Inside Radio reports Nielsen is once again pushing back the currency rollout on its Digital Audio Service. This measurement tool had already been delayed earlier in the year. Now there is no firm date for its release. This is a critical piece of radio’s transition to the modern media era, requiring measurement that can provide listening information as broadcasters increasingly expand their services in the digital space.

Apparently, the sticking points revolve around measuring all the different digital outlets consumers use to listen to radio. And there is a lack of agreement between Nielsen and broadcasters about just how much “missing data” we’re talking about.

That speaks to the larger issue of digital measurement and its end result – monetization. Because without metrics, money is hard to come by. Advertisers won’t invest in radio’s digital platforms if there isn’t a trustworthy and comprehensive way to measure them. And Nielsen’s fits and starts with digital ratings are all part of the ongoing frustration that plagues content creators and publishers in their efforts to deliver usable measurement tools to marketers.

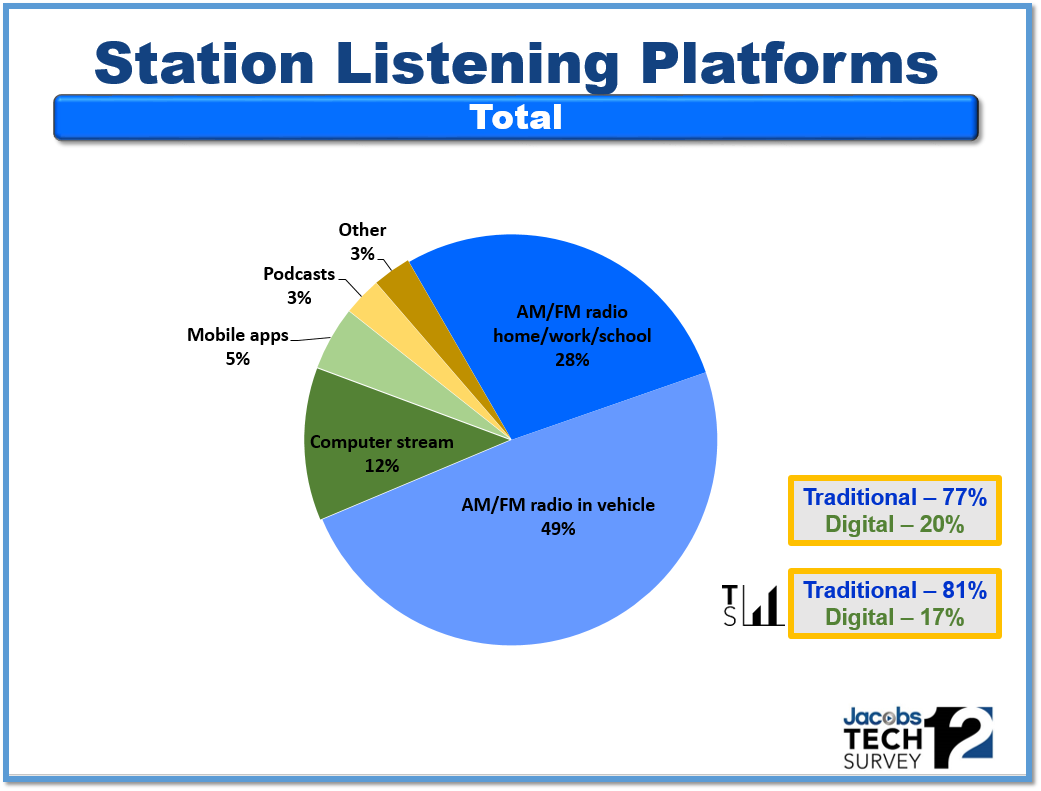

I am reminded of this “metrics gap” each year we get our Techsurvey information back from the field. The past few years we’ve included a question that asks listeners to think back to the previous week and how and where they listened to the station that sent them the survey. Here’s this year’s chart from TS12:

That box in the lower right hand corner says it all. More than three-fourths of consumption to our stakeholder stations occurs using “regular radios” in cars (nearly half of all usage), home, work, or school – referred to as “traditional” listening. But one-fifth now takes place on digital platforms: computer streams, mobile apps, and podcasts. And the main takeaway here is that each year, consumption of broadcast radio stations continues to shift in the digital direction, underscoring the importance of metrics that can capture it all. You can see last year’s results from TS11 in the box at right as well.

Notably the same trend is taking place in our Public Radio Techsurvey (to be presented at the PRPD Convention in September). Now bear in mind that our techsurvey’s are web-based, using primarily radio station database members as our sample frame. Over the years, we’ve observed these studies are a bit ahead of the curve. But any way you slice it, broadcast radio stations are experiencing increased usage on digital platforms that goes unaccounted for.

Radio has had to confront many complicated challenges during the past decade or so. But none looms as large as this ongoing inability to measure and monetize usage on a plethora of devices and outlets.

The same problem is impacting podcasting’s ultimate growth curve, especially the ability to generate meaningful revenue. An ongoing topic at this month’s Podcast Movement conference in Chicago was how little is truly known about how people use podcasts. Sure, download stats are plentiful, but beyond that, there is scant information about whether consumers actually listen to podcasts, as well as where they listen and when. These are the components that contribute to making a platform a viable revenue generator, as well as informing producers and talent about what’s working…and what’s not.

Part of the issue is that consumption has moved across so many platforms, gadgets, and devices that there’s no comprehensive way of capturing it all. The television industry is going through many of these same frustrating gyrations with its measurement, driven largely by complications caused by DVR viewing. Nielsen’s Total Audience ratings have incorporated viewing metrics over three days (C3) and one week (C7), including viewership over 35 days. But advertisers aren’t on the same page about which of these numbers is most valid for creating media and marketing plans. The tipping point continues to come down to measurement.

As Group M’s research maven Lyle Schwartz told MediaPost this spring:

“It doesn’t really exist until the marketplace can analyze it and project it. You need months of data, you need time.”

Unlike in radio, Nielsen’s not the only player in the TV ratings game. comScore is in pursuit of better metrics, bolstered by its merger with Rentrak.

And that’s why this newly announced initiative to provide a new data solution for radio occurs at an intriguing time. There’s already been a lot written about the emerging group of radio broadcasters looking to start an alternative ratings measurement service powered by Shazam in their pursuit of finding their own answers to this digital audio conundrum. Whether it will result in a solution to this audio usage Rubik’s cube or pressure Nielsen to step it up, the overriding goal is how to best measure everything.

I can tell you that as a programmer, that’s precisely what we want, too. There’s never been a great need for an accurate 360° method of measuring how our content is being consumed across both new and traditional platforms. A level playing field, a way to understand a brand’s true reach and value, and a reflection of the art and science we blend together to make better audio programming is essential. Yes, metrics matter for monetization, but as the NPR One app team and other digital content creators are learning, data informs content decisions, too. The programmers at Pandora, Spotify, and other pure-plays are able to see cross-platform usage in advanced ways that allows them to craft features and applications that provide a more satisfying user experience.

Metrics along won’t solve radio’s problems. As consumption data becomes more comprehensive and sophisticated, hopefully some thought will go into coming up with answers addressing how to train radio sellers and marketers about how to use this ocean of numbers. Just having a metrics dashboard loaded with data will fall short if sellers aren’t properly versed in how marketers can best benefit from it. We can only hope for the end of cost-per-point transactions or tossing in that “value added” remote.

To truly benefit from the explosive digital revolution, radio will need to address both measurement and monetization, but also how all this data can better inform both programmers and the salespeople tasked to sell all this content.

We’re in the middle of a digital media revolution without the tools to navigate the changes. It’s yet another example of where the industry’s resolve to work together to forge solutions has never been more paramount.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Another fine and timely post, Fred. It will be interesting to see how Nielsen responds to the Shazam challenge. Nielsen, at least potentially, has a lot at stake in PPM. The opportunity to single source TV and radio through PPM could be very powerful and deliver $$ to both broadcast TV and radio. Cross-measurement of TV and radio via PPM is happening now in Canada via Numeris, our national ratings company. It’s still early days, but it is starting to change the way people are thinking about selling and buying both TV and radio.

Jeff, that’s encouraging news. Here on the ground – working closely with programmers, sales managers, and digital directors – it’s SO glacial. Clearly, these are big, gnarly issues with many moving parts. Each passing year amounts to lost revenue and brands that aren’t developing as quickly as they should. I know we’ll look back at this period of time as being an awkward, uncomfortable one. Here in the middle of the mix-master, it isn’t a lot of fun. Thanks for the note and for reading our blog.