The only thing worse than not being competitive in your industry is not knowing who you’re competing against.

In radio, stations and broadcasters continue to spend money, time, and resources on consistently squelching the other stations in town, while often not understanding the larger, dynamic media lay of the land.

At Jacobs Media, we will get the call the moment a translator signs on across the street. How can it hurt us? Are they duplicating our music? Are they using our slogans? Should we block, stay the course, or do something else? That’s not to say that these types of ankle-biter competitors aren’t real. But there are larger forces afoot being virtually ignored, and they are taking their toll on listening and the all-important share of mind.

Yes, satellite radio, pure-plays and streaming personality shows, podcasts, and the growing appeal of YouTube personalities somehow fall below the radio radar. If they don’t appear in the Nielsen or Eastlan book, they don’t exist.

By the way, commercial broadcasters used to take this same head-in-the-sand approach to public radio before Arbitron began to include powerhouse stations like KQED, WAMU, Oregon Public Broadcasting, and WNYC in their PPM reports. Today, these public radio stations – and many others – are often leading forces in their markets, proving there is much more to audio usage and tastes than Classic Hits, Country, and Sports Talk stations. The reality is that these public radio stations were always there, impacting their markets. It was clearly a case of out of sight, out of mind.

But new media isn’t invisible. Stations that are conducting perceptual research begrudgingly see the impact that digital and satellite channels are having on their audiences, splintering tastes and altering usage patterns with growing momentum. Yet, no one seems especially worried. That’s because the focus is on radio dollars, radio ratings, and in-market scrambling to win the battle over who had the most banners at the Taylor Swift show.

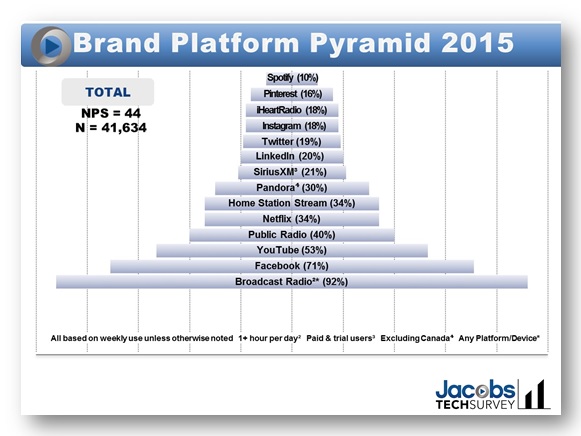

Yet every day, radio’s hold on its audience gets a bit more tenuous, as increasing numbers of consumers discover there’s more to entertainment and information media than radio, television, and newspapers. That’s one of the reasons why we created a special Brand Pyramid in our newest Techsurvey – to show broadcasters the channels and platforms their audience is using, above and beyond radio:

Yes, they still listen to radio – after all, most are members of station email databases. But they also use copious amounts of YouTube, public radio (there it is again), Netflix, Pandora, and Sirius/XM.

So why aren’t broadcasters more concerned?

Mostly because the belief that “We can’t do anything about _______________ anyway. So let’s focus on the competitive environment we can control.”

But that line of thinking only allows radio’s new competition to gain an even stronger foothold. As the chart above shows, these are radio fans using these other channels. Imagine what P2s and P3s are doing, not to mention those who have left the building entirely.

And the notion that digital media channels are alien media life forms so different from radio that we mustn’t acknowledge them sounds just like what Borders, Comcast, and every daily newspaper were thinking when the Kindle, Netflix, and Craigslist were just nascent players. Not any more.

Broadcast radio has amazing strengths: companionship, at-work accompaniment, concert presence, charity activities, better sound quality, simplicity, $0 price tag, DJs– all of those sadly go without saying. In the war that has yet to be acknowledged against digital media, these assets are of critical importance. Except that the more we don’t talk about them, the less impact they have on consumers who are hungrily looking for the next big thing.

One of radio’s biggest challenges is that it is often taken for granted – by advertisers, media buyers, carmakers, local community leaders, listeners – and itself.

As the digital age rolls on, radio is continually being repositioned by these other players as loaded with commercials and music repetition – two of the most often stated complaints. That’s primarily because there’s no effort or push behind marketing radio’s true values.

And that has nothing to do with the fact that almost everyone is still listening. That may be a fact, but it’s not a benefit.

It’s not a reason to listen. It’s not a reason to advertise. And it’s not a reason to include radio front and center in the dashboard.

Radio’s competitive arena is undergoing great change. But the industry is still operating like it’s 1999 when consolidation was all that mattered, and it was one broadcaster versus another.

The battle lines have been redrawn. But radio stations are still busily lobbing grenades at one another while the competition continues to grow mindshare and audience share.

Radio needs to recalibrate its radar, and in the process, redefine its competitive focus.

Time for radio to get its head out of the clouds.

- What To Do If Your Radio Station Goes Through A Midlife Crisis - April 25, 2025

- A 2020 Lesson?It Could All Be Gone In A Flash - April 24, 2025

- How AI Can Give Radio Personalities More…PERSONALITY - April 23, 2025

Thank you. Excellent as usual! “….head out of the clouds?” Too often,it’s somewhere else!

Clark, I’m NOT going there, but thanks for the comment.

Very insightful, Fred. And may I add: Courageous.

It can’t be easy for you to run the risk of being the “messenger with bad news” in an industry you yourself rely on for work. But you always offer suggestions and remain positive. THAT’S what makes you unique, realistic and effective. The more time I spend as a retired radio warrior trying to understand the civilian-world, the more I applaud your observations and suggestions that we smarten up…and fast. Doing that costs nothing, and may mean everything for the future of Radio.

Truly appreciate the kind comments, Jim. Thanks for reading our blog.

WELL SAID, Fred. Our industry has always spent too much time trying to predict the weather when we should be spending more time building arks.

And the good news is that given radio’s relationship with Home Depot, we should get a good deal on lumber! Thanks, Biv.

“But the industry is still operating like it’s 1999” As a one time tier one country artists once sang, there’s your trouble!

1999 – first off, radio sounds like it did in 1999…except not as good. Less research, more tracking, more syndication. But lets look at everything that 1999 ushered in:

Less Management – Companies that own their stations outright (no debt) have no GM in top ten markets

Syndication – The industry that people like most for its personalities often doesn’t have one in the day part most known for and sought after for personalities.

Less Research – In the face (per the new brand platform pyramid) of increased and growing competition. Can’t you just hear it? “…Dey awl tawk wit flat as in Detroit, Buffalo an Cleveland. We can get away wid one music test fuh awl of em).

Dumbed Down Sales Departments – Draconian non competes, crappy comp plans, less overall money and constant goal post shifting to make a quarter. More competition, less effective revenue generation

No marketing – in most cases absolutely NONE.

Centralized Decision Making – in a media that people chose almost exclusively for localism.

This sounds almost comical except that its true. 1999 (really 1996) and every change that dereg/consolidation brought helped to shrink radio’s listener hours and revenue base. I alluded to this yesterday, but it was the cause of virtually every problem other than increased competition that radio faces. It reads almost like a manual of how not to react to a problem.

Yet no matter how bad the results are, despite the fact that companies who invest more achieve comparable margins, radio persists in doubling down in what hurt it most.

And per yesterday’s column, although the results should and could have been worse, almost everyone still listens at least sometime. But few who buy radio believes it, in the face of and probably because of, radio’s very public game of Jackass.

My apologies – this has evolved into a rant, but someone please explain why such lunacy continues in the face of documented poor results. People laugh about weather forecasters being paid when they are wrong half the time, but radio CEOs are wrong almost all the time and get paid a lot more.

can anyone cite another industry where the reaction to increased competition is to get worse?

I think that many of us enjoyed radio in 1999 more than today. (Although if you would’ve asked us that same question in 1999, we would have preferred radio in 1983.) Nothing is the way it used to be – whether it’s air travel, buying a car, or going to the dentist. We adapt, we adjust, and we make the best of the cards sitting on the table in front of us.

You can always come here for a little rant.

Feel better now?

Every time I read something with the theme that radio needs to wake up to its competition I think back to 15 years of warnings. Nobody was listening then, and there is not a lot of evidence anyone is listening now.

You can stack the pyramid any way you wish but the main theme still revolves around Lowry Mays’ 2004 comments in Fortune Magazine: “We’re not in the business of providing news and information. We’re not in the business of providing well-researched music. We’re simply in the business of selling our customers’ products.” It was only a few years later that Broadcasters Foundation of America created the Lowry Mays Excellence in Broadcasting Award. Go figure!

About your “One of radio’s biggest challenges is that it is often taken for granted – by advertisers, media buyers, carmakers, local community leaders, listeners – and itself”: Blaming it on everything (everyone?) else has been a constant. Meanwhile, tech companies continue building another iteration to improve customer experience.

Radio’s biggest challenge is realizing that you don’t bend the internet to fit radio’s business model. You change the model to fit the internet, and all it is offering consumers and advertisers.

I wrote in December, 2009: “Locally, advertising managers need to understand that whether they agree or not, whether they understand or not, whether they want to implement metrics and analytics into their own sales system or not, measuring how much money is spent on advertising against how much money is made through that advertising is unavoidable.” Yet, in 2015, radio still sells impressions with no follow up on facts leading to a definitive ROI.

Agree: “…the industry is still operating like it’s 1999…”

Radio – mostly in markets 1-75 – has a qualitative and content problem; created by firing all the creative (and expensive) people in radio that were good at making content, and failing to hire people from outside the industry who knew how to gather and analyze data. Until these items are corrected there will be no re-calibrating its radar.

Selling customer’s products isn’t a bad goal. The more engaged your listeners are and the more of them you have and the more touch points available with those listeners for customers to access, the better you’ll do at it.

Radio sells engaged eyes and ears – less engagement, fewer of them, less product sold. even Lowry’s goal is being thwarted by 1999.

Bob:

The goal is to create content that draws audience. The result of that goal is it gives opportunity to sell more product, if the commercial quality is engaging – with production directors’ workloads that’s a big “if.”

The most important part of Lowry Mays’ comment is in what he states radio doesn’t do: “We’re not in the business of providing news and information. We’re not in the business of providing well-researched music.” He and other leaders in radio proved both of those points. The results are evident and advertising dollars, as predicted, dropped under his premise.

Ken, it’s been challenging for all legacy industries – especially in media – to wrap its head around the problem. Audience erosion, new platforms, monetization, and the constant state of change. Broadcasters have made mistakes to be sure. But so have the rest of us. In a landscape that doesn’t stand still even Jeff Bezos failed with a phone, Microsoft decades later still has troubles with operating systems, and Apple’s Newton was a disaster. I realize these were all forward-thinking experiments, but the takeaway from all this is that we all are guilty of miscalculation and looking back at the past is rarely productive.

I strongly believe that radio can still be very competitive in this high stakes game, but it will come down to embracing 2015, as young Zach Sang reminded us these past two weeks in Radio’s Most Innovative.

Thanks so much for your thoughtful comment.

I could rant for three or four pages with supporting evidence and case studies that reinforce your excellent post, but the only people who would read them are the ones who already know that listening to radio is only part of a forever widening media consumption behavior. The people who really need to read the post are too busy trying to shake off the hangovers from being out too late after their company’s stock took a hit yesterday. For them, the health of the stock is far more important than the quality of the product or truly understanding the competitive landscape.

And that’s a shame.

Mark, thanks for the comment. I honestly don’t believe that there’s much of a difference between the rank and file and the corporate teams when it comes to this issue. Appreciate you reading the blog.

Bravos, Fred. Pitch-perfect observations.

Truth be known, Radio has a great many of the characteristics digital media competitors covet. We were the first wireless, mobile, real-time platform and first to scale nationally. Some suggest Radio was also the first social media. My thought is that honor properly belongs to the cave painters.

Radio also cracked the monetization code early on. Our primary revenue engine was first introduced this week in 1922 when AT&T launched the second way to monetize Radio (the first was selling radios). “Toll broadcasting” began on their New York station WEAF. They adopted the economic model used for their telephone business – a communication system for hire by minutes and seconds used. An apartment developer paid the toll of $50 for ten minutes of air time, and Radio advertising was born.

As the first incumbent in the ad-supported audio space, we enjoy significant advantages. What’s needed now is an intellectually honest approach to competing for the future. The competition for listener attention, advertiser dollars and regulatory change will continue to escalate. We can do this. Effective leadership and serious investment will be required. Physician, heal thyself!

Thanks, Fred, for keeping this important issue on the jacoBLOG radar.

FYI – Perhaps we should take a hint from our younger broadcast sibling. 110 broadcast and cable networks and the 11 largest MVPDs combined forces earlier this year and founded the Video Advertising Bureau (VAB). Video competitors working together for a common good? We live in the most interesting of times.

We do indeed. The need to look at the audio space more holistically is essential. Radio now longer has the market cornered. It is shared with many other suppliers and channels. While overall usage my be diminishing, radio’s opportunity to fulfill the jobs listeners hire us to do has never been better. Thanks for the kind words, contributing to the conversation, and for reading our blog.