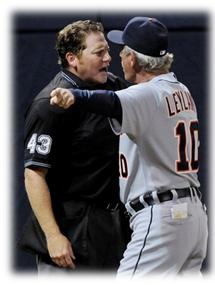

We’re getting closer to the World Series, and we’re already seeing some hotly contested, competitive games of baseball.

And there’s nothing worse than teams that are always going at it with the umps – arguing balls and strikes or feeling that the deck is stacked against them.

And there’s nothing worse than teams that are always going at it with the umps – arguing balls and strikes or feeling that the deck is stacked against them.

Similarly, the teams that blame other variables – the weather, injuries, and tough calls – always seem to be the ones that are on the losing end of the final score.

Sadly, radio is often guilty of that type of media whining. Satellite radio always seems to have the promotional dollars. Pure-plays don’t have to run so many commercials. TV is getting all those political advertising. And the top-rated station in the market never charges enough for their spots.

Blah, blah, blah.

But now a new study from the Media Behavior Institute suggests that radio may have something to actually complain about – MBB.

You’ve never heard of MBB? That’s because I just made it up. It’s Media Buyer Bias, and it is very likely afflicting the radio business when it comes to “getting on the buy.”

OK, so the sample was small (and as the Media Behavior Institute acknowledges, “non-projectable”), but they armed a group of advertising industry executives with a mobile app diary to study their personal use of media and gadgets over a one day period. They compared the actual media consumption of Madison Avenue types to MBI’s USA TouchPoints study which measures these same usage dimensions among real consumers.

And the results were revealing. The media executives actually spent more than half of their lives on email, compared to only 20% for the actual population. The ad mavens also over-used the Internet by a margin of 28% to 15% for real consumers.

Ad pros also use mobile apps and social media far more than most Americans. In many ways, we shouldn’t be surprised by these findings because as the MBI points out, their over-consumption of digital media “is part of their job, but the the data indicates they clearly are not representative of the overall population they are hired to influence with media.”

Ad pros also use mobile apps and social media far more than most Americans. In many ways, we shouldn’t be surprised by these findings because as the MBI points out, their over-consumption of digital media “is part of their job, but the the data indicates they clearly are not representative of the overall population they are hired to influence with media.”

And that’s the real point. Media buyers are, in fact, not like real people.

But the real controversy comes into play when the MBI looked at traditional media where average consumers use everything more than industry execs do – except for print. While only about one-fourth of the consumer sample read some form of print during the test day, more than four in ten (42%) of the media pros pick up a newspaper or print publication. (And you wonder why those newspaper advertising sections continue to be thick and robust.)

But the biggest departure between these advertising pros and consumers?

Radio. While 80% of the USA TouchPoints sample used radio in the test period, only 42% of these advertising professionals followed suit.

MBI’s Mike Bloxham concludes that while a larger sample is necessary in order to generate meaningful conclusions, it seems logical that the behaviors of advertising pros likely influence their decision-making. As he notes, “If we find as a community that we are markedly different from the communities that we are trying to communicate and engage with for our brand clients, that is a real challenge.”

Indeed. And it’s an even bigger challenge for a radio industry that is struggling to get its fair share in an increasingly crowded media environment.

Tomorrow: an idea to help change radio’s “optics” among media professionals.

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- The Revolution Will Not Be Monetized - December 30, 2024

- What Kind Of Team Do You Want To Be? - October 4, 2024

Re: “…it seems logical that the behaviors of advertising pros likely influence their decision-making.”

This is difficult to digest, not because it’s an effective argument but due to the Golden Rule of programming radio: “If you play only the songs you like, you’re doomed.”

Just because the media buyers are more tech savvy than the general population is not reason to say it’s why they buy new media. That’s akin to attaching radio’s overabundance of Lady GaGa songs to programmers listening to her music in personal settings.

Media buyers are becoming adapt at fixing an ROI on media, that’s why we see a shift away from radio – this ROI is a number radio cannot offer using its current sales packaging.

“New” and “accountable” are what’s being chased by media buyers. Whether they are tech-savvy or not.

Tying a radio campaign into an online destination can be tracked. When that happens radio will lose its tenancy to blame others for revenue stagnation, and the industry will have actually changed something in what it’s offered advertisers over the last 60 years.

Ken, no argument on accountability or ROI – these are the prioriites that increasingly matter in the advertising industry. But if buyers are not personally connected to a medium or its outlets, that loss of proximity has to play a role in their prioriites and decision-making. Thanks for clarifying and adding to the conversation. There are lots of tentacles to this conversation.

Nothing new here. Media buyers have always bought what and who they like. Numbers are great but relationships are everything.

Maybe I needed a little reminder of that, Biz. But in an industry that has always been respect-challenged, actually seeing it quantified was more reinforcement of radio’s inability to capitalize on its ratings and its media influence. Thanks.

One possible bias I see in the study is that it appears that it’s sample size is solely agency execs from New York City. As I used to tell my planning teams when I worked at the big media agencies that began with a “M”…”New York City is not indicative of the rest of the country….get out of the Manhattan bubble.”

I wonder how this survey would project if agency execs from other markets and agencies of all sizes were included. I’m guessing that it’d still skew toward more new tech because that’s just how agency folk are programmed, but at the same time not nearly as tech heavy as in NYC.

Jeff, I wondered the same thing. It’s a small sample and it’s probably all NYC folks – the least representative people (or radio market) in America. But I believe your second point is spot on, too. Namely, a larger, nationwide study of media pros would reveal a similar, if somewhat less extreme pattern. I would welcome the RAB and other radio industry organizations underwriting an expanded survey, because revenue generation is Job One in radio. Programmers are putting in maximum effort under less-than-desirable circumstances to create strong content and generate great ratings. If radio isn’t properly selling through to the decision-makers, there’s something very wrong here. Thanks for your comments and for reading our blog.