No matter who you talk to, there’s no denying broadcast radio is facing existential challenges largely due to the onslaught of digital media – in both of the worlds of programming and sales. Audio is coming from all sides now – streams, podcasts, satellite radio, and customized playlists. We saw this all over the Las Vegas Convention Center two weeks ago at CES 2019. And broadcasters are now experiencing the pain of losing revenue to digital brands that promise accountability to advertisers.

No matter who you talk to, there’s no denying broadcast radio is facing existential challenges largely due to the onslaught of digital media – in both of the worlds of programming and sales. Audio is coming from all sides now – streams, podcasts, satellite radio, and customized playlists. We saw this all over the Las Vegas Convention Center two weeks ago at CES 2019. And broadcasters are now experiencing the pain of losing revenue to digital brands that promise accountability to advertisers.

Legacy media are especially challenged to keep pace – much less survive in this environment. For the most part, the audience is aging – whether we’re talking newspapers, magazines, television, or of course, radio.

As has been the case for some time now, newspapers appear to be in the direst of straits. Beyond shining examples like the New York Times, Washington Post, Wall Street Journal, and a handful of others, most local newspapers are beset by severe cutbacks, employee buyouts, declining readership, and falling advertising revenues. Everything’s being downsized, including staff and the physical size of newspapers themselves, and most noticeably, local news coverage.

A recent article in the Washington Post confirms the shrinkage facing the newspaper industry. The story written by Steve Cavendish leads with the blaring headline:

“Local newspapers have already been gutted. There’s nothing left to cut.”

Meanwhile, television finds itself in the midst of an entanglement of epic proportions. Cord-cutting may soon become an Olympic sport. Pay TV is rapidly becoming an endangered media species, as viewers rapidly gravitate to video streaming services. And so-called “skinny bundles” will not save the day. Netflix is the eye of the TV content hurricane, of course, dominating the action and the disruption. And who believes their newly announced rate increase won’t simply be absorbed by subscribers clamoring for the next “Bird Box,” as well as movies and scripted TV series that are often better than most films showing in theaters?

And speaking of which, let’s talk about the movie industry. How many of us can say we’re attending more movies at theaters than we were a couple years ago? And once again, Netflix is the culprit. But it’s bigger than that. There are many reasons why more actors, directors, and producers have gravitated to the video streaming ecosphere. There’s more freedom and less box office pressure in the worlds of Hulu, HBO, and Amazon Prime. And frankly, there’s better content on streaming TV than at a theater where the popcorn is overpriced and the experience isn’t as good as your media room.

Oddly enough in this disrupted media universe, radio might find itself in an enviable position – relatively speaking. It may have dodged the digital bullet. Don’t take my word for it – or even the responses from thousands of our Techsurvey respondents.

The newest analysis from Deloitte Insights slices and dices the entire media environment. “Technology, Media, & Telecommunications Predictions, 2019” is a hefty 112 pages, and it’s loaded with info, analysis, and prognostications about where the entire enchilada may be headed. And it’s an entertaining read.

These days, everyone seems to wearing a swami hat (myself included), bloviating about where the puck is moving. Deloitte may not be the end-all-be-all, but they certainly pour a lot of time, energy, resources, and money into putting together this environmental scan – which they’re been producing annually since 2001.

And their report is extensive, covering 5G, AI, smart speakers, 3D printing, and eSports, in addition to traditional media sectors. The section closest to home is titled “Radio: Revenue, reach, and resilience.”

Or as I now refer to it: “Radio’s 3 R’s.”

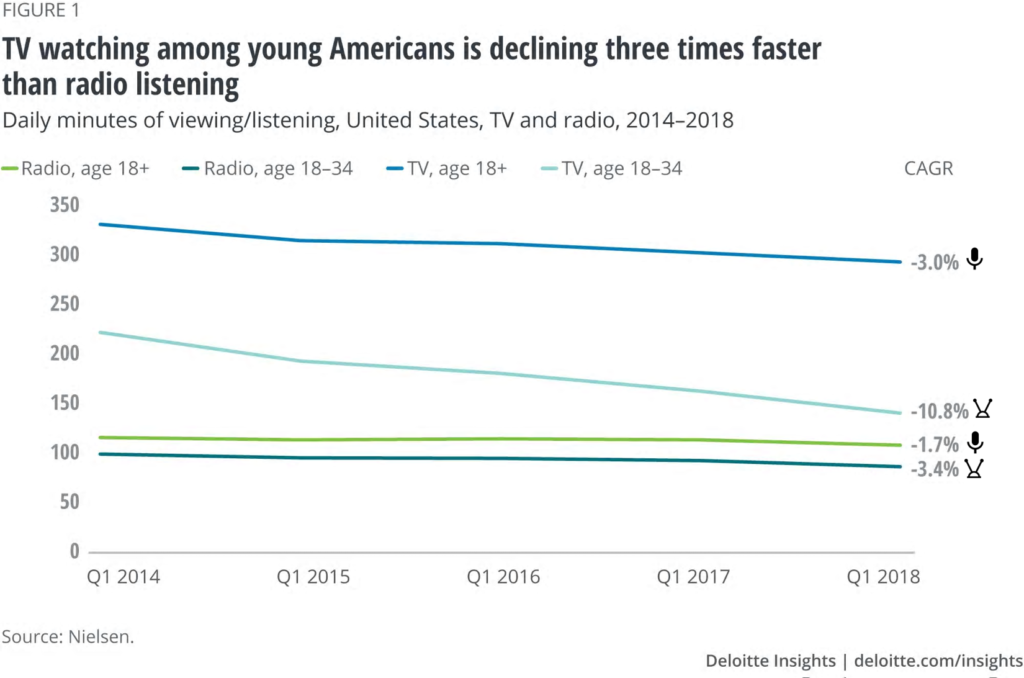

Deloitte’s “take” by research analyst Duncan Stewart is an inherently positive one for broadcast radio. Just by the ratings data alone (and Deloitte uses Nielsen for both media trajectories below), TV viewing is falling three times faster among 18-34 year-old consumers here in the U.S.

Deloitte goes on to predict that by 2025, more young Americans, aged 18-34, will be listening to radio than watching TV. Now I realize that a “We’re eroding slower than TV is” argument does not make for a compelling sales pitch, much less a rationale for investors to sink their portfolios into radio companies.

But the Deloitte report goes on to make some compelling arguments for broadcast radio’s staying power and continued efficacy in an unsettling media environment. In their “Foreword,” here’s their take on radio:

“To prove that even old (media) dogs can learn new tricks, we also write about traditional radio and its resilience,,,even as it celebrates its 99th birthday this year!”

Stewart debunks the “Nobody listens to radio anymore” saw by making the point the medium is often overlooked, under-estimated, under-rated, and simply taken for granted – by just about everyone:

“Radio is the voice whispering in our ear, in the background of dinner, in an office, while driving the car. It is not pushy or prominent…but it is there.”

Stewart also contends that broadcast radio is largely under-reported – that more people are actually listeners than they admit or recall. He points to radio research methodology as part of the issue, but also to radio’s background nature. As Stewart concludes:

“But the radio is on, the sound is coming out of the speakers, and our ears are hearing the radio (and the commercials) even if we are not consciously reminding ourselves, ‘Hey, we’re listening to the radio.'”

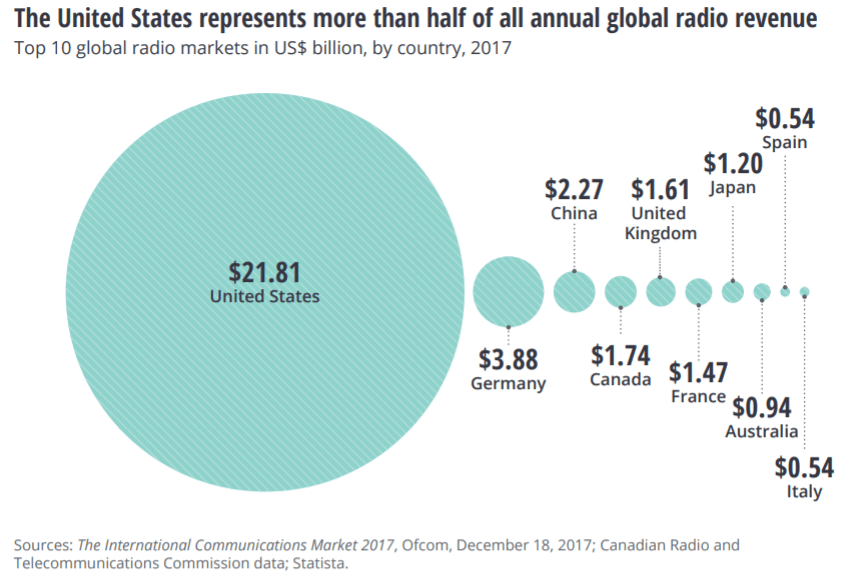

And for the record, U.S. broadcasters dominate a majority of annual global radio revenue – 5x more than its closest competitor, Germany.

It’s a powerful chart, and one that should stimulate more American radio execs to attend international events like Radiodays Europe. This is not the time for radio broadcasters in the States to take an isolationist view of the global industry. There’s a lot to learn from broadcasters everywhere.

In the Deloitte report’s “Bottom Line,” Stewart concludes with this happy takeaway for radio execs:

“The obvious implication of all of the aforementioned aspects is that radio is not going away, and it should be a big part of the ad mix for those buying advertising.”

Of course, “the rub” is advertiser perceptions, where Deloitte reminds us that while broadcast radio provides excellent ROI, buyers and planners at the agency level rank the medium six out of the seven included. Not good.

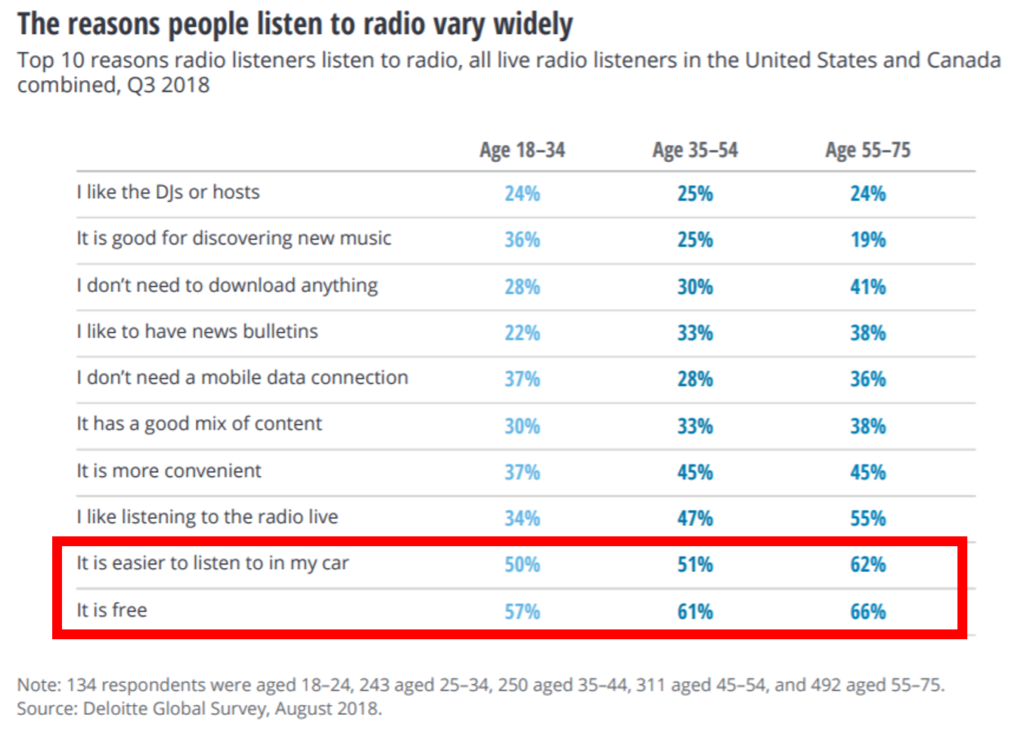

Their other caveat is that because radio listening can be passive, background, and often accompanying other activities, broadcasters must do a better job determining “the why” behind why listeners of different stripes choose to tune in.

And for that, they turn to a research study they conducted among North American radio listeners in 2018. Here’s how it broke down:

The chart is a bit upside-down, but I’ve highlighted the two biggest drivers: radio is easy to access in cars and it’s a free service – two often overlooked positives. Personalities are much further down the list, and Deloitte’s researchers apparently did not ask about radio’s local characteristic.

Techsurvey stakeholders and readers of this blog know this chart greatly resembles the one we create and produce every year across thousands and thousands of radio listeners throughout the U.S. and Canada. And beyond broad age groups like you see in the Deloitte study, Techsurvey (and its companion Public Radio Techsurvey and Christian Music Broadcaster Techsurvey) break out the key drivers by gender, generation, and by format – datapoints critical to the strategic planning process.

Techsurvey 2019 is in the field now, and will be publicly presented at the Worldwide Radio Summit in Burbank in late March. That’s where we’ll see the updated industry chart for “Why Radio?” – one of the best indicators of why broadcast radio remains viable even in the midst of all the digital media competition.

Deloitte’s “Technology, Media, & Telecommunications 2019” is a well-thought out report, and it’s impressive it wasn’t written by RAB, radio’s CEOs, Pierre Bouvard, Katz Media, or other groups heavily invested in broadcast radio’s past, present, and future. Deloitte has no horse in this race. They’re simply trying to help investors and their clients better understand a very fluid media environment.

Deloitte’s contention that radio has 3 R’s makes the case that radio’s reach and revenue have largely carried the day. But it’s R #3 – resilience – that caught my attention. The first two are much mentioned every day by broadcast radio proponents, but resilience is an interesting variable. It’s a term I am beginning to hear with frequency across the business spectrum.

caught my attention. The first two are much mentioned every day by broadcast radio proponents, but resilience is an interesting variable. It’s a term I am beginning to hear with frequency across the business spectrum.

And it perfectly describes the radio business and so many of you working in the industry today. Back in the 70s and 80s when radio was flush with cash, high margins, impressive multiples, and steady demand across the advertising spectrum, it wasn’t all that difficult to hack out a successful career, especially if you were talented and had that all-important work ethic.

Today, you need more than that – and resilience is one of those qualities that figures into the equation. We’ll unpack it tomorrow, with some true-life examples of resilience in action.

Thanks, Steve Goldstein.

To access the Deloitte study, go here.

- Five Years Gone: How COVID Changed Radio - March 7, 2025

- Radio’s Dilemma:The Man And His Art - March 6, 2025

- Let’s Watch A Podcast! - March 5, 2025

Radio: Faster than a speeding bullet. Audio more powerful than all media. Able to penetrate everywhere, wireless and free with superior content origination. Listen, up in the sky…..

Love this, Clark. But where’s the cape?

Great post, Fred. I agree, that “reasons” table is weirdly upside-down. Putting that aside, those results (“easier” and “free”) are what we might call passive reasons. The opposite end, where fewer people say why they listen, has more active reasons: “like the hosts” and “good for discovering music.” I think that has to be significant– the chart seems to be saying that many people default to radio, they don’t choose it on equal footing with other audio categories.

But, to play the other side of this idea, the difficulty and expense of personalized, digital audio are product failures. As you and I have discussed in this space, podcasting is still ridiculously difficult for mainstream newbies, and certainly slows its audience growth. I think Google will play a part in reversing that, and Zack Reneau-Wedeen, who runs Google Podcasts, will address as keynoter of our upcoming Podcast Business Summit on March 5.

The car is still very much in progress. I remember your connected car presentation (with Edison) at the 2013 Radio Show, sounded a clear warning about how car dashboards are changing, and how difficult it can be for radio to co-exist in those environments. It might seem like radio has weathered that looming crisis, five years later. But we are not even halfway through the generational cycle of car buying — the average age of American cars on the road in 12 years. My point is that radio could lose its legacy ease-of-use in the car, even as digital options might become easier. (Important to note that voice control helps everybody, a potential leveler of the field.)

There is also a slow-moving generational shift in time spent, if not absolute reach. (Nielsen shows this in all its public reports.) At last year’s RAIN program alongside the Radio Show, we featured a Gen-Z panel. Each of those young Florida students claimed to never *choose* radio, though they heard it second-hand. (TSL vs. reach.) One of them said radio sounded like “gibberish.” Another said he had an ongoing argument with his mother, that she should abandon radio.

I’m listening to terrestrial right now, and I chose radio yesterday in the car. I don’t want this post to appear antagonistic. I just see warning signs, even while admiring radio’s durability during a time of rapid change.

Brad, i think you have it right. In order to survive and thrive in the media morass, broadcasters are going to have to work harder to provide benefit and sustainability. Your “take” on both podcassting’s ability to superserve audiences is correct – radio has a long way to go. And as the industry has learned since the days of the DASH Conferrence, winning in the car has beocme expoentially more challenging thanks to Apple, Google, and Amazon – not to mention seemingly infinite entertainment choices for both drivers and passengers.

The puck continues to move away from legacy media – we know that. And it’s incumbent on broadcasters to adapt, innovate, and take risks – or else be left behind. Sure, the Deloitte report was encouraging in a sea of negativity about radio. And your post doesn’t read as antagonistic – it’s realistic. Thanks for taking the time.

just want to say one thing – radio is already digital.

ahem – let’s not get hysterical – Netflix has some MAJOR problems, financially speaking

going to more movies than ever – my wife and i have seen all of the best picture nominees except “Green Book” which we will be seeing tonite.

the glaring hole in any Deloitte insight is a lack of understanding regarding the role of the automotive market – automotive content consumption – to say nothing of the fixed wireless revolution – ugh

Thanks a ton, Fred. I know what I’m reading through today. And finally a credible story with good news for a change! Gonna share far and wide. Be well.

Jim

Jim, a lot of people feel this way. It was truly nice to see an outside analysis so favroable to radio in the midst of all the naysaying. Thanks for the comment.

of course radio listening is under-reported!!! No one knows what drivers and passengers in cars are listening to! 50% of the market!

Deloitte analysts have their over-compensated heads up their asses when it comes to radio. not a clue not even close Happy talk lacking insight is not helpful. Thanks for bringing reality home at the end with your own insight.

So, how do you really feel about Deloitte, Roger? 🙂

Seriously, their report is perhaps the most optimistic I’ve seen. And while it was truly gratifying to read some wonderful news about the radio industry in the big media scheme of things, there’s no question broadcasters have a lot of work to do in order to stay relevant, top of mind, and in the mix. THanks for your comments.

Trust me when I say, the automakers DO know what you are listening to, if you have a car newer than 2017…that will either work for us in terrestrial radio or against us. They also know where you are driving, why you are driving there, and what your driving patterns are. It is no longer a “diary measurement” or even PPM. They (automakers) have the power to mine the data right from your dashboard.

Game Changer.

Fred and Paul – we greatly appreciate the yeoman’s work you do in helping us better understand and capitalize on the developments in our industry.

No matter what technologies that are competing for radio’s share of time spent with media, there exist profitable, unique and compelling actions that radio can take today.

It begins by each of us asking ourselves: “Apart from all the wonderful things radio is doing in your community, what are you doing to create a more profitable, continuous, self-amplifying, and self-sustaining, community-focused experience, doing so for the concurrent benefit of your market’s constituents (not just your audiences), your advertisers and your companies?”

Andy, thanks for the thoughtful comments. It’s important that radio broadcasters look at these moments in time as opportunities, not burdens. Appreciate you framing it up.

Radio a free”wireless” service.

If it would’ve been invented today, terrestrial radio would be lauded as one of the innovations of CES. Again, another sign the technology is so simple, seamless, and easy, it is easy to take it for granted.

One thing I would have been interested to see is how Talk Radio and Music Radio score.

I find myself on Talk Radio more since it’s a bit more engaging. The local music stations seem repetitive and I often wonder if these stations purchase the same playlists. I seem to know what song is coming up next. If that’s incorrect, it would give me a plausible reason for my string of Powerball failures!

One thing a local radio station has done that drives me crazy is they are double or triple stacked advertising. For example, they used to start the show 3 minutes past the hour. Now it’s 6 minutes and even during the show, the talk radio hosts go on and on about the current sponsor. I understand they need to survive and cash in on prime time hours. But I’m abut to tell them where they can put their constant drumming for “MyPillow”.

Thanks for the read.

Paul, thanks for the comment. Our Techsurvey breaks out all formats which help these programmers hopefully create better stations. As for the commercials, I can’t help you there. 🙂

Really an amazing piece and it creates so many ideas and thoughts while reading. You are a beacon for media people high and low.

Too kind, Billy. Just calling them like I see them. Thanks for reading the blog.