Back in May of last year, I went out on a limb and recommended buying Facebook on the eve of their IPO. Since then, it’s been an incredibly rocky ride – mostly down – as Facebook has struggled amidst all kinds of Wall Street obstacles. (Eventually, NASDAQ admitted a glitch and paid a $10 million penalty to settle charges that it disrupted the stock offering.)

Back in May of last year, I went out on a limb and recommended buying Facebook on the eve of their IPO. Since then, it’s been an incredibly rocky ride – mostly down – as Facebook has struggled amidst all kinds of Wall Street obstacles. (Eventually, NASDAQ admitted a glitch and paid a $10 million penalty to settle charges that it disrupted the stock offering.)

But here we are – nearly 15 months later – and Facebook is right back to its IPO price – and perhaps poised to start providing a true return on investment. This is no surprise because when you have a base of more than one billion addicted users, you’re eventually going to figure out how to make money on the thing.

And that’s the point of new media businesses like Facebook and others to come. They’re not built on the same foundations as traditional enterprises. In a recent Seeking Alpha article, technologist and software developer Bryan Waters noted that Facebook’s business model is essentially upside down:

“Facebook started its business backwards, which seems to be a growing trend on the Internet. It started by building its audience with a general idea of monetizing them later. It grew its audience by creating exclusive groups beginning with select universities and added each new group insuring it had proper build-out for handling the load. By the time it wanted to add a new market, the users where already waiting anxiously to sign up.”

This isn’t the way companies as we knew them were built, where you have to start the money machine rolling from day one. Like other new media businesses – Pandora and Spotify are good examples, too – the idea is to build cume and then time spent listening (or usage). It’s at that point when you start trying to figure out how the thing is going to pay for itself. Back when the Facebook IPO hit the market, I showed a slide from Techsurvey8 that showed how much daily usage the social media juggernaut was generating from its already massive base of users. It was clear to me that with that many users and that much usage, Zuckerberg and his team would find a way to make money. A lot of money.

A little more than a year later, Facebook continues to be at the epicenter of all conversations about social media, including rewriting the rules of etiquette every week. We hear amazing Facebook stories where business, sports, politics, and relationships are affected by this platform every single day. It should signal to us that we’re looking at a cultural phenomenon the likes of which we’ve never seen.

Facebook has widened its footprint, creating usage and impact far beyond those early days when only college students had access. For the millions of people who wondered why they would ever need to sign up for Facebook, the answers seem obvious now.

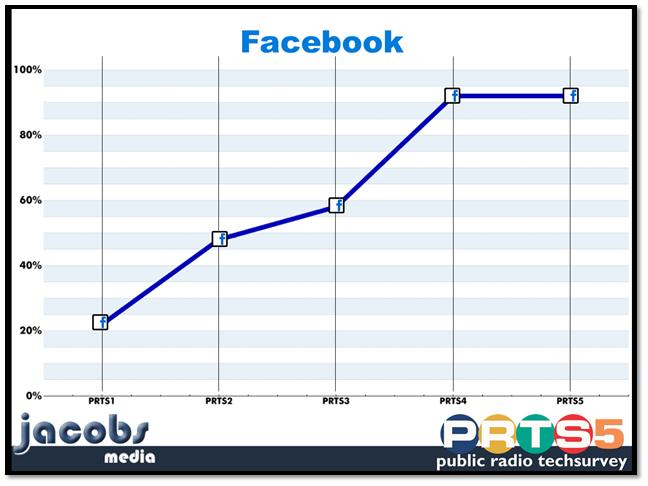

In our most recent national technology study for the public radio system – PRTS5 – this trend chart jumped out at me because it says so much about how the world of social has changed in just five years – where nearly three-fourths of the audience are Boomers – or older:

Facebook has driven this growth, as parents and grandparents have joined its legions to connect, engage, and share.

Facebook has driven this growth, as parents and grandparents have joined its legions to connect, engage, and share.

And as Waters points out, in the time since the IPO, mobile has dominated Facebook’s investor calls. That should tell us a lot about their vision for the future – and what every other media company should be thinking. According to this quote from their Q4 2012 earnings conference call:

“Today, there’s no argument. Facebook is a mobile company.”

Zuckerberg and the Facebook executive team could have been speaking for Apple, Amazon, Clear Channel, and Time Warner.

Mobile is at the epicenter of media today. And new companies and new brands aren’t going to take the traditional growth path we remember from our business and economics courses back in college.

Today, “grow audience-monetize later” may in fact be the new avenue to success.

Every media company – traditional and startup – should be taking notes.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Leave a Reply