Last week, I wrapped up my industry presentation for this year’s Public Radio Techsurvey. It was a good study, especially relevant this year because of the research aggregation that City Square put together a few months ago. To read about this new, breakthrough research in public radio, go here: https://bit.ly/47iIGwb

I still have a few more versions of PRTS to put together and present, mostly to station groups and organizations looking for a different “cut” of the data.

And waiting in the wings, it’s next year’s Techsurvey 2024 for commercial broadcasters fielding in January. (For more information on how you can be a part of this study, go here.) And so the “research cycle of life” continues. As our head researcher, Jason Hollins, will tell you, we’re on a perpetual perceptual path where one of these national studies seems to follow the other. As many of you know, we have designed and conducted Techsurveys for Christian music radio for a decade now.

I opened my calendar for this year, and it appears I’ve presented versions of these studies live and virtually 75 times in 2023. And I enjoy every last one of them. If there was ever a time when the radio industry needed good, hard, reliable data it is right now. Some of the fails and blowouts by broadcasters in the past couple years are attributable in one part or another to a lack of research. Now if you know me and you’ve seen our work these past decades, you know I do not believe research is a panacea that can answer all questions, much less solve all problems. It is most certainly not.

But designed and executed properly, research is radar. It provides a look at where you’ve been, and a glimpse at where you might be going. Yes, it is better at showing “what happened?” rather than “what will happen?” (Otherwise, every TV show and movie would be a hit.) But it can provide a look at the landscape, shedding light on the potential for things to work – or fail – with a degree of confidence.

For radio, our industry is truly at an inflection point. You most certainly don’t need a weatherman to know which way the wind is blowing. We can all feel the gusts – and they’re chilling. Some of the trends present pre-pandemic have accelerated since. When there’s sweeping change and paradigms shifts, all bets are off.

At a time like this, there’s no money or time to waste. Staffs and talent need to be deployed wisely. There are hard limits on financial and human resources. No one is in a position to misuse any of it. This moment matters.

matters.

Now, the Techsurvey series of research in the commercial, public, and Christian music wings of the radio business is far from perfect or infallible. As most know by now, it’s a focused look at broadcast radio’s core audiences – the ones who listen most and also regularly donate (especially apt for stations and organizations whose business models rely on financial contributions rather than advertising). So, it doesn’t account for everybody – casual listeners as well as those who no longer listen to AM or FM stations. And because it’s an online survey, it requires a certain access and knowledge of WiFi to devices that will get you online.

So much for its drawbacks. These Techsurveys can help radio better understand what its core audience is up to – the gadgets and platforms they use, their perceptions of radio (and other media), and their reactions toward new technology (e.g., AI, electric vehicles, video podcasts, etc.). They also have huge samples. For public and commercial radio, most of our Techsurveys are comprised of 25,000 (or more) respondents. And they’re broken out by format, so an NPR news operation, a Top 40 station, or a Christian contemporary network can all glean useful information from the data.

But I think what these surveys really provide are “reality checks” – a way to go beyond our bubbles, to more clearly see the media landscape we’re all in: connected cars, mobile, social media, video, and all the other tools, outlets, and diversions the radio audience now regularly uses (or will, probably sooner than we think).

The captains of the radio industry will likely be sitting down soon with their CFOs, sales leaders, and content people to budget for the year ahead. This is never a fun or easy task, but this year in particular is looking especially arduous and even painful for many of them. While we had a shining exception last week when Saga released their numbers (and a request not to be painted with the “radio brush” that spells gloom, doom, and missed projections), most of the recent earnings calls have not been pleasant, nor do many paint a pretty picture of the immediate future. (When political advertising is the salvation, that’s never a good thing.)

The captains of the radio industry will likely be sitting down soon with their CFOs, sales leaders, and content people to budget for the year ahead. This is never a fun or easy task, but this year in particular is looking especially arduous and even painful for many of them. While we had a shining exception last week when Saga released their numbers (and a request not to be painted with the “radio brush” that spells gloom, doom, and missed projections), most of the recent earnings calls have not been pleasant, nor do many paint a pretty picture of the immediate future. (When political advertising is the salvation, that’s never a good thing.)

That’s where I’m headed this week, and I very much hope you come along for the ride. I don’t claim to be smarter than any of you. But I am exposed to more research, more focus groups, more conferences, and more high-level meetings than most of you If I cannot come up with perceptions and realities that may be helpful to you, then shame on me.

Starting tomorrow, I’m going to take a deeper dive into my data to hopefully provide some clarity for the particular challenges you may be facing, whether you’re a small market programmer, a major market DOS, or you’re a station owner plotting your next move.

It’s also a not-so-veiled request to encourage you commercial stations to sign up for Techsurvey 2024, and play an active role in making these studies a success. If you have ever benefitted from our Techsurveys, this year is our 20th, an accomplishment I’m especially proud of. But as I learned a couple decades ago, we can’t pull off these studies without you. They are priced so that any station can become a stakeholder. If you’ve never been a part of Techsurvey, or you’re a lapsed participant, now’s the time to jump in. Info here.

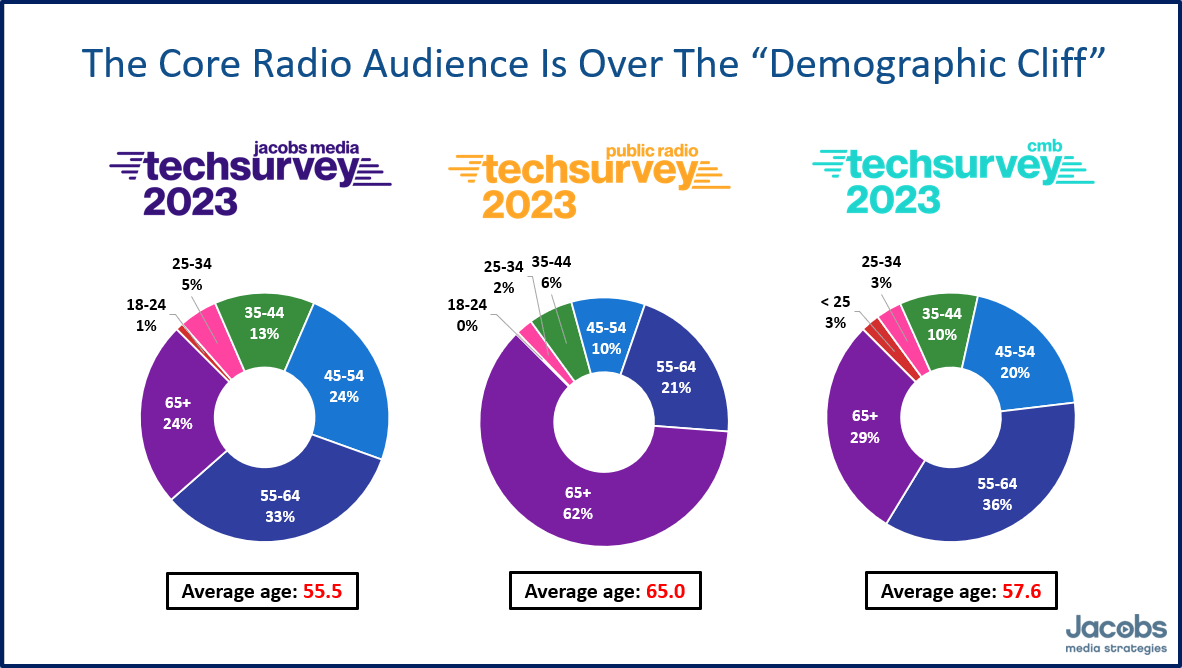

But let me give you an hors d’ouevre for tomorrow’s post – a “reality check” finding from not just one Techsurvey, but all three.

The aging radio audience – an unhealthy trend for an industry getting “too mature”

We spend so much time and energy focused on 25-to-54 year-old demographics – at the exclusion of everyone else – that it’s easy to forget how quickly the radio audience has aged. Our Techsurveys tell that story vividly, no matter what audience you’re looking at. While there are undoubtedly more casual listeners occupying the younger age cells, the reality is that the core audience has grown alarmingly long in the tooth.

It’s as plain as day when you look across the commercial, public, and Christian music samples in one of the opening slides of virtually every Techsurvey presentation:

As an industry, we spend so much time worrying about certain formats aging out that we’ve lost sight of the whole platform. The existential challenge facing broadcast radio is its “maturity.” That sign post up ahead (to quote the old TV philosopher, Rod Serling):

SYSTEMIC IRRELEVANCE

It is inevitable, if radio doesn’t wake up to the immutable reality all its key platforms are going over that dreaded demographic cliff. Either the industry learns how to sell and market older listeners to an unforgiving and myopic advertising industry or it had better find a way to attract young consumers to a medium they’ve had only peripheral involvement with.

So, now you know where I’m headed. Tomorrow, I’ll provide several of these examples of Techsurvey research that tells a vivid story – if we’re willing and courageous enough to look it straight in the eye.

As those other television sages tried to teach us,

“The truth is out there.”

Best we heed it.

- Media And Technology In 2025: Believe It Or Not! - April 18, 2025

- In Radio, You Just Never Know - April 17, 2025

- The Secret To Making A Great Podcast (And Great Radio) - April 16, 2025

I had the local classic rock giant, KGB-FM, on much more than usual last week for “Beatles Day ’23.” I honestly was surprised to hear just how many commercials were targeted at seniors–things like various medical devices or for those having joint pain. (At one time, on that same station, that might have had a WHOLE other meaning.) I listen to the station regularly but I guess I was listening a bit more intently last week. Frankly, it made me feel older than I already am. And a bit sad. On one hand, why not target that audience? I mean, after all, they were playing 40 year-old Van Halen songs and even older music from the likes of Fleetwood Mac, Boston and Heart. But on the other hand, the music really does seem to have strong appeal across demographic lines…and I’m not sure hearing commercials for denture adhesives will make any Gen Y or younger feel “at home.” But what’s the answer? You don’t want to take short-term gain money over long-term loss of listeners. But in the meantime you have to pay the bills if you’re going to stick around for anyone TO listen to. I guess that’s why you write this column, Fred, to help the industry navigate these very real challenges for a century-plus year-old medium. I wish you well. And in the meantime, I’d be curious if you could dig up any data on any spikes in radio listenership for “Beatles Day,” as well as any demographic information on sales and streams of who’s buying and who’s listening to “Now And Then.” That information might be key for radio’s future direction.

Good for KGB. You’re right, of course, that a thirtysomething hearing AARP spots isn’t going to feel right at home. But at least KGB may be cashing in on part of their prime demographic appeal.

And you know I’m on the lookout for “Now And Then” stories in the ratings and elsewhere. Thanks for weighing in.