A number of years ago, a close associate in the radio business was lamenting the difficulty he was having convincing his radio bosses to even consider staffing up a digital department. At the time, his company’s traditional revenue and operating margin were still tolerable to the company’s shareholders. Like most public companies, however, his was struggling to make the next quarter’s goals rather than playing a longer game.

The more we talked, the more exasperated he became. (I have that effect on people.) And he confided, “I’ll be happy when the day comes when we no longer use the word ‘digital’ in people’s titles and job descriptions. We’ll just have programmers, salespeople, and the other folks who have roles in the media mix.”

Back before the Internet, of course, it was just “radio.” So, there was no reason to add that word or even “broadcast” to business cards or boxes on the org chart. Once “digital” came along, however, these delineations – radio/digital – became necessary. In the same way the advent of the electric guitar made it necessary to describe non-electric guitars as “acoustic,” we now have digital program directors, radio salespeople, and other descriptive separators that keep workforces divided, often physically, intellectually, and philosophically.

It has most assuredly taken its toll on operations, monetization, and profitability. The lack of understanding and even empathy on both sides often pits one team against the other, as if their goals were different. Too often, more resources and mental bandwidth is spent trying to work around the other team. As a result, less progress is made, and growth is stunted. These divisions harm day-to-day operations and the enterprise itself. But they also penalize advertisers and marketers when they contract to do business with our companies. To retailers, marketers or brand managers, it’s about results, regardless of the pathway consumers take.

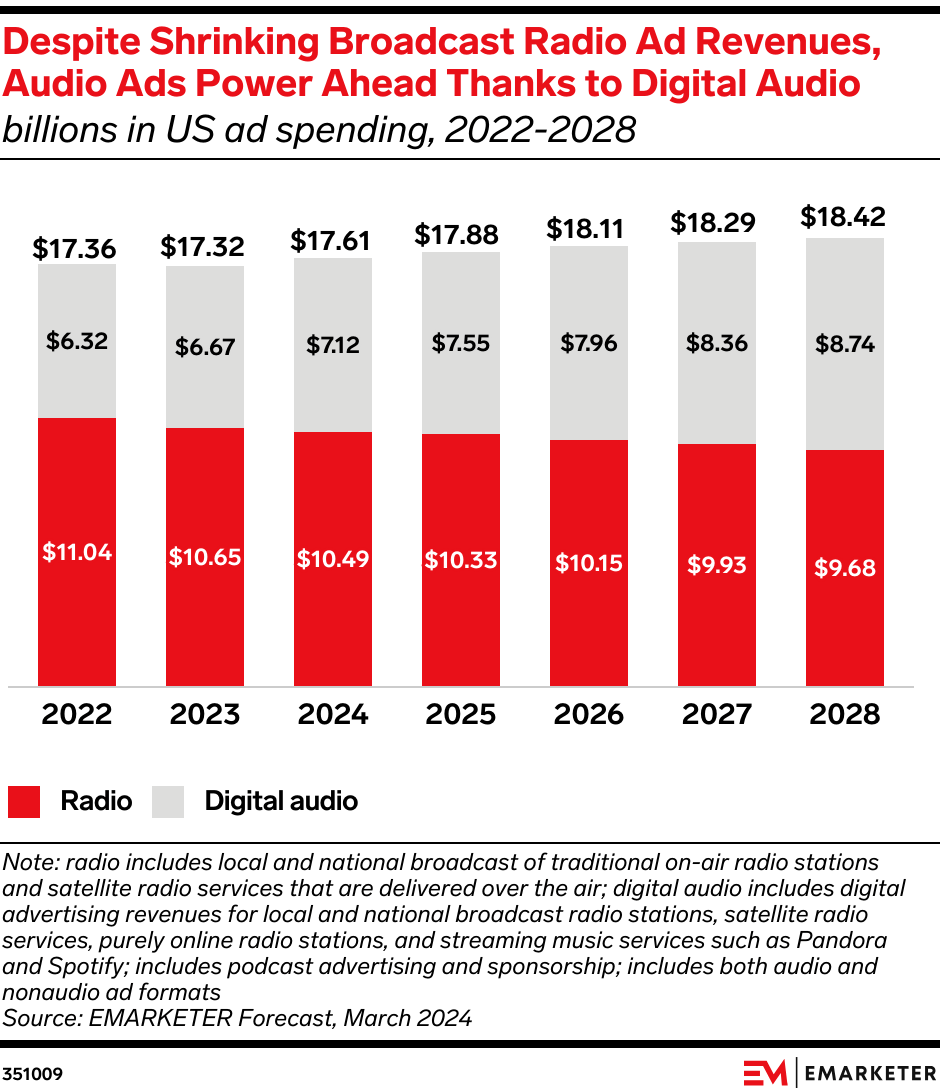

I thought about this media schism when I happened across a recent article, accompanied by a telling chart from eMarketer, a company famous for its media data. In a piece titled, “Digital drives growth in audio ad market, as radio broadcast advertising shrinks,” Meaghan Yuen points out the obvious – digital audio’s revenue growth has been “longer and steadier” compared to TV, thanks in large part to the long history of streaming audio and iPods. When you think about it, we’ve been streaming audio and listening to music files for decades now. Entire generations of people have grown up listening to music and audio content this way.

But I’d also argue the presence of radio all these decades – in numbers bigger than all digital platforms – has cemented habit and routine as well, major factors in achieving strong usage patterns over time. That, of course, contributes to the continued rise of audio ad revenue where digital now makes up 40% of every dollar spent. Audio, in general, is an entertainment and information pastime, which explains why the numbers above these bars show projections of more than $1 billion in revenue over the seven year span starting in 2022 and predicted through 2028:

At the same time, we cannot ignore the fact eMarketer also forecasts a steady decline in radio revenue, contrasted with an impressive rise in digital dollars. Again, to anybody who has followed these trends of radio vs. digital spend, this is old news.

(If you read the fine print, “radio” defined for this eMarketer chart is comprised of both on-air and satellite combined. Thus, the red revenue bars on the chart are inflated a bit by satellite radio spot dollars from their approximately 50 channels that carry advertising.)

But why the “vs.” in the first place? Why do most analyses pit radio up against digital, especially when it comes to revenue? Is it the classic battle of old vs. new, traditional vs. modern? And those in charge of how these numbers are reported might tell you how sales numbers can be moved back and forth between the two categories in order to suit the goals of the moment.

But here’s another reality: most digital platforms and brands – podcasting, streaming audio – are digital only. They don’t have a broadcast component.

Advantage: radio.

Advantage: radio.

That because the best broadcast radio properties and companies have a robust digital presence, giving them a one-two punch.

So, there is a caveat: companies that have been slow to build their digital assets aren’t going to qualify for this radio + digital twofer. Sadly, that knocks a lot of radio stations out of this conversation.

But for those who have invested in digital resources, content, and personnel, there’s a definitive edge. When a marketer is talking to a radio entity that has built up viable digital assets, why wouldn’t they logically want a healthy combination of both digital and radio? In other words, prime digital assets supported by a powerful and popular megaphone called “radio” where well more than 80% of the U.S. population can be reached with a campaign.

This should be a strength for radio. Rather than the two departments squabbling and competing for turf, the sum of their parts far outweighs what either individually brings to the marketing party by themselves.

And as the chart indicates, digital shouldn’t be treated as an afterthought, or a little brother to radio. It won’t be long before digital overtakes radio in the revenue column.

But for radio to fully take advantage of this 1 + 1 = 3 proposition, it assumes radio reps can walk and chew gum at the same time. That is, do they have the ability to package the best of both worlds into powerful marketing assets that can brand, put butts in seats, or get the locals out to a mattress store, new car showroom, or the grand opening of a phone store?

locals out to a mattress store, new car showroom, or the grand opening of a phone store?

True, it requires an understanding of what the various digital tools can provide, whether we’re talking about web video, a newsletter, podcasts, mobile app avails, email blasts, social media posts, and of course, local events and personality endorsements.

That colorful Venn diagram at the head of this posts depicts a valuable marketing intersection. When they’re on their game, radio broadcasters can offer digital assets in combination with their proven ability to use their airwaves to connect, communicate, and even commune with the locals. That gives broadcasters an edge if (big “IF”) they can educate and train their sellers to integrate and package on-air and online assets in attractive arrays that give advertisers more complete and holistic marketing campaigns.

But up to this point, this has been, at best, aspirational; at worst, impractical.

That’s because too many lifelong radio managers might not grasp the power of the 360° marketing model – the best of both worlds, the sum of the parts.

And radio’s account execs have long complained about having too many things to sell, and thus default to the low-hanging fruit – :30 and :60 on-air commercials that may/may not integrate the all-important digital component. As we should have learned by now, and the eMarketer chart confirms, radio ads alone aren’t attractive or effective enough by themselves for many advertisers.

And radio’s account execs have long complained about having too many things to sell, and thus default to the low-hanging fruit – :30 and :60 on-air commercials that may/may not integrate the all-important digital component. As we should have learned by now, and the eMarketer chart confirms, radio ads alone aren’t attractive or effective enough by themselves for many advertisers.

But a radio buy enhanced with “digital chocolate chips?” That’s a whole different ballgame.

So, pass the Doublemint, Trident, Bazooka, or Orbit. And let’s take a walk.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

1 + 1 = 3. Digital is Delivery. RADIO IS CONTENT.

Maybe so. But you could flip it around, too (depending on who you’re pitching!)

“Can we all just get along?” ~ R. King

Actually, here’s an idea that will set the cat amongst the pigeons (but could redound to commercial radio’s benefit): Since digital, unlike broadcast radio, hasn’t missed the conditional-access train, why not monetize listeners’ loathing for ads by offering, for a price, an ad-free stream that parallels the OTA program except for the ads (ie, more songs inserted, cleverly edited to match the length of the stopsets)? A whole new revenue stream up for grabs, with plenty of OTA cross-promotion. Now we’re having fun…

Bauer Media in Europe is doing just that – a low monthly subscription in exchange for a commercial-free version of the station PLUS you get a handful of “song skips” every hour. Not sure how it’s doing, but it’s already a couple years old and in several European countries. We tested the concept in our Techsurvey last year, but with mixed results. Only a handful of station P1s say they’d pay for this perk.

What Bauer is doing is probably indeed the best current example. Just in case, its omnibus site in the UK (for now, at least) is https://planetradio.co.uk. However, that might end up being supplanted by Rayo.

Combo! It’s the perfect solution to gain sponsorships and increase ad dollars!

That’s the goal!

Good piece, Fred! It’s like Offense and Defense in football arguing which is more important. (Not to mention Special Teams.) You wanna play the current game and excel? Embrace rule changes and new trends…or miss the bus. Digital? AI? Bring it on.

As a fan of sports analogies, I thank you, Dave, for making a good one.