observors would concur with you about this KQ shift. We’ll all be watching.