A few scenes from the past couple of weeks:

A few scenes from the past couple of weeks:

First, I was invited to speak at both the Nebraska Broadcasters Association and the Texas Association of Broadcasters conferences – in the same week. I love doing these events, an opportunity to share our thoughts, but also to learn from broadcasters across the spectrum – from large markets with corporate ownership as well as the mom and pops in small markets.

There are variances, of course (and generally speaking, the smaller markets are doing better than the larger ones), but the central message is pretty much the same:

It’s harder than ever to grow the traditional advertising business.

Anyone who tells you otherwise is in an anomalous situation. The struggle with spot sales is across the board. And note that Texas and Nebraska aren’t swing states, so there is little or no political advertising to make up the difference this year.

My travel ended last week in my home state where I attended the Michigan Association of Broadcasters’ convention at the beautiful and iconic Grand Hotel (pictured) on Mackinac Island (for Somewhere In Time fans, this was the incredible location where they filmed the movie). I’ve never been around happier broadcasters, especially the television execs, and it was about more than the locale.

As a battleground state, Michigan’s television airwaves have been glutted with political advertising for at least a couple months now, with no end in sight. Well, the finish line is likely November 5 but that won’t slow the party down for the next 76 days. On Mackinac Island, there are no cars – just horses, bikes, and fudge stores. But there was talk about expanded inventory, adding digital channels, and more because at least the TV people in the room are looking to have banner years. Of course, they all realize their 2025 budgets will be based on growth over this year, which is going to be fundamentally impossible, but they’ll worry about that next year.

In all three states, there is a common thread – nobody is talking about broadcast revenue growth from non-political advertisers. In fact, most acknowledge it’s harder than ever to just stay flat in this environment, much less grow. This is particularly true in radio, where national business has dissipated and local advertisers have more options than ever, especially in the digital realm.

As I returned to the office late last week, I was then treated to two more data points that simply cannot be ignored:

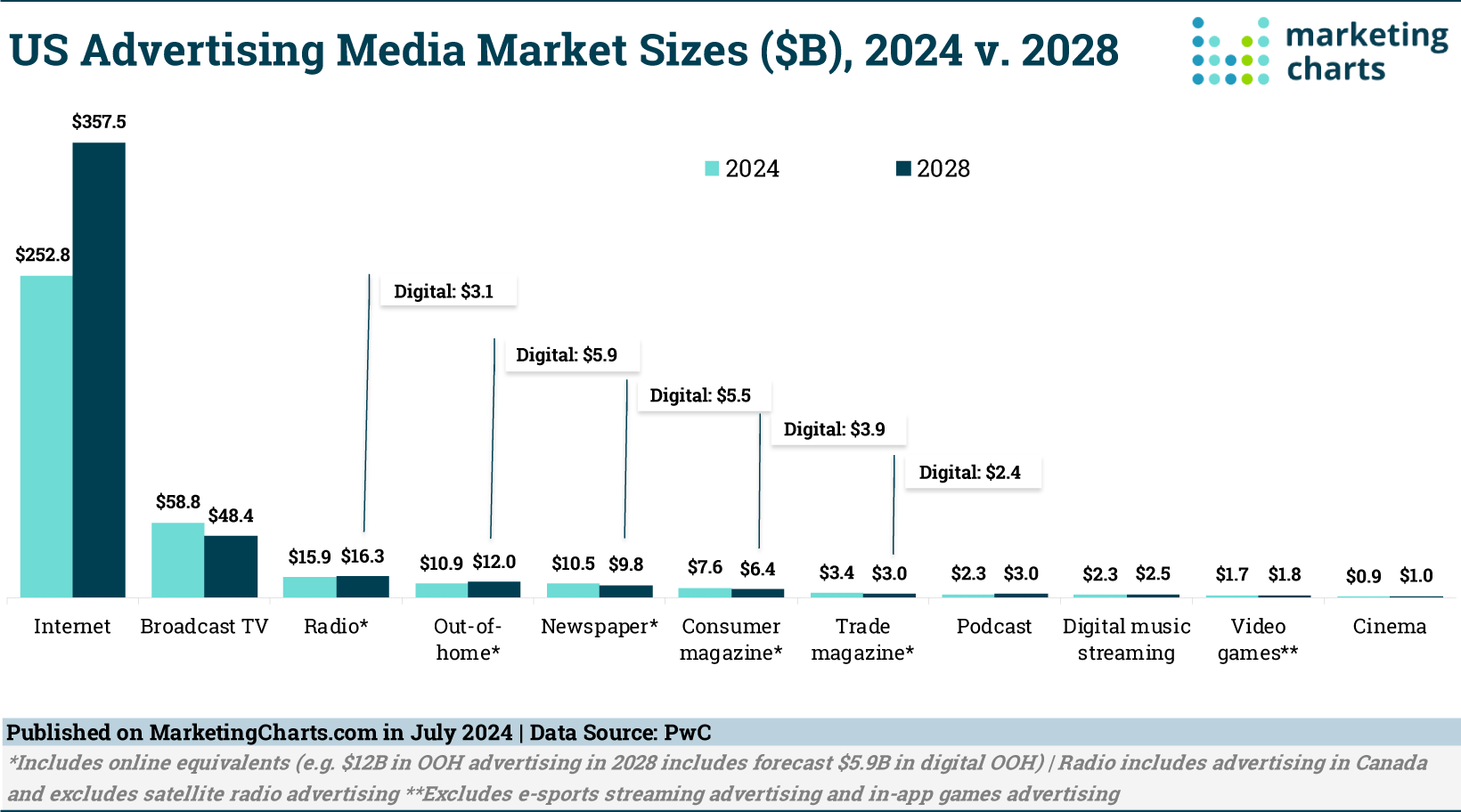

First, PwC released its annual projection of advertising spending from 2024-2028 for each media category. As has been the case for several years now, radio is expected to barely grow, while “Internet” continues its meteoric rise.

And then over the weekend, the Harris/Walz campaign announced a major media buy of $370 million through Election Day. Broadcasters (primarily in the seven battleground states) should be strutting their stuff and working to find even more inventory. But once you go beyond the headline, here are a couple of sobering facts about radio and political:

- Of the total budget, the campaign is earmarking $200 million for digital, while $170 million is being allocated for television. A little back-of-the-cocktail math indicates absolutely no budget left for broadcast radio. The Harris/Walz media mix represents a huge departure from the way political advertising has been traditionally doled out. In fact, Harris’ Deputy Campaign Manager, Quentin Fulks, told the New York Times, “This is a modern campaign in 2024 and we’re not just stuck in the times of old, where 80% of the budget used to be on television.” While some of the “digital” dollars will be allocated to streaming TV channels, this is still a blow to the linear media business as we’ve known it.

- Radio wasn’t even mentioned. And this buy is focused on the swing states where we are told every vote counts.

Signs of decline in the traditional advertising business abound. Each day, it seems we read about RIFs and “right sizing,” not only in commercial radio, but also in public radio. Last week, WNYC announced another 8% staff cutback, which have been preceded by cuts throughout the system.

As reported recently by CNN Business (yet another news operation feeling the pain), “The traditional financial models just don’t work anymore,” Southern California Public Radio chief content officer Kristen Muller wrote in an email to listeners. “Most advertising dollars that once supported us are now heading to giant tech platforms like Facebook and Google, resulting in a significant drop in sponsorship revenue — a tough pill to swallow.”

And then last week’s obituary for the once-proud WCBS-AM in New York City. Most of us weren’t “in the room where it happened,” but it’s not a stretch to conclude that iconic station’s ultimate fail must be due in no small part to a failure of sales to sustain this radio treasure. Yes, 1010 WINS is still providing a round-the-clock radio news service, so redundancy is a logical rationale for WCBS-AM’s demise. But in a media market of New York’s magnitude and given the station’s long-time relationship with the advertising community, you might expect a different outcome.

And then last week’s obituary for the once-proud WCBS-AM in New York City. Most of us weren’t “in the room where it happened,” but it’s not a stretch to conclude that iconic station’s ultimate fail must be due in no small part to a failure of sales to sustain this radio treasure. Yes, 1010 WINS is still providing a round-the-clock radio news service, so redundancy is a logical rationale for WCBS-AM’s demise. But in a media market of New York’s magnitude and given the station’s long-time relationship with the advertising community, you might expect a different outcome.

This friction in some of the U.S.’s biggest radio markets should tell us something about the state of the union as 2024 painfully chugs along. The up arrows remain reserved for digital marketers, while everyone else is left fighting the media scraps. As I travel to conferences and participate in scores of Zoom calls every week, it is sadly startling to hear so many broadcast leaders still trying to grapple with this reality and make the requisite shifts in their operations.

Look at the time. It’s getting really late. What I just shared with you are facts, not alternative facts or somebody’s hopes for a future that is slipping away. Stations of all sizes, markets, and formats need to accept the reality of the inexorable shift away from revenue for linear broadcasting as it races headlong into the digital department. The trends of the past several years since the pandemic are solidifying, if not accelerating.

But if there’s good news in this cautionary tale, it’s that no industry of this magnitude can pivot as quickly and efficiently as radio. It costs significantly more to re-tool a television station, a newspaper operation, or movie theaters than it does radio. But the transition doesn’t just requires a few keystrokes on a spreadsheet as broadcasters re-allocate their resources and investments in digital content. It is mandatory to instill a mindset change throughout the building or the organization – including in the sales department – if it is to succeed.

At issue here is that in spite of the unassailable revenue trend line toward digital – and away from linear – most of the companies that make up our business still talk, walk, and think like radio companies first. You know that old saying about the duck. Even as radio companies excise the R-word from their business cards and websites in favor of “media” or some other 21st century monikers, the fact is, most continue to view their world from a “radio first” perspective. Yes, digital is now part of the menu of entrees and appetizers the salespeople can sell, but they are too often an afterthought in their marketing hierarchy.

At issue here is that in spite of the unassailable revenue trend line toward digital – and away from linear – most of the companies that make up our business still talk, walk, and think like radio companies first. You know that old saying about the duck. Even as radio companies excise the R-word from their business cards and websites in favor of “media” or some other 21st century monikers, the fact is, most continue to view their world from a “radio first” perspective. Yes, digital is now part of the menu of entrees and appetizers the salespeople can sell, but they are too often an afterthought in their marketing hierarchy.

Right now, the radio lens is a problem, and it permeates most stations. Programmers continue to sweat their over-the-air ratings as they’ve done since the days of Bill Drake. Sellers continue their quest for the lowest-hanging fruit (despite the fact it is rotting). And just about everyone in the operation is incentivized on the linear numbers and broadcast sales. Staffing is usually pitched toward broadcast with digital being an afterthought.

their quest for the lowest-hanging fruit (despite the fact it is rotting). And just about everyone in the operation is incentivized on the linear numbers and broadcast sales. Staffing is usually pitched toward broadcast with digital being an afterthought.

Here’s the test:

In the middle of the day today, your station goes off the air. How long does it take someone with the authority to do something to find out what’s happened? Seconds? A minute, at most?

But what if the stream goes down? Or the app gets a bad update and isn’t working? Or your command to Alexa suddenly connects a listener to a radio station in New Zealand?

An hour? A day? Until a listener calls the station to tell you about it? Companies communicate what’s really valuable by how their org charts are arranged and defined, and how their budgets are structured. Priorities, priorities.

Fred has written before about Nancy Lyons (pictured), a Twin Cities-based head of the Clockwork ad agency. Nancy acknowledges the need to shift to digital but warns about the “analog transformation” – the people who need to drink the Kool-Aid, smell the coffee, get the memo, WTFU, and help their operations make the shift. Or get out of the way.

But we can’t fix it all this week. And because my background in sales, it is obvious that if the industry’s revenue generation systems were working well, we might not be in the current morass. So here are my suggested moves (and I’m eager to hear yours):

1. Cut ties with salespeople who cannot– or refuse to – sell digital. I honestly don’t understand why a seller – who is supposed to be money motivated by nature – cannot recognize the revenue shift happening in front of our windshields, and not want to go all in. Yet, how many salespeople at your stations simply refuse to sell digital, hiding behind the excuse of “I’m a radio salesperson” or their age (“That’s for younger salespeople”), or they just go through the motions?

At this stage, it’s time for those people to consider another line of work or that condo in Tucson, because based on these revenue trends, there is little to no chance their billing will grow this year or in the future. They are simply fishing in a pond that’s shrinking. And they’re taking the place of someone who could be helping the operation grow – or at least hang on.

I’m not suggesting you clean house today, but at minimum I would insist that any salesperson hired in the future have digital sales skills and experience and/or possess mass quantities of digital energy. That’s what it’s going to take.

It might also make sense to review how your sales offerings are structured and commissioned. Think like a salesperson – are you attaching the most attractive incentives to the inventory you most want to move? If not, don’t expect your sellers to do what you ask for the good of the operation. It doesn’t work that way.

2. Pigs can’t fly. So stop handing out wings. Some salespeople simply cannot get their heads around selling digital, but it amazes me how many stations keep trying to push this boulder uphill. They’ve tried increasing commissions, training seminars, offsites, consultants, cajoling, yelling, pleading, and more.

uphill. They’ve tried increasing commissions, training seminars, offsites, consultants, cajoling, yelling, pleading, and more.

When I ask managers why they still engage in this futile practice, a commonly stated excuse is this: “The traditional radio salesperson considers the accounts theirs, and in many cases they have a great relationship with the client and we are concerned about upending it.”

We should be way past the point where letting 1995 thinking rule in the Age of AI. It’s time to either get these people to buy in, replace them, or hire a digital sales team and turn them loose on all accounts. Way too much money is being left on the table.

3. Every digital item should be scrutinized and evaluated. Most managers can tell you chapter and verse about their Nielsen or Eastlan ratings – panel changes, time-spent listening trends, cume, turnover, ethnic sampling, etc. But ask about the particulars of their digital assets, and the feedback typically gets fuzzier.

Most aren’t conversant about what’s a good number, much less how to read and understand digital reports. Some of this is understandable because in many cases, the data is spread all over the place. And many are working without a dashboard that aggregates all this user information.

The end result? Digital metrics go up, they go down, they go sideways. And most managers in the building, whether they’re in content or marketing, don’t know what to do with them anyway.

You’re not going to effectively sell or market these assets if you don’t understand them, aren’t losing sleep over them, and don’t know how to move them.

Of course, this requires knowledge, prioritization, and understanding. And maybe bringing in people outside the radio sales pool with a broader perspective in how to move the digital needle.

4. Sales needs to start being proactive. Rather than waiting for the programming or digital department to roll out another “next big digital thing,” why not determine what your sellers need in order to generate revenue and provide a service to clients?

Maybe it would be helpful to have an email database two or even three times the size of what it is now. And maybe it means surveying those people to determine their intent to purchase in the coming year: a house, a car, a new addition, sending a kid to college, moving a parent to a congregate living facility, taking an international vacation, or hiring a financial planner.

Perhaps it means putting together an event marketing plan in a market and audience conducive to paying for live entertainment. Or a branded podcast or newsletter produced in conjunction with a paid advertiser (who also can provide expertise and content).

If you think you can sell it or perceive a need for it in the marketplace, why not take the lead and help the company figure out how to accomplish it?

5. Do your homework. So much of the way our industry has gone about mapping out any semblance of a digital strategy has been almost entirely a SOTP mission.

Seat of the Pants.

And look where that’s gotten you.

You cannot research everything, especially something the market or your audience hasn’t experienced before. But you can do that all-important due-diligence to determine who you’re up against, the size of the market, and consumer desire.

And sometimes, conducting a short survey among your database members supplies just enough confidence – or discouragement – to help you make that decision. Because every screwup, misfire, and irrationally exuberant move will cost you big-time in 2025, including impacting your sales team’s confidence. Ask any CEO – there’s no margin for error.

6. The ratings ain’t what they used to be. Nothing is. This isn’t a knock on the ratings companies, but it stands to reason that if fewer dollars are attached to ratings, then they simply aren’t as important.

It’s simple math. And if Nielsen, Eastlan or anyone else cannot provide media companies with a more holistic measurement of all their audience engagement, this current disheartening trend will only continue. Or get worse.

Digital data and analytics are more important than ever, because more dollars are allocated on those metrics than radio.

Once again, the good news for radio is that no other medium has the ability to move its (still) large cume to digital content. When a station promotes a newsletter or a podcast that’s relevant, the audience moves. But without accessible, reliable, and affordable measurement of your success and the corresponding skill to monetize it, what’s the point?

7. Commit to increasing your digital footprint. It’s where “the fish are.” If conventional ratings aren’t as directly valuable to revenue as they used to be, why does so much of our programming efforts focus on squeezing another 15 minutes of listening or limiting the number of your stopsets and their placement on the clocks?

programming efforts focus on squeezing another 15 minutes of listening or limiting the number of your stopsets and their placement on the clocks?

What would happen if there was an all-out commitment throughout the station to increasing streaming, podcasts, newsletters, livestream video, website visits and engagement, and building up one of the most valuable tools a station can have – its email database?

When a client’s ratings go up – or down – they call us and we talk about it. But I can’t tell you the last time a client called to brag about their streaming numbers or downloads. This simply doesn’t happen.

There’s a disconnect between the investment in time and resources at stations and where the dollars are shifting. This is central to what is holding radio back – a lack of investment in quality digital content, setting priorities for the station about the most important KPIs (key performance indicators), staffing properly, and goal-setting.

Get smarter by hiring a digital content specialist – most of the PDs working in radio today are capable – at radio. But many will also tell you they either don’t have the time or the aptitude to create competitive digital content.

Radio cannot turn the tide without this change happening. The revenue isn’t going to magically start flowing into :60s and :30s again. The toothpaste is out of the tube.

One thing I’ve heard from many broadcasters is that they don’t know where to start. They may not really understand digital content and what they should be creating, how to price and budget, how to train and structure a sales team, and what the metrics mean. As Jacobs Media embarks on our newest initiative – Jacobs D.R. – that’s our primary focus. But it’s going to be a long slog to turn around 100 years of doing radio one way and merely flipping a switch.

One thing I’ve heard from many broadcasters is that they don’t know where to start. They may not really understand digital content and what they should be creating, how to price and budget, how to train and structure a sales team, and what the metrics mean. As Jacobs Media embarks on our newest initiative – Jacobs D.R. – that’s our primary focus. But it’s going to be a long slog to turn around 100 years of doing radio one way and merely flipping a switch.

But if we don’t get started soon, the radio industry won’t be able to count on political dollars much less agency dollars in the near future.

Email me and tell me what you’re thinking: paul@jacobsmedia.com

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- The Revolution Will Not Be Monetized - December 30, 2024

- What Kind Of Team Do You Want To Be? - October 4, 2024

What a great blog today! Spot on in every aspect!

It’s high time for radio to shift its focus from selling spots to selling impressions. Impressions are the currency in the advertising world.

Most radio brands reach more people than ever if you fold in social media (assuming the station is approaching social media correctly), podcasts, terrestrial, etc. However, most stations need to roll the number up and present it properly.

For some reason, radio loves to focus on the outdated metric of “spot count”, “Reach” and “frequency of 3.0”. It’s over, folks. Sell impressions across your platforms. You’re reaching more people than ever and leaving money on the table.

Thanks for the comment, Brian. It’s appreciated.

Let me add one additional thought, instead of selling “impressions,” how about we sell “audience?” Should it matter to a client if a station delivers audience from over-the-air ads, display, pre-roll, newsletter, or email blast? Many stations have built up large audiences outside of their AM or FM signal, but there’s not a strong enough mechanism – or belief structure – to adequately monetize it.

Good to see the juices are flowing. Hopefully we’ll advance the ball a little today.

Paul, thanks for writing a blog that says what needs to be said. I’ll take your response to Brian one step further. Instead of selling “impressions” or “audience” how about stations sell “360-degree access to consumers”. Many stations – but not as many as in the past – do events, participate in community causes, do appearances, etc. in addition to the on-air and digital platforms you mentioned. An old, but still relevant positioning statement from the RAB was, “On-air, online, on-site, and on-demand.” There’s probably a more concise way to say, “360-degree access to consumers”, but you get where I’m coming from. I enjoyed your “poke the bear” talk at the Texas Association of Broadcasters convention and look forward to you being a part of Radio Ink’s Radio Masters Sales Summit coming up in three weeks.

Yeah, I’ve been poking a lot of bears lately, but the trendlines are so painfully obvious. And the opportunity is right there to be taken. It’s going to be stressful, but continually missing budgets is more stressful.

The statistics here are truly alarming, Fred. I’m sure many can agree that during promotions meetings, when it comes time for the digital department to present analytics, the room often goes silent. No one seems to ask the crucial question: “How can we actually make money off digital?”. That has always scared the living shite outta me.

When I did afternoons live in Phoenix on 94.9/95.1, there wasn’t a time I didn’t open with “On Air, at (station) and online at blah blah .com.” Then again, that OM at the time truly knew digital—it was part of his DNA.(That’s a whole ‘nutha positive story)

It’s clear that most of these veteran Program Directors, GM’s/Sales, need to take courses in digital. As you’ve pointed out, there’s a disconnect between where the dollars are shifting and where stations are investing their time and resources.

Relying on one person to read off your monthly digital analytics from an Excel spreadsheet just isn’t going to cut it anymore. It’s like trying to run a marathon while stuck on a treadmill—you’re moving, but you’re not getting anywhere.

I meant “Paul* 😉

Paul here 🙂

I’m waiting for the day when a PD runs up and down the hall screaming about the big jump in their streaming numbers.

We’re talking about a fairly significant mind-shift that needs to take place, but one thing about people in radio – we are competitive. So why not steer that energy into developing new channels to engage/reach audience, and monetize it?

Paul,

The problem is that most radio stations no longer serve the local community, and the account executives are forced to sell every digital widget available. Commercial spots are secondary because the station can only deliver a small audience. Since the FCC began the process of deregulation in ’81, local stations have lost their identity. Radio stations are bought and sold like commodities, formats constantly change, and programming is syndicated from elsewhere. Unsurprisingly, smaller markets are doing better as they are more likely to be independently owned and still serve the local communities in which they operate.

I grew up in Metro Detroit, listening to local artists and air personalities. Detroit’s music had a unique sound, which was very industrial and much different from the flowing “wave-like” melodies from the West Coast. This was never more apparent when listening to Motown before and after Barry Gordy relocated to California. Listening to different stations when you traveled across the country was always entertaining. You got a glimpse of that town’s culture. Taylor Swift is a talented musician. Scan the dial today; you will hear her music on almost every station, regardless of the city or format. Radio needs to reconnect with its communities, and advertisers who serve those communities will reconnect with them.

Agree with you on many fronts, Chris. Thanks for sharing. And yes, Detroit radio has always been pretty special, if I do say so myself.

Fundamentally the main problem with any form of digital advertising is that it is oversaturated in almost every market, at least in the United States. What radio does or doesn’t do in around about ways what you are talking about some of it’s essential moves. This might be a crazy thought but it’s something our company has been doing for the last 2 years plus is figuring out how can music play a role in advertising on radio to bring back both a solution to help enhance radio advertising buys as well as listeners of radio as a music device.

There is a solution to help save the music industry We’ve designed it and are working to see it through, How that ties into radio could play a big role and not only bringing back radio as a serious medium but also increasing listenership on a regular basis.

Well thought out what you wrote, it was very long and I must admit I didn’t get a chance to read through the whole thing, maybe tonight. But I read through at least half of it and then skim through the rest. Maybe connect at some point soon.

Cheers

Nolan Apostle

Event City

Eventcity.net

Nolan, sounds interesting. Please keep us posted on how this develops. We love innovation!

One of the reasons why I’ve gotten hooked on Portuguese radio is that Grupo Renascença Multimédia makes public announcements about everything–including its digital/online traffic. Its latest release about that came out in early July, and apparently covers a third-party/overall report from June…

https://gruporenascencamultimedia.com/2024/07/11/grupo-renascenca-multimedia-confirma-lideranca-destacada-da-radio-no-digital

Granted, all of its formats are national.

Wish I could add an intelligent comment, but it’s challenging enough to understand everything happening here in my native language. I’ll check it out – sounds interesting. Thanks for sharing Eric.

There’s a lot here to unpack. Like much of what gets recommended here, ita all worth doing, but nothing is likely to move the needle much.

Digital – radio doesn’t own the digital assets they sell, so they’re effectively manufacturers reps, getting some percent of what they sell. If digital pays 15% of what radio spots do, we’ll, do the math. Digital will never amount to enough unless creates/acquires it’s own digital products and they attract a big audience. There are plenty of digital rep firms, so radio doesn’t add much.

As for podcasts and newsletters, yes, they’ll help on the margins, but it’s all reaching for the stars standing on a chair. I looked a at ranker recently and radio can brag about reach all it wants, but I was shocked at how delivery has dwindled in a short time. Digital isn’t radio’s solution unless it creates its own products.

Paul, this is a great piece of thinking. My first thought was, “Amen.”

I’ve been directing our digital services for almost a quarter century (you may recall being at our station to help us see the way forward when our digital department was first established many years ago) and have overseen the creation and development of numerous digital products to be sold on every platform possible in that time. We sell everything. Newsletter space, website space, podcast space, stream space, and even social media space (think of what we do there as something like a host read). If we can find a way to fit a message into it, we’ll put it there, and we’ll sell it. We started selling digital space early on and developed various ways to break the model of how and what to sell just as soon as we could figure it all out. And we’re *public radio* for goodness sake. Anyway I’m confident we’ve given it our all.

But (you knew there was a but) so far there’s been a limit to what we can make selling all that space, no matter how we package it. Demand isn’t what we wish it would be, and when we’ve tried to raise prices we just hit the sales wall. Why?

As I read your piece, and I think about how much money radio is apparently losing to digital (somewhere!), and how much we’ve invested in selling it, and then wonder what’s missing, two things occur to me:

1. Many prospective advertisers probably lose interest as soon as they hear the word “radio,” even though we have lots more than that to offer. They have a faulty impression that we’re nothing but a legacy platform. Our brand says “not today, thanks.”

2. Advertisers who love(d) radio like the idea of a cume that measures in numbers way higher than what we can usually claim for “views” or “listens.” Anyone who’s been measuring audience on both broadcast and digital for a long time knows what I mean – these are not comparable data points. They’re two different metrics for two different worlds.

Looking at those two points, and thinking about the strategic effort vs the return we’ve seen so far, and then contemplating your point that there must be money being spent *somewhere* and we just need to figure how to get it back in our direction, it seems to me what’s needed is a massive educational effort. We must educate advertisers so they understand that what radio has to offer is way more than what they probably realize. We must also educate them to understand how our digital audience is measured, and why, and how that’s different and more valuable than buying auctioned impressions on Google or Facebook, and what that all means for their potential reach with us. They simply need to learn to think of us differently.

Of course, as you wrote above, it’ll be harder to do this if you don’t have the digital inventory to sell. Thankfully that isn’t our problem. But I did want to just point out that even when you do a lot of the digital stuff you mentioned right, and even when you have sales people who get it, it’s still really challenging. We’re bucking brand perception. And we can’t change that part until, as you say, we change ourselves. That “mindset change” you mention is critical, and really the hardest part.

Thanks for this great post. You really helped me think through next steps.

Bill, it’s great to hear from you and it’s encouraging to see you are still fighting the good fight.

A few thoughts

* Totally agree with the perception of “radio.” It makes me crazy when I hear sellers ask a client, “what’s your radio budget?” What an insane question – why ask about 10% when there’s a lot more money probably being allocated to digital?

* Check out this website: https://santafe.com/ Believe it or not, this is a radio company that owns several stations in the market. But you wouldn’t know it by going to this site unless you open up the nav. and scroll down. That’s because the owner (a radio veteran) realizes he needs to broaden out the appeal to users as well as advertisers. He’s made a huge investment in content, but it’s very successful. I guarantee you his staff doesn’t think they are in the radio business with some digital products, but instead, are in the digital content/information business that also owns radio stations.

Orientation is everything.

Keep in touch.

When you’ve “pivoted to digital”, “moved your cume” from radio to “apps”, larded up your website with celebrity piffle like Audacy & iHeart, surely the $ will roll in. Meanwhile, stop lobbying to keep Ancient Modulation in cars. Stop telling Congress you’re the life-saving “First Informer”. And turn your license back to FCC because you don’t need it anymore.