Yesterday’s post discussed the key barriers facing companies when it comes to embracing digital, especially traditional businesses like radio companies. Today, we’ll tackle the same issue from the standpoint of sales and revenue generation. And who better to take on that lofty problem than our resident sales guru, Paul Jacobs? He’s more spent time in more radio station sales meetings in more markets than perhaps anyone this side of Speed Marriott, Roy Williams, and Paul Weyland.

Yesterday’s post discussed the key barriers facing companies when it comes to embracing digital, especially traditional businesses like radio companies. Today, we’ll tackle the same issue from the standpoint of sales and revenue generation. And who better to take on that lofty problem than our resident sales guru, Paul Jacobs? He’s more spent time in more radio station sales meetings in more markets than perhaps anyone this side of Speed Marriott, Roy Williams, and Paul Weyland.

Here’s his post on what it will take for radio to get over the digital sales hump. – FJ

The radio industry has a successful and storied tradition. It is one of the longest running entertainment and information platforms. It has spawned iconic personalities. It captures the local market flavor better than any other medium. It is steeped in tradition.

But is that tradition getting in the way of revenue growth?

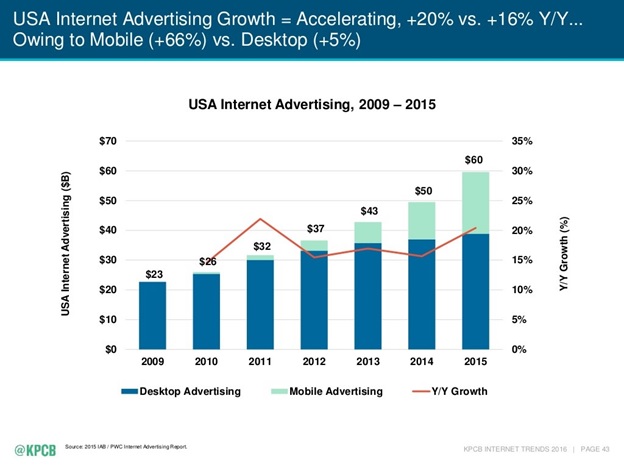

That thought came to mind last week when two research studies came out that coldly frame radio’s revenue challenge. The first was from BIA Kelsey. The respected research group provided a revenue forecast for media through 2020 and the results shouldn’t surprise anyone: local advertising revenue is projected to grow at a compound annual growth rate (CAGR) of 4.2%, driven by “exceptional increases in mobile and social advertising, continued strong political advertising in even-numbered years, and an overall growth in the U.S. economy.”

While that’s a nice story, a deeper look shows that “traditional” advertising revenue (i.e., radio, television, etc.) will have zero growth, while digital and online revenues will have a CAGR of 12.8%. As they say, do the math.

Yet bound by tradition, too many radio sales departments continue to call on the same advertisers, using so-called tried and true sales approaches (think One Day Sales), and hiring the same types of people who understand radio, but aren’t knowledgeable enough to effectively market digital, event marketing, and other “non-traditional” revenue opportunities.

Maybe it’s a labeling problem – the concept of digital and event revenue is often categorized as “non-traditional.” That may be true from a traditional radio perspective, but based on this BIA Kelsey data, dollars generated from these categories need to be taken much more seriously than simply described as something that sounds like a secondary source – like a Plan B or dessert.

So what’s the reason for radio sales’ “digital speed bump?” Why does it continue to flail around in the digital space, despite objective data that suggest it may indeed be the key to solving the industry’s stagnant revenue situation?

For more clarity, we turn to the well-respected analyst from Kleiner Perkins, Mary Meeker, who just released her annual Internet Trends Report. Her new deck is comprised of a whopping 213 slides. Over the years, her analysis and forecast have become the gold standard for helping industries of all shapes, sizes, and categories better understand what is happening with disruption caused by new technology.

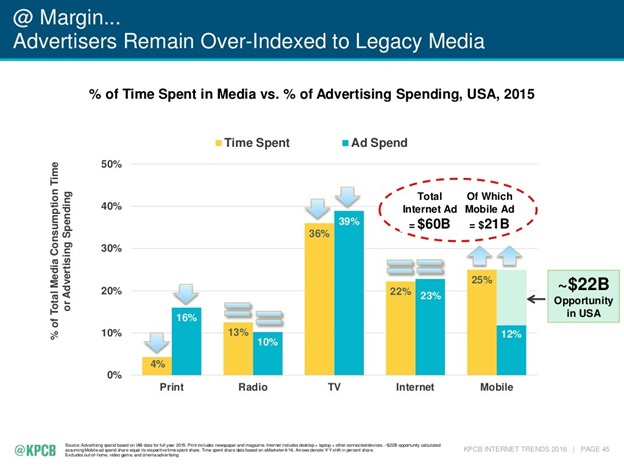

There are two key charts that jumped out at me in my quest to help radio stations, clusters, and companies generate much-needed new revenue streams. Meeker’s conclusion (as it has been in recent years) is that while consumers continue to engage with “legacy” media, all but one of these options is generating a higher share of revenue vs. its level of engagement: radio.

And as amazing as it may seem, one legacy media silo – newspapers – is generating four times the ad spending vs. its time spent; while mobile, which has the second highest engagement time, generates half as much revenue given how much consumers use their smartphones.

So what is all of this telling us?

First, the radio industry is being outsold by other legacy media. Every day, radio salespeople are asked what is happening with listening due to pureplay competitors like Spotify, satellite radio, and Pandora. But despite this, broadcast radio listening levels remain incredibly high. Concurrently, how many people under the age of 50 are reading a daily newspaper? Meeker’s data tells us the answer – not very many – yet the newspaper industry is generating a lot more revenue than radio in spite of dwindling readership and a product that has simply not kept up with technology.

Second, Meeker finds that online and mobile revenue are projected to explode in the coming years, while radio revenue will be flat. So, despite the efforts of several broadcasters to diversify their offerings into online, events, and mobile, the industry hasn’t gone nearly far enough. If spot revenue is flat, while digital dollars keep climbing, it’s fair to conclude the radio industry needs to do more. In fact, a strong case could be made to completely realign the sales structure of the business so it’s not nearly as dependent on “radio” advertisers, and begins to aggressively present itself as a multi-media solution in which radio is an important part to a wider array of potential clients.

Finally, why does the industry keep going back to the same revenue reservoir it has milked for decades? Tradition. Broadcast radio desperately needs to grow its revenue, and digital is the obvious place to go. Many broadcasters are investing heavily in digital content assets, including streams, apps, podcasts, video, social media, and websites. But too many sales resources are still focused on the traditional part of the revenue pie that isn’t growing. Sales staffs are designed to accommodate “radio” advertisers, providing “radio” promotions (remotes, ticket giveaways) instead of offering strategic, proven, data-oriented digital solutions like the pureplays are.

In many ways, radio is facing a revenue roadblock of its own making. By thinking about “non-traditional” revenue as an adjunct business, the industry relegates new revenue streams to second tier status. If spot revenue is flat, then the components of NTR make up 100% of the radio industry’s growth potential.

That digital speed bump I talked about earlier? It’s right there in front of us.

And it’s time for radio to step on the gas and get over it.

Thanks, Tom Bender.

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- The Revolution Will Not Be Monetized - December 30, 2024

- What Kind Of Team Do You Want To Be? - October 4, 2024

Two quick comments.

1) May 2011, I wrote the following, which was told to me by a high-level radio sales exec who you know: “The people running radio are close to retiring. At this late stage of their careers, what is it they have to gain by placing their retirement’s security blanket in jeopardy – introducing something new? They won’t benefit when the change is fully integrated. So why start? Their objective is to continue with lip service until they cash-out. Then, it’s somebody else’s problem.”

2) I went into Best Cuts to get a hair cut this past Tuesday morning. Sat down with music from a Cleveland, OH radio station playing on the store’s speakers. The music continued for about 20 more seconds, then went into a commercial break. The spot cluster was continuing to run as I paid for the haircut and was walking out the door – which is when I finally heard the Jock’s voice again. I estimate that the break was 12 minutes long.

Spot sales are stagnant in radio, and nobody should be wondering why. Trace it back to this quote from Gary Fries, in his comments about a flat July 2005 revenue: “The Radio industry is very actively and aggressively pursuing new technologies, formats, and platforms which will drive the business as we move forward into the second half of 2005 and into 2006.” This pandering false messages to the troops has been an active part of management for a long time.

We’re coming at a crossroad with traditional media playing in this digital sandbox. Either we need to embrace digital with the same force we do with our known mediums, create separate digital divisions geared on turning out native / sponsored content at a granular level, or continue to wade in the waters of “flat” revenues and watch the media world pass us by.

The margins of digital advertising 1.0 do not support the investment needed by traditional media to make a splash in the marketplace. We need to focus on what we do best…. content, and charge a premium for it.. until then, bloggers and lifestyle sites are going to continue to carve away at our audience by becoming “social influencers” for some of our major advertisers (yeah, I’m looking at you automotive).

Good thoughts, and thanks for sharing. While the margins might not be great, keep in mind that in a flat revenue environment for spot, digital represents 100% of the industry’s growth. Imagine what would happen if that became a major priority?

Ken, thanks for the thoughts. History is what it is. The numbers don’t lie about today’s situation. The question is, retirements aside, it doesn’t take a PhD from Wharton to focus on where the revenue is. It’s smart business. Some broadcasters have moved in that direction, with good results. The movement is happening – it’s just not happening fast enough.

Paul this is a brilliant article and could not be more timely. Thanks for this one!

Much appreciated. Thanks for the kudos.

We used to purchase air-time for a show that we did on marketing and recently moved to our own studio. The cost of the equipment and consulting matched the annual cost of being on the radio station. In a year on the air in an afternoon time slot, we received one lead. In that same year, via podcast syndication, we received dozens of leads.

We attempted to speak to the executives at length about monetizing their station. They could have easily sold studio and engineer time to corporations to develop syndicated audio and video podcasts for them – but it was outside their comfort zone. The result? They lost us as we built our own.

I was in the newspaper industry and they made a similar mistake. It’s a suicide not a murder. Content is being devoured at a stronger pace than ever in the history of humanity, audio included. The problem is that radio stations still think they’re in the ad-over-airways business when they have a studio with every capability to be a digital syndication studio.

We WANTED to stay with the station, we loved the talent and engineers that did such incredible work, it just wasn’t what was driving results for our business. It’s not too late for radio stations to change… but I’m not optimistic they will.

Douglas, I have a feeling (and I am a glass half-full guy) that the tide is turning and eyes are opening. I know a lot of stations and companies are stretching the boundaries of what is possible. It’s just not fast enough nor comprehensive enough. And the internal mindset (especially in sales) is still to focused on Nielsen and “radio revenue.” If we can get people to see what non-radio revenue looks like (and it’s infinitely bigger), maybe they will begin to actually grow their business.

Hi Paul,

Former hedge fund analyst, second generation small market radio owner, DASH attendee and Millennial here.

My clusters as a whole are showing 6% growth. Some “markets” as much as 10-13%.

We dedicate 0 effort to digital or other off air revenue. 100% spot revenue. Majority of the stations don’t even stream or have websites.

While we may not be up as much as the 12.8% you quote for digital when you figure in the difference in margins I’m way ahead when you look at it from a Profit perspective versus a Revenue perspective.

Granted there’s always room for more Revenue growth I just could never figure out why I should dedicate more resources to capture those dollars and dilute my margins. Work 9x harder to make 3x more money?

Perhaps the issue is that we’re not dedicating 100% of our industries resources towards convincing advertisers that plain, old over-the-air spots and sponsorships can be sexy, innovative and highly effective.

It’s great to hear you are doing so well. There are many aspects to your story, including the fact that you are in a smaller market where there may be fewer options available to clients. Spot radio remains a great business, but getting it to grow is hard in many markets. Rate compression is part of it, but also the fact that many sales teams tend to focus on “radio advertisers” instead of growing the radio pie. Maybe this is part of your success.

But the other side of the reality is that the audience is gravitating to online audio, regardless of market. So the question is, should you be serving that portion of the audience, and if so, how can you adequately monetize it? I believe that needs to be part of your overall equation.

The biggest challenge for broadcasters isn’t just monetizing digital, but measuring it. If we had adequate measurement that could be additive to our over the air listening, then the value of this audience would increase. Nielsen has been working on this for some time, but it’s still not ready. Once that happens, then the margins for this audience will increase.

Thanks for the comment, insight, and thanks for attending DASH.