In last Wednesday’s post, we talked about how music performers are faced with difficult challenges and decisions over distribution and monetization. We have used this space in past posts to discuss the way that digital data and consumption patterns are changing the relationship between artists and their music, and the fans that listen and purchase their songs and albums.

Yet, on the radio side of the ledger, so much of how programmers, consultants, and researchers evaluate music is definitely old school. Yes, there are mechanisms in place like KKDO’s “Like/Don’t Like” voting system that provides early indicators of potentials hits or predictable stiffs. Some PDs are consulting digital services, including Shazam, YouTube, and iTunes to gain a better sense of what consumers may be up to.

But for the most part, it’s the charts, music sales, callout in one form or another, and library tests. Most of this activity is simply minor variants on the way stations have evaluated music and deciphered data for decades.

Yet, the dynamics have changed. While music discovery is a high priority for listeners of new-music based formats, radio no longer has the market cornered. Instead, consumers have the ability to find leading-edged sites and sources that provide them with knowledge and resources. And those who love bands – or brands – can easily navigate to their websites in order to learn what’s around the corner, or even rumored to be.

In the past, music directors (when that position existed as a mandatory part of a radio station staff) tended to be involved with record label relationships, music scheduling, and programming of feature shows and specials. Today, they need to be attuned to how songs and artists are faring on multiple sites, along with keeping up with news alerts and developments on artist websites. It has become a more complicated and demanding job.

So when a Spotify Artist blog post by Will Page (their Director of Economics) and Kenny Ning (Spotify Analyst) flew into my inbox the other day, it only reinforced my concerns that broadcast radio is moving further behind the musical curve.

The post talks about the power of streaming exposure (on Spotify) for Meghan Trainor’s single, “All About That Bass.” But a deeper look at their analysis reveals a fascinating dynamic between streaming, Shazam searches, and sales. And then there’s radio.

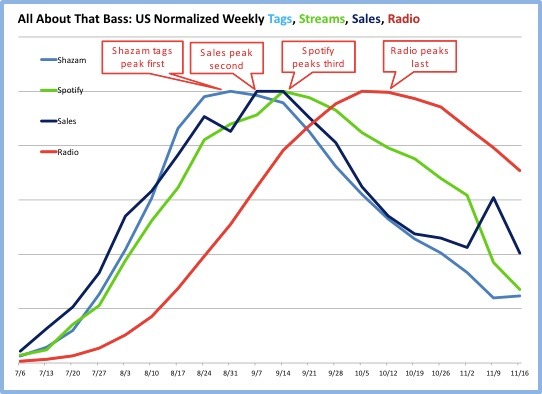

Here’s the trajectory of these four variables on Trainor’s song first in the United States:

The first thing you notice is the close connection between Spotify on-demand streaming (green), Shazam tags (light blue), and sales (dark blue). As the chart notes indicate, their peaks are different – starting with Shazam, then sales, and finally Spotify streams. But the three curves are very much aligned, as they rise and fall on essentially parallel paths.

And then comes radio (red). You’ll notice that across the country, the song’s airplay tended to lag weeks behind the rapid rise of this song on these three charts – including sales. That last one is the head-scratcher. You can understand how PDs might not be aware of streams or even Shazam tags. But sales should be a rather obvious indicator that something was going on in a big way with this song.

Yet, radio’s curve is late. And then interestingly, long after the song started to head south on the three charts, radio airplay continued to rise, and then tailed off at a much slower rate.

Why is this?

Is it that many radio stations don’t take this kind of information into account or don’t have access to it? Or does it have more to do with a conservative policy toward new music? Now we’re looking at a lot of radio stations here, probably most of which are in the CHR or Hot AC formats. So does it make sense that they appear to be behind the curve – at least for this song?

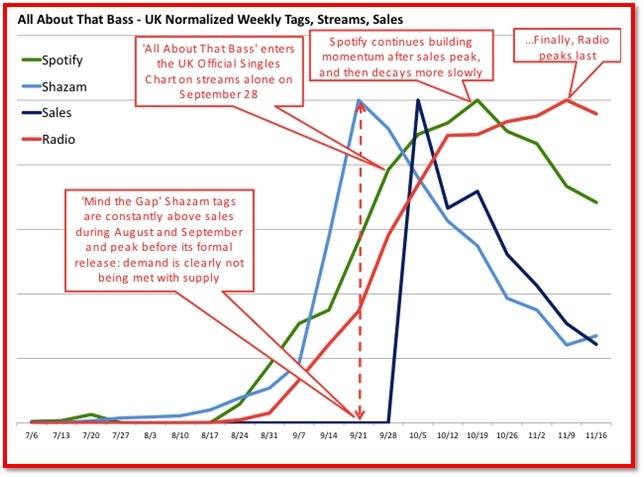

For contrast, Page and Ning also studied the UK during the same time. The color coding is the same.

There are all sorts of interesting differences here, driven in part by the fact the song was available on Spotify six weeks before it went on sale as a download. Thus, the gap between supply (sales) and demand (Shazam tags), which Page points out.

But the other difference is that UK radio is very much in the mix. Clearly, fewer radio stations mean that a big “add” from the BBC can propel a song, as you can see during the week of 9/28. That said, it is clear from these two charts that while UK radio (like in the US) peaked last of the four variables, it was also very much in the mix when the song started to show momentum everywhere else.

And in case you’re wondering, Trainor is not a Brit. She was born in Nantucket, Massachusetts.

So a few thoughts and possible implications to all of this:

1.Can radio still be the music discovery vehicle for most people? Does it want to be? As Clayton Christiansen might ask, “What job do consumers hire FM music radio to do? Is music exposure still a top job duty for broadcast radio? This data indicates the early adopters on pure-plays might find a song first, and then the Shazam tags begin. For those who are not especially involved with discovering music via streaming services or on YouTube, radio may still be breaking music.

In this scenario, however, is radio’s marketing nomenclature off-base? That is, when stations trumpet that “they play the new music first” or even “Here’s the new Lorde,” are they in essence dating and even embarrassing themselves because so many consumers found the song earlier and elsewhere?

2. Shazam is a strong indicator of curiosity and continues to be a useful indicator of a song’s potency. With Shazam, tag levels often jump once airplay begins – an indicator that a song may indeed be a hit because its sparks the need for more information about a song and a band. Programmers have always desired a way to visualize audience interest, and Shazam’s tracking data indicates that it has definitely arrived.

3. Streaming data has value (especially on-demand streaming). With algorithms, exposure happens but not with any consumer impetus. With on-demand streaming channels, however, programmers can get a much better early warning indicator that a song has appeal.

4. Radio (in the US at least) appears to be fashionably late to the party. But it stays longer after everyone else has moved on to the next big thing – even after sales are tailing off. That old adage comes to mind: “When people say they’re tired of a song, that’s the moment to move it up to power.” Or words to that effect. That philosophy has served radio well for decades, but in the face of pure-plays, does radio hanging onto ultra-“burned” songs widen the gap between FM stations and pure-plays? And does radio come off as dated?

5. Is PPM fear creating a culture of music conservatism? Are we seeing statistical indicators that radio is often sandbagging when it comes to new music airplay, hanging back to see what everyone else is doing before taking the plunge?

And if some of these or all of these are true, are they necessarily bad things or are they yet another indication that the equation and the dynamic of new music exposure is fluid? Is broadcast radio’s place in the hierarchy of music discovery moving downward? And if so, what are the implications for programming, marketers, and even the musicians themselves?

This doesn’t suggest, by the way, that radio’s influence on an artist, a song, or on music sales is diminished. This exercise is more a matter of timing and brand perception, two variables that are changing because of the influence of digital media.

Tomorrow, we’ll explore what this means to radio, and how the fire hose flow of new media and technology begs for a change in the thought process and philosophy of music programming.

Does broadcast radio need to reconsider its raison d’être in the digital world?

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

Any data on where they’re listening to the song when they “Shazam” it?

Good question, Patrick. The data was not part of Will Page’s report. It is fascinating to see the role Shazam plays in discovery.

I agree – it never seemed like that service had as big of a footprint as what they’re indicating above.

Playing Devil’s advocate… What if radio is the source for a lot of this music discovery? On the US data it seems to indicate that the song is getting played in radio; it just hasn’t peaked. What if people are still finding this new tune on FM, then searching it out on streaming services, then pushing sales and chart data (which radio then reacts to accordingly)?

I know that’s putting a lot of faith and stock in radio, but the act of searching through Shazam implies active listening through speakers on a device other than the one where Shazam is installed.

The new Nielsen study (and our Techsurveys) agree that radio still plays a major role in how consumers discover music (although this is changing for Millennials). You are right that the study does not account for influence. It is, however, fascinating to see those other curves – especially sales – line up, while radio is on a fairly different trajectory. What moves the sales needle? That’s a big question.

Thanks for bringing this topic into the daily discussion, Fred.

Here at Bridge Ratings we have been intensely analyzing on-demand streaming data for almost a year and are finding some smart programmers using our data and making insightful decisions. Comparing their own airplay with streaming behavior in their markets, they instantly can determine true active interest and “hype” vs “reality.”

In additional studies, we have confirmed that on-demand streaming behavior more closely mirrors actual radio listening behavior – and on-demand experience in its own right – than call-out or auditorium testing does.

Hopefully, this new source of actionable music consumption metrics will help more programmers get clarification on the behavior of their listeners.

Dave, thanks for the insights. Hopefully, radio has a come a long way in the analytical process from calling record stores on Monday morning. Thanks for taking the time to weigh in and comment.

I think its time for radio to face the music (someone had to say it). Your contention, “…This doesn’t suggest, by the way, that radio’s influence on an artist, a song, or on music sales is diminished” seems off the mark. When every other means of measurement is moving on with a song, radio is peaking, It seems as though radio is so late to the party that it shows up in force when people are leaving for the next party.

But could it be that radio’s abandonment of its traditional measuring tools are at least partly to blame? The graph suggests that folks were burning out on the song at the moment radio was embracing it and I would content that callout should and would pick up on that – and should have informed radio when the song was peaking.

I would suggest that not enough stations are DOING callout anymore and that’s the reason radio was late on this song. It used to be that sales lagged behind airplay and at least for one song, that isn’t the case – and the metrics have changed.

Or maybe people just use radio differently and despite what they say when asked in studies, radio isn’t he music discovery vehicle it once was. If so, radio needs to figure out if it could or should try to get that position back.

In any event, why don’t Clear Channel or CBS own Shazaam and Pandora? When Instagram started eating into Facebook they bought it. Lyndon Johnson once said “…its better to have them inside the tent p*ssing out, than outside…p*ssing in.”

The best way for radio to figure out the digital landscape is to buy in, learn and integrate in its best interests.

Bob, thanks for raising some important points. Clearly, this study suggest that broadcast radio should be re-evaluating the ways in which they analyze music tastes and preferences. Dave Van Dyke’s comment speaks to that. How radio now fits into the discovery ecosystem is a key question in a landscape where Spotify, Pandora, YouTube, and Shazam are becoming more important tools.

As for your last question, my suspicion is that the former Clear Channel would tell you they’re proprietary ownership of iHeart Radio is the optimum path, while Cumulus execs are probably content with their Rdio partnership. But as for the question of why these platforms weren’t purchased early on when they were struggling to survive, you’d have to ask them. Thanks for taking the time, Bob.

Great comments Bob. Led me to a couple of observations:

While I agree that more stations doing callout would be great, radio’s primary job is playing hits. Exposing new music is secondary (or not even relevant for some formats). Stations hold on to songs as people appear to leave for the next party because big hits don’t burn quickly. Just because they know it and aren’t seeking it out on Shazam or Spotify doesn’t mean they don’t want to hear it in the mix.

As for sales not following airplay I wonder if we are taking into account how much music sales has changed. it is much easier to purchase a song today. If you can stream it you can buy it instantly – no trip to the record store necessary. Plus the culture today is more song driven than ever so a lot less people wait for the album to come out.

I think this is a great conversation and I hope this post and tomorrow’s entry lead to more discussion of where radio stands in the music ecosystem.

Great blog!

Here is what I keep thinking about… as streaming grows in popularity, music sales will continue to slow down. The whole point of spotify is not having to buy music anymore. Labels lose revenue.

Streaming doesn’t sell tickets and promote concerts very well. That’s how artists make their money. The need to make money isn’t in favor of streaming.

And all of that is why local radio has a more important role to play in brand building and revenue generation than most labels give it credit for. Some of the divisive comments from the music industry have only ended up hurting those who have made them. Thanks for chiming in, Eric (and as much as it pains me to say this, congrats on the Buckeyes – a truly amazing accomplishment).

Received from Jerry Del Colliano this morning!

Music Is Killing Radio

Now downloads are down to under $1 billion.

Remember when record sales accounted for $16 billion a year?

It’s more like half of that now and declining.

Pandora, Spotify and YouTube are not coming anywhere near replacing the revenue from lost record sales even with those lopsided licensing deals that supposedly favor the labels.

Spotify has 15 million paid subscribers and with all due respect that is nothing compared to all the Spotify users who are getting it for free with ads.

The artists are getting pennies but don’t blame the streaming music services. Record labels have always screwed the talent out of their fair share of revenue.

YouTube is so popular with teens as a replacement for radio it is scary and still the geniuses in the music industry are making only pennies on streaming rights compared to record sales.

While the music industry contracts along the lines that a handful of powerful record labels have dictated, 95 million Millennials are now using music like toothpaste instead of the way baby boomers did.

Radio in an effort to save money has dumbed down its stations to a continuous loop of repetitive music with announcers that sound like their puking on the sweepers between the music.

There is no reason to believe that Millennials will use music any differently than they do now – it works on the fly, on digital devices, in the background for gaming. And they certainly don’t need radio stations to tell them what they want to hear.

Yet, things are about to change again in music and by extension, radio.

High-resolution audio is coming. It’s present on TIDAL and Deezer now. Whether it will breath life into the music industry is not known. I doubt it.

Apple will try to disrupt streaming media when it converts Beats into a more affordable monthly stream. Can’t see how Apple – the people who helped kill off albums – will stimulate the music business with this venture.

Vinyl continues to grow – go figure. Scratches and inconvenience equate to a warmer, richer sound for those who care. Question is, will enough people care. I doubt that, too.

Pandora has been growing local ad revenue over 100% year to year and ended 2014 with 109 local sales reps (mostly recruited from radio) so while Pandora listening favorably competes with radio in many markets, they are also draining ad revenue from music radio.

Music is what made radio.

Now it is what’s helping to kill it.

Don’t get me wrong. People will always listen to music. But the way they value and use music has definitely changed.

Meanwhile radio companies are plowing ahead for another lousy year losing audiences, time spent listening and revenue and refuse to rethink their use of music as a programming tool.

If you’re open to changing the way you program music stations, you’ll want to hear the concept and information I am going to present at my Philly conference two months from now.

That’s a game plan that can favorably alter the outcome for 2015.

Here are some other critical things we should get ahead of:

Too Many Commercials – How spots are scheduled can make a difference. Also, the length of spots in each stop set. There is much that can be done. To proceed as is is not a solution.

Unremarkable Programming For 70 Million Baby Boomers – All the focus is on young money demo Millennials. Baby boomers have been radio’s most loyal listeners but that’s changing now. Ignore baby boomers, target them or better yet discover what the two disparate groups have in common.

Outdated Morning Shows – They like personalities but increasingly they don’t like much else about morning shows. Focus on three new features to replace traffic, time checks and weather. Yes, they don’t need them. But consider these three potent options to replace tired old staples of morning radio. (And you can sell them!)

Music That Is Too Repetitive – Audiences have hated music repetition on radio for decades but they had few alternatives. Not so anymore. Two new strategies show promise. One adds more new music without watering down the hits. The better approach is to rip up the traditional playlist and present the music differently.

No Compelling Reason To Listen Longer – Radio TSL has been down every year since the early 90’s. Under 30’s don’t even listen to any song all the way through even though music radio is built on the assumption that if you play the right songs, the audience will stay tuned in. Now, there is a way to keep listeners from straying and it isn’t longer music sweeps.

Don’t Like the Way Stations Talk To Them – Sounds dated, insincere. Too much bragging and hype. It all sounds like radio is out of touch. Talking down to listeners whether we mean to or not. Surprising words that turn off young audiences when used on the air, in promos, sweepers, imaging and commercials. Learn them and overcome this objection.

Radio Is Not Authentic – Demographers have discovered 5 things that Millennials crave. Do these 5 things every hour of every day and radio becomes more relevant to the 95 million members of this age group. One of the 5 things they crave is more authenticity. Learn the fastest way to master being truly authentic to Millennials but also the four other expectations that radio is currently not meeting. They are screaming this out for you to hear.

Lack of Music Variety and Customization – Spotify, Pandora and YouTube are killing radio when it comes to variety and customization. There may be no way to compete with that, but audiences are beginning to tell us what these streaming services are lacking presenting a great opportunity for responsive radio stations to do what streaming services cannot do.

Outdated News and Talk – Two staple radio formats are seeing audiences erode or attracting unsellable aging demographics. News stations don’t just sound like their father’s radio station – they sound like their grandfathers radio station. Droning on and on with sleepy features designed for station sales managers not for listeners to crave. Conservative talk is also over because audiences want compromise not red meat. And Progressive talk radio never really worked. It’s a no-win. But spoken word is something young Millennials like, really like – here is the spoken word station of the future (bring an open mind).

Don’t Know Where the AM Band Is – Think about it. There’s nothing for audiences under 60 on AM. So you may be thinking that younger money demos won’t listen to an AM station, right? True, unless … well, I’ll show you a number of things you could do on two tin cans hooked together with a string that Millennials would eat up. Will you take that challenge? Because I’m going to do it and you’re going to want to brainstorm on it. Forget the FCC. AM needs to disrupt FM the way FM disrupted AM.

PLUS, What Audiences REALLY Want In Digital Content …

There is nothing worse than doing something well that doesn’t need to be done at all. Some stations are doing impressive digital initiatives that audiences simply don’t care about.

Instead, drill down on what listeners really want in digital and get a better return on your investment in time and money:

Storytelling Instead of Podcasting

Short-Form Video Revenue Stream

Non-hyped Social Media Beyond Facebook and Twitter

Content Audiences Can Binge on Just Like They Do Netflix

Apps Not Websites (and That Includes Radio)

Wow, Billy, you’re doing MY job! There’s a lot here – some good questions, smart observations, and a lot of food for thought. Rather than try to respond to many of these points individually, I’m going to leave that up to the readers of these comments. Thanks so much for taking the time to share your thinking and points of view.

We’re watching an industry change before our very eyes, it’s not good for the creative side, artist or label, it’s not good for radio!…whomever comes out with the latest digital technology that allows them to dam up the river and hold listeners captive, they make the money!

There are so many variables, it’s hard to stay on point…!

If I could say and I know I’m preaching to the choir, Popular Mainstream Radio has nothing to do with music discovery in my opinion because it’s already done for them through the services and consultants and tools that broadcasting companies use to develop their playlist, it’s a mature industry that has had a great history and has had it’s day and continues to evolve and hopefully will survive, but at this point follows the trends and charts very very closely and, understandably so, is so afraid of losing revenue and listenership that they just aren’t going to take the chance on previously untested content which would be construed true music discovery to the end user the listener, because sadly, the business model is shrinking for the broadcasting industry itself.

And why should they, as you can see, they also have all these other digital delivery systems further taking the testing right out of it and doing it for them, Shazam, Spotify….etc. etc. etc, this isn’t anything new, companies have been doing that for 200 years, watch the other guy make the mistakes and if we see a for sure winning race horse, we’ll jump on it……so, knowing you’re spinning music that has already built huge market share in the public listening ear….it’s a no brainer!

Hey, I’m just an artist, what do I know!

Instinctively, you know a great deal. I don’t think it’s a black and white. There are clearly people who have moved on to other services, but there are still many in the population who are hearing songs on the radio for the first time. And that repetition is also an important factor in the decision to buy music (for those who are still doing that), or to see an artist in concert. You would think that artists could benefit from some well-placed radio advertising that would drive consumers to their websites. But that’s a different story for another day. Thanks, Billy.