Over time – hundreds of rating books, scores of perceptual research studies, and all those focus groups – you begin to establish format parameters. Whether you work in Hip-Hop, Country, News/Talk, or Rock, you learn who’s in the tent, as well as who will likely have little or anything to do with your station.

Sure, Nielsen sharing reports often indicate odd sharing patterns, often with stations that seemingly are incongruous with yours. More often than not, you explain those listeners away as outliers, anomalies, or simply ratings glitches that happen from time to time.

It’s easy to get comfortable with your format boundaries – and if you test your music and other variables – you begin to settle in on the gender, age, and ethnicity splits that define your core and secondary audiences. In fact, most stations get narrower and narrower – interviewing within a tight demographic and testing many of the same songs over and over again.

But that’s fine and logical if all you’re doing is staring at radio data. When you open your mental parallax and begin to look at audiences through a new lens, you begin to see a different picture.

Last week, Nielsen Audio’s Jon Miller and Nielsen Music’s Haley Jones presented a webinar – “Data & Insights To ROCK Your Programming” – a look at rock music through a different perspective. Nielsen has been presenting format-centric presentations for some time, based on ratings and findings from their Nielsen Music 360 studies.

Oftentimes, the results don’t always follow those traditional lanes and appeal patterns radio programmers have come to accept as gospel. In fact, this new study of rock music fans suggests related radio formats may be unnecessarily narrowing their programming and marketing focus.

There’s too much data in the report to embed and discuss in this post, but I’ll give you a few of the highlights that jumped out at me.

First and foremost as it relates to “the tent,” nearly half (48%) of music listeners are fans of the Rock genre, Classic Rock having the widest appeal, well ahead of what Nielsen categorizes as Alternative and Heavy Metal.

And Rock fans are nearly 50:50 male/females, debunking the myth the genre skew is always testosterone fueled.

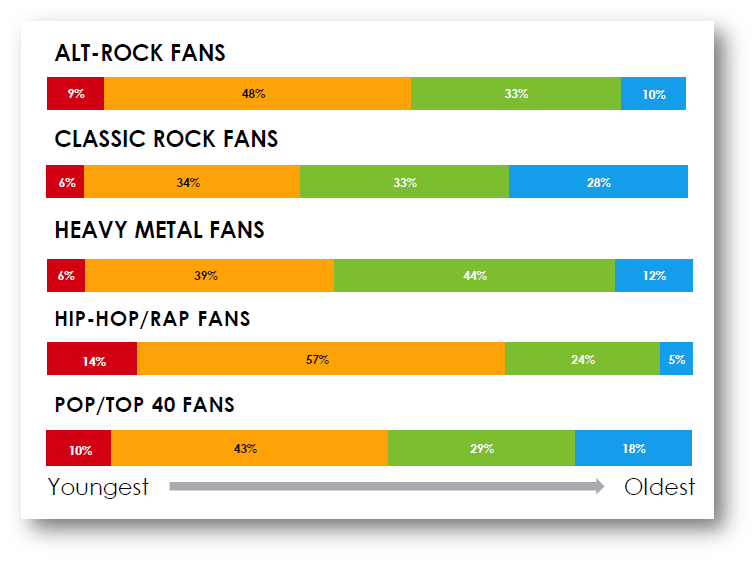

Then there’s the generational breakdown of core fans by format. And for this chart, Nielsen included a couple non-Rock genres for contrast purposes.

Clearly, Alt fans lean heavily Millennial as you’d expect, and Metal devotees often fall into the Gen X category. But the generational balance of Classic Rock hounds goes a long way toward explaining what we’ve been seeing in ratings book, perceptual research, and at concert venues. Millennials and Xers make up a bigger percentage of fandom than Baby Boomers – again turning conventional wisdom about the format on its ear.

If you’ve been living in the “Why are we playing music that’s older than our audience?” paradigm, think again. Classic Rock defies the stereotypical “radio age targeting process” because of its multi-generational appeal.

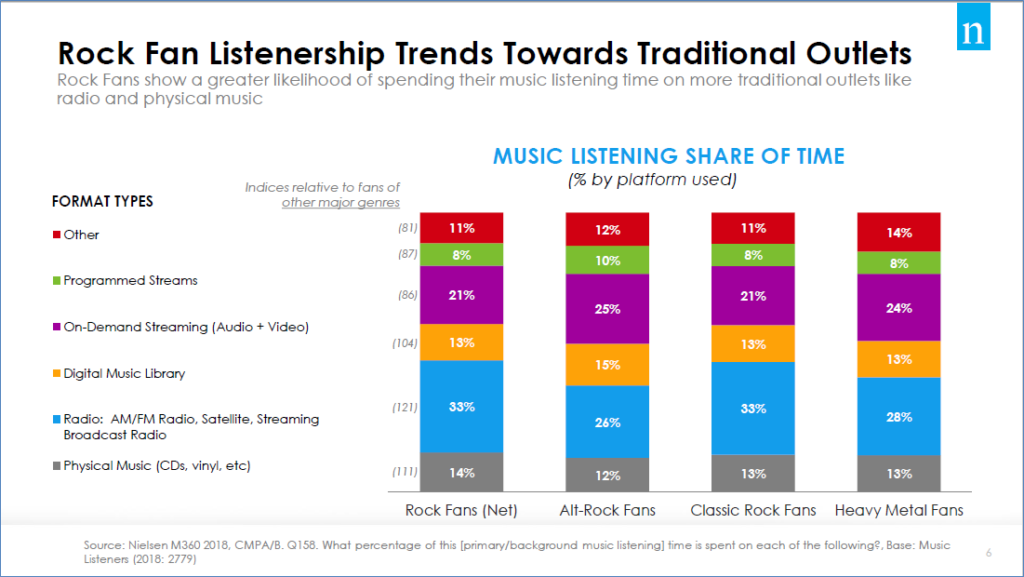

Finally, this chart caught my attention as well, because it underscores that radio still very much matters to fans of the various rock genres.

While those who love Alternative music are very much divided among the various distribution outlets, fans of Classic Rock lean heavily toward radio. Note, however, Nielsen defined “radio” as broadcast + satellite, so the line is a bit blurry.

The Nielsen data also tell us that rockers of all stripes stream a lot of catalog (or gold) – more than any other format genre – from Country to Pop to Christian.

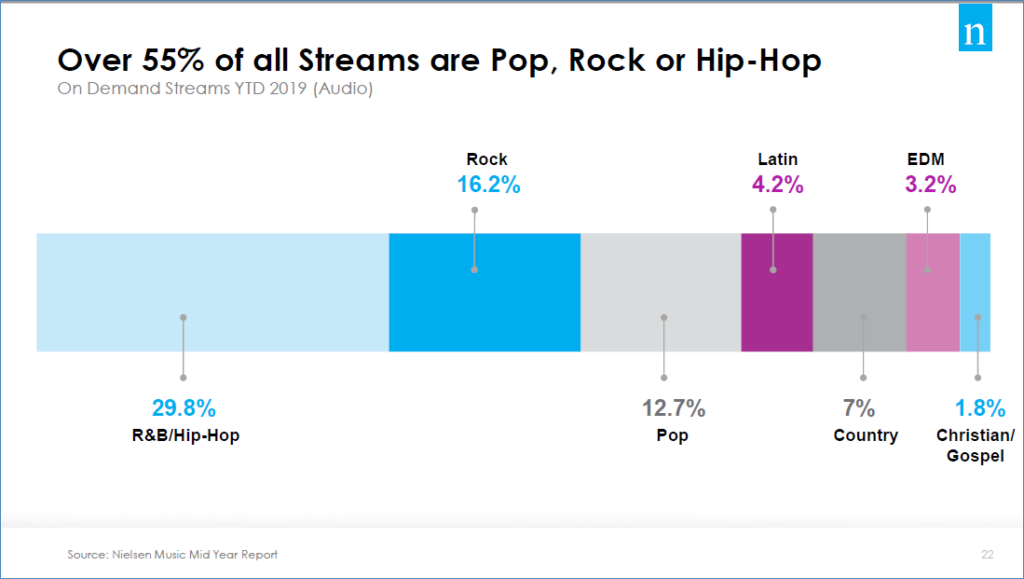

And here’s a reality check – outside of Hip-Hop (a clear #1), streaming Rock songs is well ahead of every other genre Nielsen measured, including Pop, Country, EDM, and Christian.

Like all data, these reports from Nielsen’s various divisions are a stimulus to rethink many of the givens that govern the way we think, research, program, and market radio formats.

It suggests there are more and different fans of Rock genre-based formats than we see in the ratings, especially as PUM levels slip downward. And in the webinar, Haley and Jon also reminded us of the other immutable truth about American radio programming in 2019 – it continues to get tighter and tighter.

Looking across the four Rock formats that Nielsen tracked in BDSradio year-to-date, the average station plays just 308 titles (Classic Rock on the high side – 337 – versus Alternative on the other hand playing 276 songs).

It is not possible to determine whether these conservative playlist numbers are the root cause of why the Rock genre may be limiting itself – or whether these tight libraries are part of the reason why these stations perform as well as they do. It could be a combination of both.

Nielsen’s presentation suggests the demographic “isms” that have become part of the standard music testing parameters might be scrutinized in light of this streaming data.

And it also suggests there is more audience out there than what we’re seeing in the ratings. As music fans have gravitated to other platforms to enjoy  their favorite artists and songs, many of radio’s key advantages may have been overshadowed or lost along the way. It’s been two decades of “bright, shiny objects” – satellite radio, Pandora, iPods, Spotify, iTunes, Alexa – while radio has pretty much stayed on the sidelines and out of the limelight.

their favorite artists and songs, many of radio’s key advantages may have been overshadowed or lost along the way. It’s been two decades of “bright, shiny objects” – satellite radio, Pandora, iPods, Spotify, iTunes, Alexa – while radio has pretty much stayed on the sidelines and out of the limelight.

The assumption that consumers intuitively know radio’s strengths is lost on emerging generations of fans who didn’t grow up with AM or FM radio. Quentin Tarantino’s new film, Once Upon A Time In Hollywood, is a throwback to those days when radio ruled – in this case, the iconic and ubiquitous KHJ.

Back then, everybody knew what radio was all about. Its primacy in a media-scarce environment, coupled with the fact it truly exposed Americans to new music and entertaining local DJs, made radio the king of the media jungle.

Today, radio needs to re-establish its value proposition – that it is free, simple, surprising at times, curated, and local. Of course, not every radio station can make these claims but the medium by virtue of its reach, habit, and tradition is still in position to “expand the tent.”

Radio isn’t dead.

Neither is rock.

We just need to change the way we think about both.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Hi Fred

Haley and John knocked this one out of the park. Part of the argument you parse well here is Rock is the second highest streaming genre behind Hip-Hop. But it is notable and consistent with your observation on the Classic Rock format that more than any other genre streamed, Rock is older than any other style. 90% of Hard Rock, 85% of Mainstream Rock and 80% of Alt Rock is NOT “Current ( from the last 18 months). It is Gold based.

Two conclusions; Rocker fans love what they know and Radio does not play current material frequently enough for it to stick. Haley points out Mainstream and Alternative Rock respectively require 102 and 165 spins to achieve the optimal number of spins per week to reach the average listener. If they don’t hear them they don’t know them.

Rock is alive and well. If Rock radio listened to the audience it would play tracks like “BLOW” with streams at 3.3 million (US) and almost 600K (Canada) last week alone. Thanks Jon and Haley for a great wake up call

Andrew, appreciate the comment and the observations. It was an eye-opening webinar.

“When you open your mental parallax..”

Would that be my parallax view?

Asking for a friend…

But on a serious note, at the end when you talk about selling radio’s value proposition, I started to cry. Why? Because, as usual, radio has to DIY this abominable situation itself having received no help from the NAB/RAB.

Oh Fred, you knew I was going there…

I did, I did. And I admire your consistency and perseverance.