No one loves a provocative research study more than me.

At Jacobs Media, we conduct our fair share of research every year – three Techsurveys among commercial, public, and Christian music radio fans, in particular. And throughout the year, I relish seeing OPR – other people’s research – to learn the questions they ask and the answers they yield.

My first job out of school was with the Frank Magid research firm in Marion, Iowa. At the time, it was the only company of its kind – well ahead of the media research trends. And among us research analysts, it was very competitive. Oftentimes, we vied to see who could come up with the best and most effective research questions.

So, when I bumped into the Signal Hill Insights blog earlier this week, Jeff Vidler‘s research findings almost jumped off the screen. In fact, he had me with the headline:

“All Audio Is Not Alike: What Each Type Brings To Listeners And Advertisers”

Wow.

We live in a world of metrics – what audio source has the most cume, the most eyeballs, the most downloads, the most TSL, etc. We’re into superlatives – hence all those “mosts.”

But the one we never ask is which audio source is most effective?

That’s what Jeff’s newest online research study attempts to tell us. He surveyed just north of 1,500 Canadian adults earlier this month. And he compared their use of audio: radio, streaming services, owned music, and podcasts.

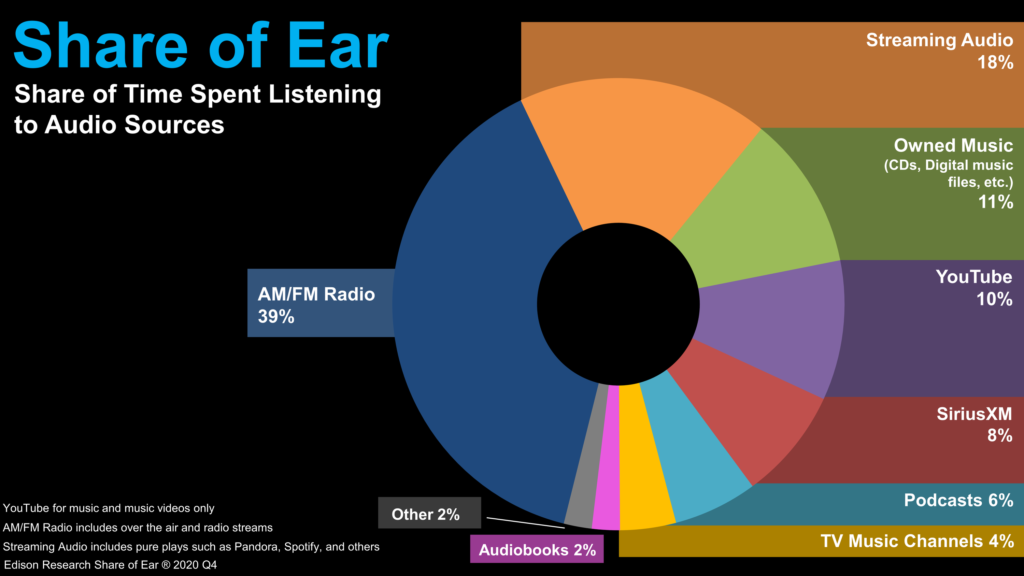

The findings are nothing short of spectacular. That’s because we tend to view audio listening as a pie – different sources make up different “slices.”

Last week in a blog post about Nielsen’s newest measurement tool for TV – The Gauge – I questioned why radio doesn’t have a similar ratings tool. And I noted the closest metric is the Infinite Dial’s “Share of Ear” chart – for many, the industry standard.

And why not? For years, it’s provided a longitudinal look at the state of audio – based on share of use.

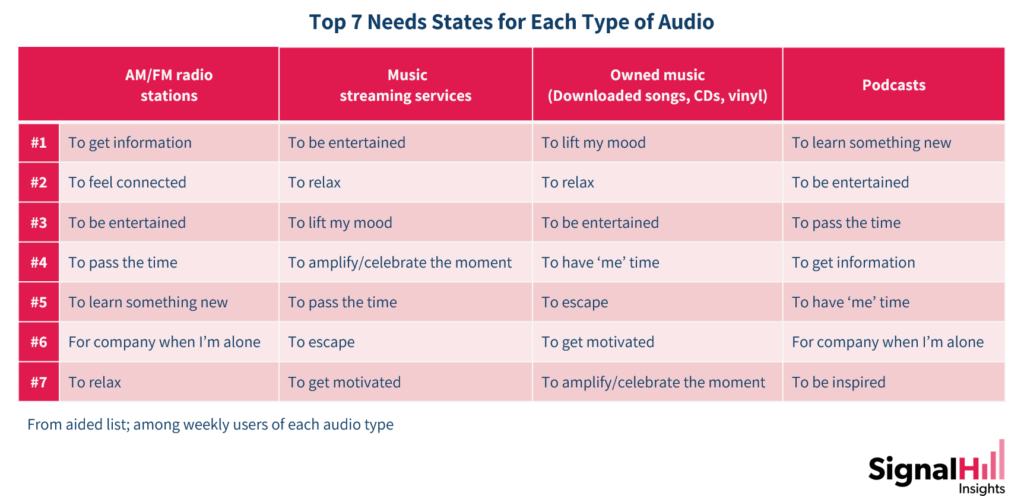

Vidler turns many of the typical questions we researchers usually ask about on their side. In his “all audio is not created equal” premise, he first asked about what he calls the “need states” for each audio platform.

In the telling chart below, Jeff ranks the top 7 for each audio category:

Music streaming services and owned music have much in common. For each medium, two of the top three “needs states” are the same:

- To relax

- To lift my mood

That is revelatory about how people listen to services that are often all music and no talk.

Podcasts are cut from a different cloth. Listeners point to the benefits of learning new things, being entertained, and uniquely, to pass the time

But then there’s broadcast radio – an entirely different audio animal. Entertainment and information, not surprisingly, are core needs. But in second place is a need that shows up in no other “Top 7” list:

To be connected.

Listeners get it. You don’t feel a true connection to a medium if it’s not live and in the moment. Streaming music, owned music, podcasts – all canned. They could have been recorded yesterday…or in 2019. You can pause and rewind them. Yes, they can be entertaining, and in the case of podcasts, even informative. But they aren’t live. They aren’t in real time. They aren’t connected to anything remotely local or in real time.

have been recorded yesterday…or in 2019. You can pause and rewind them. Yes, they can be entertaining, and in the case of podcasts, even informative. But they aren’t live. They aren’t in real time. They aren’t connected to anything remotely local or in real time.

A great radio station stands for something – music, entertainment, personality, community spirit, service. These other audio media occupy time but lack a sense of belonging.

This perceptive research question from Jeff Vidler provides a truer sense of the distinctions between these media – rather than staring at shares.

And it begs the question why we don’t ask a “needs state” question series for formats, and in the case of perceptual studies, each key station in the competitive arena. So often we get a ratings report only to find out the rock station with the big morning show, charity drives, and concert promotions has the exact same share as the Variety Hits station with no DJs, no van, and no radiothons. Do you think the “needs state” pecking order would be a little different? And couldn’t that information be used with local buyers, agencies, and retailers? Yes, I’ve made a note for Techsurvey 2022.

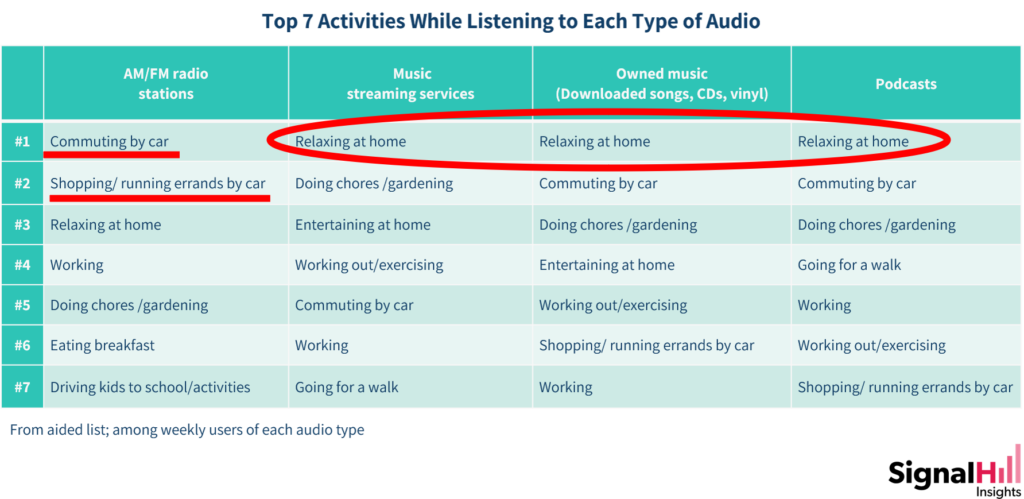

But I digress because Jeff’s new research has produced another important chart I’d like to share with you. Similar to the “needs states” data, it’s a true platform differentiator.

Respondents who used the aforementioned audio sources at least weekly were asked about the activities that most frequently accompany each one. This time, I got out my red Sharpie:

You don’t need my markings to see what’s going here. Music streaming, personal music, and podcasts are most associated with RELAXING. AT HOME. Not out shopping or being engaged. Chilling out at home, kicking back, and listening.

AM/FM radio listening? It goes best with commuting by car and shopping/running errands while you’re in that car. In other words, engaged, spending money, buying stuff. Looks like pretty good fodder for a media buyer. But maybe that’s just me.

Last week, this blog talked about “windshield media,” such as radio where consumers listen while they are in the vicinity of local businesses.

Jeff Vidler reads his chart this way:

“It places radio firmly on the last mile in the path to purchase. Radio is the ultimate medium for timely messages to reach consumers when they are out, about and ready to spend.”

That all-important “last mile” helps us understand that effectiveness as a marketing medium is not just about time-spent listening or share of use. It is what those users are doing, where they’re located, and how much they’re engaged that truly matters.

The chart clearly delineates between media where you “lean in” – like radio and podcasting – versus those where you “lean back” – streaming and personal music.  Where would you rather market your products and services?

Where would you rather market your products and services?

Jeff breaks it down this way:

“We see both podcasts and radio as ‘lean-in’ audio (see above), but we do see another important distinction between radio on one hand and both podcasts and music streaming on the other. People usually listen to radio when they are ‘plugged in’ — driving to work or around town, or while they’re working.

“They listen to radio to connect to what’s going on around them. But they listen to music streaming services or podcasts to unplug, to disconnect, or to escape. That provides a very different context for both programmers and advertisers.”

Now some of my more cynical readers will remind me that this Signal Hill Insights’ research is conducted among Canadians – not Americans. And to that I say, do you really think there’s much of a difference? Here’s what Jeff says:

you really think there’s much of a difference? Here’s what Jeff says:

“The cultural borders between Canada and the US are very porous. Having spent the better part of my life doing audio research on both sides of the border, I am still amazed at how much similarity there is in audio consumption in both countries. There are some big differences from Europe, even from the UK and Australia. But the North American audio landscape is as flat as the Great Plains or the Canadian Prairies.”

In other words, Fuji apples versus McIntosh apples.

Apples.

Jeff’s big takeaway from his research is an important one:

AM/FM radio, music streaming and podcasting each serve a distinct set of needs and listening activities, creating opportunities of their own for advertisers.

True that. And those distinctions are what radio sellers need to communicate to advertisers, especially in this moment in time where we’re at the precipice of the rebirth of shopping and spending habits this summer, this fall, and the December holidays.

The study is also a reminder to programmers – and those who oversee them – about the unique and basic relationship great radio has with its fans. It is all about being in the moment, connecting listeners with their favorite music, people, and topics, and reflecting the community.

oversee them – about the unique and basic relationship great radio has with its fans. It is all about being in the moment, connecting listeners with their favorite music, people, and topics, and reflecting the community.

So, let’s put “shares” aside because while they’re a handy way to understand the hierarchy of use, they say nothing about engagement or connectedness. A pecking order alone comes up short in explaining a medium’s true activity patterns, consumer passion and value proposition, or marketing efficacy to advertisers.

You can thank Jeff Vidler for helping us understand why we do what we do.

Jeff Vidler has been an audience researcher for 25+ years, in addition to programming and managing radio stations. He serve clients throughout North America, and is obsessed with the changing audio landscape, and using innovative research to measure it. Reach him at j[email protected]

- I Read The (Local) News Today, Oh Boy! - April 15, 2025

- Radio, Now What? - April 14, 2025

- The Hazards Of Duke - April 11, 2025

Interesting column today, Fred and I totally agree radio’s great strength has and continues to be it’s “connection” to the listener/the town/the market. I’ve always believed a well programmed radio station, not matter the size market, is a “mirror” of the community it serves.

However, I am curious as to how folks in sales translate this into tangible metrics for an advertiser. I realize this column is geared toward the programming end of the building, but here’s what I’m getting at: In my small market, social media has taken on a life of it’s own with the business community. I know the column is discussing audio, but many business owners where I live see social media as the real “connectivity” media today. So if I tell them radio is the “most effective”, an advertiser would be asking the right question when he/she said “OK, prove your station really is the most effective with consumers in town”. I cannot discern that when I run an ad on your station, but I see it when I post about my business. How do I “know” radio is the most effective because no one “likes, shares or comments” when my ad runs on radio…. but boy they sure do when I post on Facebook! Pie charts, graphs and generalities are great, but proof is in the pudding. How is radio answering the tangibility question?

This is a great question that I’ll try to answer from the sales side. Some history – The agency community said that they needed more verifiable and specific metrics to evaluate radio along with digital media, which offered near real time, one by one metrics. Radio proposed PPM and the agencies gave a big thumbs up, then when it happened, agencies didn’t take radio more seriously and evaluated radio as they always had. The only difference is that radio had better metrics for its own use and a bigger ratings bill.

Fast forward and Nielsen could ask PPM participants to signify when they bought something and work backwards to see how often radio preceded this or that product purchase. That could be a really valuable metric and if this research verifies, radio is probably the last chance to reach a consumer before they buy anything where they have to drive to the store.

Some caveats, but not deal breakers.

1) Social media may well edge radio out for the “feel connected” win – but not for the last chance to reach on the way to a store.

2) The “relax at home” group is probably the last chance to reach ears before making an online purchase. That differentiation could really help radio as there are still a lot of purchases that aren’t online and could help reduce spend on social media for store purchase directed ads.

If I was in charge of something in radio besides the tuning and volume dials, I would dispatch some biz-dev people to meet with agency honchos to find out what of this type of info would be most important to them and most likely to influence their media decisions, then work with Nielsen to devise some proprietary research via PPM participants.

Are there any biz-dev people in radio?

Bob, thanks for responding to Michael. I think you accurately explained the difference between social media and radio (when done well) when it comes to “connectedness.” It is also considerably easier to create those connections in Franklin, VA (where I believe Michael is) than in a major metro with a large footprint. It helps when people know each other, and many drive by the radio station(s) at least weekly.

I also love your “reverse engineering” idea, Bob, when it comes to tracking purchases and then working backwards through PPM. As to whether there are biz-dev people working in the radio business, the answer would be “In general, no.”

Now if radio’s big shots will recognize the way people USE radio-they’ll learn how to operate radio. Why do people listen to news radio? To hear what’s happening now. Can they get it off the police scanner? Yup. But the presentation isn’t the same. Music radio is kinda like a friend being with you to enjoy a bunch of your favorite songs. I would content people listen to a music station for the overall connection, not just “10 in a row” or “The Greatest Hits” – but the greatest FUN.

The medium did it in the early days with “Color Radio” and “Radio-Active”. Is 2021 listening? Where are the overall selling p;oints ?

This could be some of the most significant research on radio in a long time.

Dave, I agree. This research is important, whether you’re in the sales cubicles or the air studio. I’m hoping this study becomes a conversation starter inside a lot of radio stations and companies. Appreciate the comment.

Right on target again, Fred. Sometimes the focus on market share (ie, who’s on top in my area) distracts us from the bigger picture: Are the listeners tuning in to anyone on the dial or are their ears elsewhere? Radio has the golden egg–immediate connectedness, no matter which station you’re tuned to. The other categories don’t have this.

To let your station become more like, say, a streaming service (eg, through remote voice tracking) is to squander the golden omelet you could have made. Or use a Brittany Spears analogy: radio is the photogenic talent that chafes at the constraints imposed by a conservator (her father). In the case of radio, the domineering father would be the distant corporate owner that won’t let the station cultivate true local talent that might have nailed that local connectedness on which real success depends.

Love this, John. “Free Radio!” “Free Britney!”

Interesting, my show is both live and a podcast. The analytics show me the podcast has the larger audience and the most international. Then there are the listeners who listen to the live broadcast online thousands of miles away. What does it all mean?

It’s the beauty of now. You still bring that old school knowledge and warmth. Coupled with your curation, it’s a tasty package. Then you add it the “new accessibility,” and your creativity is no longer tethered to a transmitter/tower geographic footprint. I believe that’s what it means.

Wonderful piece, Fred! I’ll add: In addition to opportunities to connect with the audience every day during a live show, I’ve found it’s not impossible (though obviously not as ideal) to achieve even when you’re not in the room. I’ve been having digital conversations with listeners in Milwaukee before, during and after my VT shift that I deliver remotely. Also, if morning show “Best Of” programming is curated and edited properly (aka “evergreen”) and presented without “Best Of” imaging, listeners often still respond online to station Facebook pages and other platforms with answers and comments to topics they perceive as being live, even though the jock is on vacation. I’ve experienced that a lot since adopting the “anti-Best Of” presentation for re-purposing content.

I think in order to produce great radio, paraphrasing Eric Clapton, It’s in the Way That You Use It.

I’m not surprised, Dave. You’ve always been about audience connections, so it stands to reason you’ve figured out to use the technology to create an engaging show. And I agree with the “Best of” tactic. Again, the new tools allow us to be more in the moment – even when we’re not.

One of the thoughts arising from this is “Define Radio”.

OK, so here goes: Radio is curated music and editorialized speech wrapped up in a trusted brand.

But hang on, isn’t Pandora/Spotify also “curated” music?

Yes, but it’s curated without a human context (DJ, topicality, relevance to “You”).

OK so what about Speech? Isn’t a Podcast also curated/editorialized speech?

Yes, and podcasts are pretty close to Radio, yet not quite the same.

And News? How does Radio News differ from other news sources? Is the answer as simple as editorializing?

I mention all this because Radio’s territorial lines are being eroded by other audio media and platforms. More and more radio-like experiences exist outside the radio industry. Although some radio owners are expanding their territory into podcasts, music playlists and video, other media giants are re-inventing what we know as radio but calling it something else. Think Clubhouse – it’s just a hosted radio call-in show, but no one calls it radio.

So my question is how do we define Radio and once we’ve defined it, how do we make sure it remains relevant, particularly to younger audiences?

I think this is a strong starting point, Roger. I would add that for each area of definition, radio has to prove its value proposition. That is, WHY is it an advantage for consumers/advertisers that radio is “curated music and editorial speech wrapped up in a trusted brand?” I’ll ponder this, and I hope your comment generates responses/reactions. Thanks for doing it.

Thanks, Fred for picking up the ball and running with this. I’m loving the conversation. A lot of excellent points being made. As a researcher, I’m thinking we need to drill deeper into what’s inside the listener need “to feel connected.”

I have a great community of people who care about radio, Jeff. Thanks for providing the research that was the conversation starter.