If you’ve worked in radio during the past decade in programming or sales, you’ve no doubt had that frustrating feeling advertisers aren’t seeing the total picture of what your station delivers.

Yes, your terrestrial (OTA) listening is still the foundation of your overall listening. But if your station has been proactive on other platforms – streaming, website, social media, mobile, podcasts, video – your audience delivery runs much deeper than those who show up in the ratings. That’s because in spite of well-intentioned efforts, radio broadcasters aren’t able to deliver integrated numbers that reflect total audience engagement.

And that has led to the crashing reality that many broadcasters are forced to explain lower OTA listening levels, while struggling to prove their digital audience is growing and has marketing value.

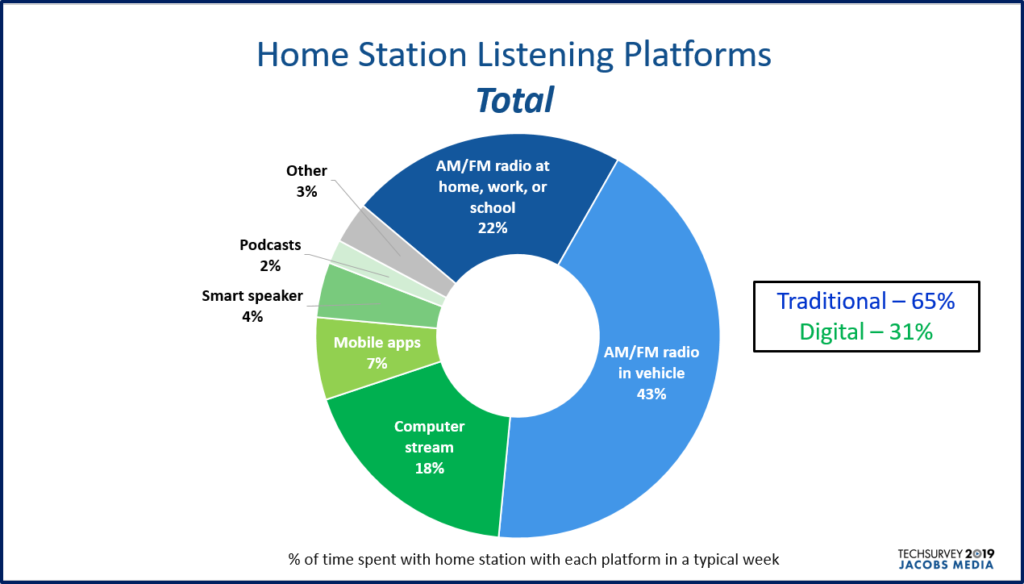

We see this every year in Techsurvey, our mega-study of radio listeners. We ask respondents to think back to how they used their preferred station during the previous week. While their answers are driven by recall rather than real usage, the results are telling. And they support the notion that digital platforms are slowly but surely becoming even more important to a station’s usage profile. Of course, this varies by format and by brand, but the average station data shown below is nonetheless very telling:

While “traditional” radio consumption – on AM/FM radios – still makes up nearly two-thirds of weekly consumption, digital plays a key role among those who use radio the most. Between computer streams, mobile apps, smart speakers, and podcasts, the percentage of digital usage is impressive.

But radio broadcasters still get precious little from these assets. And because they are difficult to aggregate, market, and monetize, advertisers often derive more benefit than they’re paying for. And all the while, they’re asking why traditional radio listening isn’t what it used to be.

This marketing Rubik’s Cube must have been what led NBCU to rethink how it will market its 2020 Olympics in Tokyo. A recent article in The Drum by Andrew Blustein – “NBCU is pitching advertisers a cross-platform approach to the 2020 Olympics” – explains the new sales strategy.

While prime time TV viewing of the Olympics has slipped every time this historic sports event is broadcast – and will continue to – consumption of the games on other screens is growing. Considering NBCU has shelled out $12 billion to snare ownership of the Olympics through 2032, recouping their investment has become more challenging over time. And they’re tired of apologizing for declining OTA numbers.

So, here’s the money quote – literally – from NBC Sports’ EVP ad sales, Dan Lovinger:

“While most people would think we program to deliver the highest rating in broadcast prime time every night on the mothership, NBC, what we’re really interested in is delivering the most compelling content to our viewers.”

No matter where they are, what device is nearby, and when they want to enjoy the Olympics. Case in point, through the course of the 2020 games, NBC Olympics will produce a 20 minute live show “airing” exclusively on Twitter.

In this way, Lovinger is downplaying the paramount importance of traditional OTA viewing, and focusing his marketing push on multi-platform. The network has a tool called TAD – or total Audience Delivery – that measures viewership on all NBCU platforms – broadcast, cable, digital, and social – in the ongoing effort to produce one big number representing consumption of the games.

has a tool called TAD – or total Audience Delivery – that measures viewership on all NBCU platforms – broadcast, cable, digital, and social – in the ongoing effort to produce one big number representing consumption of the games.

As a result, NBCU is packaging its Olympic marketing program with the old school broadcast, its web presence, and other digital outlets to achieve agency and client goals.

Sales flexibility also comes into play. Buyers can still go all-broadcast or digital-only if they choose.

But the emphasis on cross-platform marketing is reminiscent of the advice we heard from Ford marketing chieftain, Mark LaNeve back at our DASH Conference in 2015:

“Customer data, integration, and impact will be the new battleground to figure out new media mixes. Radio plays a big role in driving traffic for reinforcing brand awareness.”

As NBCU shifts its marketing emphasis to utilize the strength and power of multi-platform, the radio industry needs to get its collective head around the same concept.

Most traditional sellers are still more comfortable haggling over 30s and 60s and cost-per-point. But the reality today is that consumption patterns are changing, and will continue to sprawl onto digital platforms. It should not matter to an advertiser what path a customer took to their front door or to their website – hearing an ad on the radio, seeing a banner on a website, or hearing a pre-roll. And radio should be compensated for it.

The smartest marketers will find a way to harness these underlying strengths, turning them into benefit for advertisers and marketers.

It may be an Olympian task, but it’s the right way to go.

- Can Radio Afford To Miss The Short Videos Boat? - April 22, 2025

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

Broadcast Content is drives all digital. And, with 50+ consumers spending, agencies & broadcasters need strategic connection.

That they do, Clark. TY for the comment.

Tremendous! Great Blog!

The TAD tool you referenced, is that proprietary to NBC or is that something that can be purchased?

My understanding from the story is that it’s a tool they developed. Smart, right? Thanks for the kind note, Kayvon. I think we need one of these for radio.