As the weirdness of 2023 meanders on, it’s becoming clear the metrics that now matter for radio broadcasters.

While earnings calls may fall under the banner of “Same as it ever was,” the KPI – or Key Performance Indicator, as CFOs love to call them – is now transcending revenue, profits, and margins.

Sure, growth can be measured in lots of different ways – and the C-suite will do whatever it takes to spin the numbers to look as green as possible.

The new number that separates the men from the bots is a company’s DRP. (I just made that up, but it stands for digital revenue percentage). And it has become the Holy Grail – the number that CEOs are uniformly using to measure progress in the transformation to all things digital.

And not a moment too soon. Broadcast revenue is flagging – and I’m being kind.

A story in Inside Radio last week drew the boundary lines, showing progress – or lack thereof – in how broadcasters are moving the digital needle.

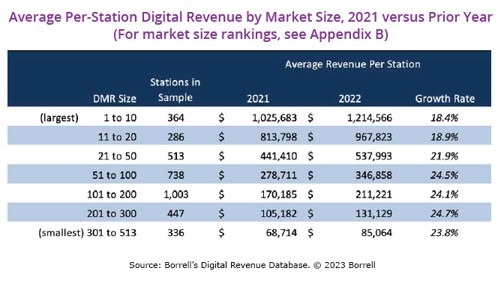

A few key pieces of information from Borrell Associates and the RAB:

- Digital now comprises half of the broadcast radio industry’s growth.

- Digital revenue is predicted to break the $2 billion barrier this year.

- The average station in markets 11-20 generated nearly $1 million last year in digital revenue.

- In markets 101-200, digital sales were just north of $210,000.

You can see some of the dynamics in the chart below:

Borrell mentioned another trend that has existed in radio since Marconi, and that’s the division between the haves and the have-nots.

So-called “Best Practice clusters” outperform their less adept peers by financial leaps and bounds. Borrell says that in the biggest markets, the super performing clusters averaged $22 million in digital billing. But the overall average in top 10 markets is an unspectacular $5 million. That’s quite a difference.

An oddity in the data shows up in that same chart. The largest markets experienced less growth – by percentage – than the smallest markets. So, how do we square this?

As we know, blowing through goals is often as much a product of how bad last year was than how spectacular this year’s sales turned out. Perhaps in the smallest markets, achieving strong gains had a less degree of difficulty given the comparison to a station year over year.

As we know, blowing through goals is often as much a product of how bad last year was than how spectacular this year’s sales turned out. Perhaps in the smallest markets, achieving strong gains had a less degree of difficulty given the comparison to a station year over year.

The other unknown is how strategically radio broadcasting companies (and most would prefer to be called “multi-platform media companies”) actually are pulling it off.

And that is, in fact, the defining difference because many companies are taking wildly different approaches. Some have leaned into podcasts, while other have focused on leveraging their web metrics.

And then there’s Townsquare, the company that’s had inarguably the most impressive results, even though their radio holdings are in smaller markets.

As Townsqure boldly announced “We no longer are a broadcast radio company.”

The company is opening up its second “call center” in Phoenix (the first was in Charlotte) providing an array of digital marketing services. The original center – now a decade old – employs 600 people (some of whom are pictured below), according to a story in Inside Radio.

In 2022, Townsquare hit a new high in monthly unique visitors – 70,000 on average. And that propelled a robust increase in overall billings of 20% year-over-year.

Of course, broadcasting remains Townsquare’s biggest challenge – or better put, high-profile laggard. CEO Bill Wilson explained radio revenue “will face the most significant headwinds in 2023.”

There no “random acts of digital” going on at Townsquare. Their strategy is cogent, well-defined, and clear. And it’s paying off in their quarterly Wall Street calls and with their investors.

Interestingly, other broadcasting companies aren’t going the Townsquare route, a departure from how traditional competition has played out over the decades. While most broadcasters openly copied each other’s successes when it came to formats, sales department structure, and other operational schematics, it’s been less apparent in the digital space.

It also leads to questions about how companies are staking out their digital strategies. How much research is actually being conducted in these digital “blue ocean” initiatives? That’s a rhetorical question because I don’t exactly know.

I DO know many companies are still researching their broadcast content, in some cases aggressively. Yet, the return on that investment might be considered questionable, given the “meh” performance of radio revenue over the past decade. And Wilson’s prediction about “headwinds” in 2023 isn’t likely to change in subsequent years.

So, why aren’t digital initiatives better studied and analyzed? Ironically, the answer is that oftentimes, digital execs aren’t always excited about having their plans scrutinized by consumers, instead defaulting to analytics. After all, when you have actual usage data, perceptual research pales in comparison, right?

But that’s like a radio broadcasting executive telling you “the answers” are in Nielsen (or formerly, Arbitron) data. In fact back in the 70’s, many of them said just that. Ultimately, more prescient and thoughtful broadcasters won that argument and audience research as we know it in radio became a staple of running a station.

Today, however, that same logic often prevails among those who fly the digital flag in radio companies. The metrics are all they need. But that negates the value of determining the market to begin with, and having the discipline (and the stomach) to better create content, goods, and services before someone clicks “submit” or “publish.”

How many digital disasters might have been prevented with a well-designed, forward-thinking research study, or even (gasp!) a series of focus groups to first better understand the mindset of the audience? Digital or analog, consumers lead with their hearts, whether they’re listening to music, tuning into sports talk, playing a video game, or downloading a new app. Tapping into their passions and emotional mindsets is still key to keeping content on the throne.

understand the mindset of the audience? Digital or analog, consumers lead with their hearts, whether they’re listening to music, tuning into sports talk, playing a video game, or downloading a new app. Tapping into their passions and emotional mindsets is still key to keeping content on the throne.

Tomorrow, we’ll put it to the test, looking at a media company we all know, and determining how they’ve elevated creating digital content for near-adjacent markets to their core product.

In the meantime, what’s YOUR digital plan?

- VOA RIFed - March 17, 2025

- Under The Influence(rs) - March 14, 2025

- Radio’s Dilemma: Trump Or Get Trumped - March 13, 2025

Townsquare is unique in that they are becoming the only media source in a lot of small markets as small-town newspapers fold. They fill a void in those markets with their websites and regional coverage from stringers and a handful of reporters. Radio is only a part of the picture, used to promote the rest of their services. The model is much less successful in larger markets where they have competition from other groups and media.

As far as digital is concerned, the medium is less important than the content. Jukeboxes are competing with on-demand music services. If you don’t have some value added in entertainment, information, or content curation you’re going to continue to see numbers fade as younger listeners find the content lacking. Meanwhile, the search for a way to monetize listening without disrupting the flow of content continues. One thing is for sure: 6+ minute commercial sets ain’t the answer.

Brian, good observations here. Thanks for keeping the conversation going.

Townsquare bought us less than a year ago. Our “digital strategy” with our former company, and every company before that was, “push them to listen on the stream” with no other real incentive to get on our app or even open our website.

While it’s a whole other world, I have to say TSM’s strategy WORKS. In less than a year, while training radio announcers how to write articles, our app downloads, and websites are getting hits that we could only have dreamed of before.

I’m not going to say that it’s easy. It’s tough to write when you’ve been trained to speak. The winning sauce is local. That’s all they really want are articles about your city or state on the sites. Then they have us use that for our show prep.

Even though things are vastly different for me, I’m no longer a PD, I’m a brand manager, and I don’t even get a whisper in music meetings they don’t consult me on anything, really; I think I’d rather be working for them than anyone else. Why? Because TSM sees the future, and it’s digital. It’s nice to know we’re here for the long haul.

I’m very interested in your next article.

Tammie, I’m a bit slow getting back to your thoughtful, candid comment. I’m sure lots of people in the industry read it with great interest. As an insider, your perspective is important, and your observations go a long way toward explaining why Townsquare is enjoying success. Thanks as always.

Wow!!!!

I’m skeptical of radio’s marriage with digital. Not because I think radio can thrive doing over the air audio, but because it’s not being done in a way that makes sense.

First, I have a question about those digital revenue figures. Most of the digital revenue that radio brings in is commission based – from selling other companies’ products to augment declining radio revenue and (hopefully) to provide its customers a broader based and more effective marketing campaign. So are those digital rev numbers top or bottom line – the difference is about 85%.

With the exception of Townsquare, who has been way ahead on digital and actually has a cohesive strategy, Radio doesn’t seem to be creating or acquiring digital products – so it appears that its strategy is to slowly evolve into a rep for multiple media products and out of radio. There’s nothing inherently bad in that, it just doesn’t feel like radio. Diminishing the core product and focusing on being a sales organization for other products looks like an admission of defeat, not a reinvigoration. It also begs the question of how those reps can bring enough value to have a seat at the media table – particularly when media buying has become more stratified with different decision makers for different media. And it doesn’t help that radio has cut sales comp along with everything else.

Radio missed the opportunity to blend its core product with digital ones years ago and now other products own those spaces. If radio wants to evolve into some other form of media (plural) platform it needs to bring in leadership that understands how to do that and can envision something workable and enduring. What they’re doing now is OK but isn’t really either.

Bob, tough medicine here, and thoughtful suggestions about where to go next. Townsquare and the NY Times have proved that to truly optimize digital, you need research, investment, and time – three elements in short supply.