Paul Jacobs is the sales side of Jacobs Media, and helps guide things at jācapps. Over the years, he has made hundreds of sales presentations to our clients, supporting our key formats and the staffs that sell them. Along the way, he has become a great resource, supplying sales managers and reps with marketing materials, articles, and sales pieces designed to further radio’s cause.

Lately, he’s been noticing changes in the retail sales environment. And in today’s guest post, he sounds an alarm for radio as it moves forward in an uncertain sales future. – FJ

Which of the following is the biggest threat to radio?

- Pandora

- SiriusXM

- Apple CarPlay

- Kmart

If you selected one of the first four options, you’d have plenty of company. For years now, radio has known about the impact of new technology and choice on radio listening. As we’ve learned, radio can monitor new media threats, program against them, sell against them, and adapt to them. They are all tangible threats to radio listening and sales efforts.

But Kmart? It’s just another troubled retail outlet, grappling with debt, store closures, and pressures from multiple sources as it struggles to stay in business. And that’s the nature of the threat to radio.

Since the 90s, when the Internet emerged as a new way for consumers to access media and preferred content, a steady stream of invaders in the form of gadgets (smartphones), distribution (connected car), content (Pandora), and listener behavior (on-demand) have emerged that get radio’s juices flowing.

And this is for good reason because gone are the days when radio dominated the audio media environment. Consumers have more choice and control than ever, and the industry needs to continually up its game in order to compete.

But iPhones, satellite radio, and even the Amazon Echo are tangible challenges that radio can see and deal with. So, while we all contemplate “the next big thing” or hot gadget, an even greater threat has been bubbling under the surface, and in the past 90 days has exploded like a volcano.

The existential threat that is right out our windshield is the shuttering of thousands of retail businesses across the country. And unlike challenges created by smartphones or Alexa, where radio can simply commission an app or the “skills,” this latest phenomenon is more complex, more daunting, and potentially more threatening.

Since the beginning of the year, major retailers have closed hundred of stores, signaling deep fissures in their business plans. The store closing count is mind-boggling, and it includes J.C. Penny (138), Kmart (108), Sears (42), Macy’s (68), MC Sports (68), Gander Mountain (32), and others – all throwing in the towel on their retail models and shutting their doors.

You can’t blame these epic fails on the economy, which continues to be robust. Consumer spending is solid, and Americans are in “buy mode.” In fact, the Consumer Confidence Index has been solid into April, reflecting a positive mood.

The problem is that behavior has been shifting away from store purchases and has moved to online commerce. This explains why Amazon’s stock is zooming. Some are predicting that it could hit $1,000/share later this year. And its CEO Jeff Bezos may be on the way to becoming the richest person in the world. You can only give so much credit to Amazon’s sale of 99¢ Kindle books.

Obviously, radio isn’t the only industry being disrupted by technology.

Those of you in commercial radio will look at this list of retailers and note that many of them haven’t spent a lot of money in radio in recent years, so what’s the problem?

Look at it another way – if these retail behemoths couldn’t fend off the Amazon onslaught, how will a small retailer on Main Street in your hometown survive? Look around your local markets and think about all the retail businesses that have closed during the past few years. Chances are, the list is stunning.

Radio’s local revenue base is being challenged, and the ripple effect impacts the entire industry.

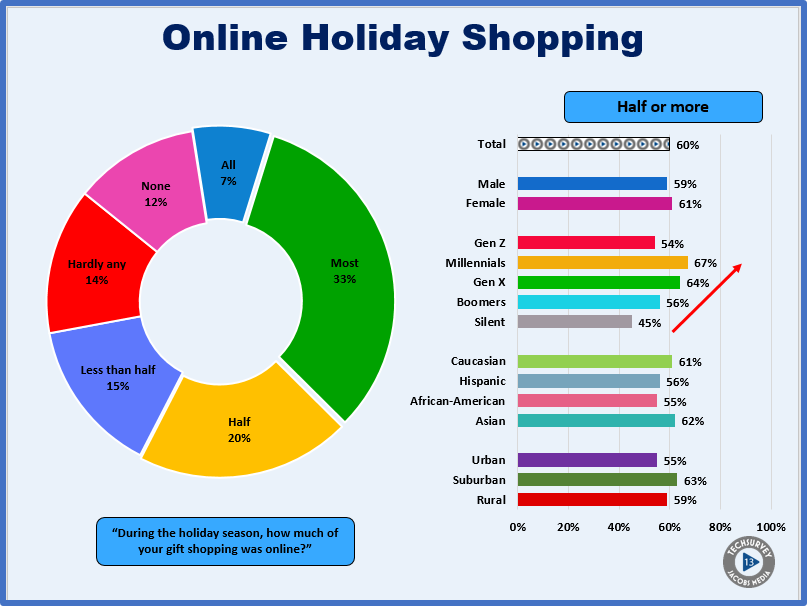

Sensing this, we included a question in this year’s Techsurvey, which fielded back in January/February, following the holiday shopping season. After 13 years of conducting these nationwide web research studies, we are rarely surprised by the data they produce. But in this new study, we were shocked to see the seismic impact of online shopping during the past holiday gift-giving marathon.

Six in ten respondents – your listeners – told us half or more of their holiday shopping took place without them leaving the house. They sat on computers or held mobile devices to accomplish a large share of their gift selection and purchasing. And the other part of the story is that this shift affects all demographic groupings as you can see on the ride side of this slide. Online shopping isn’t just a Millennial phenomenon – more than half of Baby Boomers told us the majority of their holiday purchases was of the ecommerce variety.

Six in ten respondents – your listeners – told us half or more of their holiday shopping took place without them leaving the house. They sat on computers or held mobile devices to accomplish a large share of their gift selection and purchasing. And the other part of the story is that this shift affects all demographic groupings as you can see on the ride side of this slide. Online shopping isn’t just a Millennial phenomenon – more than half of Baby Boomers told us the majority of their holiday purchases was of the ecommerce variety.

We see this here at Jacobs Media and jācapps. Amazon boxes show up every week, containing everything from diapers to snow shovels – items that have always been easily accessible on store shelves. But the advent of Amazon Prime makes it even easier to simply take delivery of basic household goods – as well as shoes, computers, televisions, and laundry tubs.

This behavior signals both a societal and an economic shift that is changing America. These online dollars didn’t go to retailers in your local markets who are advertising with your stations and other media outlets. They went to Amazon and the thousands of online businesses that have tapped into this cultural shopping change.

The threat to local radio is obvious. Hometown retailers are at the heart of the radio business model, and their demise signals a major problem for an industry that is already experiencing declines in national advertising dollars. The health of the local retail economy is paramount to radio’s long-term survival.

So, while financial analysts continue to forecast minimal growth for the radio industry in the years ahead, it’s time to consider a reinvention of radio’s revenue model. Local retailers can’t be stopped from closing, but the industry can shift to follow the money.

Here are some suggestions:

- Redefine the business model. A radio station’s cume is its biggest asset, so instead of selling radio ads, adapt the pitch and base it on the reality that a radio station has thousands of listeners, and they can be delivered in myriad ways – the email database, mobile, stream, podcasts, and video. Not only does this open up different revenue channels, it expands the number of clients that can be pitched. Currently, many radio stations focus on “radio” advertisers, a narrow approach that is a recipe of failure. These retail sales closures isn’t just a blip – it’s a trend. So, expand the field and create products and services that can appeal to a much broader array of businesses, whether they have funds earmarked for radio or not.

- Understand the reality of the data. Check out BIA/Kelsey’s “U.S. Local Advertising Forecast.” The radio industry has carved out a 10.5% share of local revenue. That leaves about 90% of dollars that aren’t earmarked as “radio dollars” – a lot of money to go after. And revenue resides in areas most radio stations have already invested in – online, mobile, and email marketing. They comprise over 25% of local dollars – a significantly deeper pool of bucks radio should be poised to capitalize on. Most stations already have a mobile app, a database, and a solid online presence. Now it’s time to re-craft these approaches to begin to capture where much bigger dollars reside.

- Change the scorecard. The yardstick for radio revenue is ratings, which has generated a little over 10% of local revenue. But the way in which digital platforms are measured and evaluated has nothing to do with ratings. This revenue is based on data and an ROI philosophy that goes well beyond what most radio stations talk about. So in order to tap into these dollars, radio needs to redesign its scorecard and its language. It starts with educating its sales teams on these new metrics and sales approaches. It’s a major leap, but with retailers closing and dollars shifting to these other areas, is there a choice?

- Go into the event business. Radio does a great job of sending its listeners to events owned by others where they spend a lot of money. So why shouldn’t they spend it with you? Once again, it’s redefining the business to one that’s focused on repurposing the cume and moving them to a concert, a food festival, a bridal fair, or a fireworks display where they not only spend money, but have significant sponsorship potential as well. Big companies like Townsquare and smart local operators like Ed Levine (Galaxy Communications) and Vince Benedetto (Bold Gold Media Group) have figured this out. It requires investment, time, and expertise to pull this off, but it is very doable.

- Diversify your business model. Hubbard, Entercom, Federated Media and others have launched digital agencies to not only service existing broadcast clients, but to expand their presence into non-radio categories. Leveraging their institutional knowledge of the audience, advertising, digital, positioning, and the local market counts for a lot, and has significant potential to expand the base of companies that advertise.

- Try some branded content. Another approach is to create different products via a series of podcasts. If the radio industry does one thing well, it’s creating great audio. Branded content has become a big category, and creating podcasts for a specific client or a series that spotlights local retailers is a way of leveraging what radio does best: using the existing distribution model, and expanding beyond simply selling spots.

- B2B. Historically, local radio has done an outstanding job connecting local businesses with listeners who purchase goods and services for themselves and their families. But there are huge dollars in a different category – business-to-business or B2B. Instead of visualizing the audience as individual consumers, think about them as specific groups, like business owners. There are huge dollars from the insurance industry, IT, staffing, legal and more targeting this group, and they’ve gone largely untapped by the radio business. Some stations have figured this out, creating Business Expos and other events, where they sell sponsorships and displays to companies that want to reach business owners.

At its core, radio is a simple business with clear fundamentals. It delivers audience to clients in a very efficient, effective manner. But it’s time to recognize the model is changing, driven largely by a changing consumer mindset and the online retail juggernaut.

Amazon may be redefining America’s retail business model. It’s up to radio to redefine its sales model.

- What Kind Of Team Do You Want To Be? - October 4, 2024

- The Revolution Will Not Be Monetized - August 20, 2024

- BIA’s Rick Ducey:How Radio Can Capture A Bigger Piece Of The Revenue Pie - June 27, 2024

THIS is a brilliant read and has so much quality info that I’m gonna have to read it again…just to grasp it all.

SPOT ON and well done.

Thanks, Dave. Everything is being disrupted, including radio’s (and all media’s) advertising foundation. Now isn’t the time to lay back, but to lean forward, leverage our best assets and strengths, and emerge stronger.

Thank-you Paul, for your and Fred’s ongoing insights and ideas that give greater impetus for radio’s need to move to a position where we’re ahead of the trends.

What will make this article’s insights and ideas most actionable and profitable? By prioritizing what advertisers want before we start focusing on what we can give them.

Gord Borrell’s 2016 SMB Survey states that our advertisers are clamoring for us (“clamouring” for my fellow Canadians) to generate documented advertiser sales results from over-arching marketing strategies – not limited to radio – that transcend our own media-centric, “it’s all about, us, Us, US!!!” pitches that are station budget focused, and not truly client-solution focused.

Money talks louder than words. That’s why systems, strategies, tactics and tools are the means to an end and not the objective – it’s each advertiser’s results that need to be preeminent.

What’s key is radio’s ability to catalyze pre-need, pre-search, pre-purchase consumer activity and play the leading role in this consumer journey, all the way through the purchase to post-purchase.

To take radio to a leadership position in the minds and bank accounts of our advertisers, we need to give them 52 weeks of documented sales results they can measure, with those results directly attributable to the various channels of their media spend.

Using any one or more of the multiple avenues available to do so (document, measure and attribute advertiser sales results), generates more dollars of revenue and profit per hour of prospecting, pitching, closing and servicing.

Thanks for your thoughtful observations, Andy. For fear of being too critical, what’s missing is imagination. The radio industry has invested in multiple distribution platforms – stream, websites, email dbases, apps, etc. – but it keeps conducting business too much like in the past. The result is that the same types of businesses – those that advertise on radio – are the ones that are called on. AE’s at radio stations monitor other stations for leads. That’s what comprises the 10.5%.

A smart AE – and DOS – would focus on where the other 90% of the dollars are going, and utilize the existing platforms listed above to capture those dollars. Simply hoping that radio revenue will grow is not a strategy.

With digital in general taking from traditional your thought on changing the business model is dead on. With radio’s massive reach and smart in house publishing (video playing a heavy role) radio stations can play in the digital space. Investment needs to occur on just how to publish and sell in this space alone and the space that is converged with radio. That is not happening and is scary. Additionally, (I’ve been saying it for 5 years) our greatest threat is Pandora (your #1 up top). As an industry we have brushed them off when in fact this product had broadened the audio spectrum but not the “radio” spend. We have spent no time learning how to sell against them. Big problem! In LA they are taking our people, converging AAS to AQH (through Triton)and are taking 5-10% of many radio buys. Wake up time!

Peter, you’ve been sounding the Pandora alarm for several years now – as we have we in the blog and in Techsurvey. They may on the selling block, but they’re been active in taking away listeners and dollars over the last decade. Thanks for the comment.

Thanks Paul and Fred for reminding the business that they’re not in the same business any more. It’s reminiscient of the mistake made by the railroads in the early 20th century, when they saw themselves in the railroad business and not the transportation business.

Yes, it’s a classic story, almost a cliche. But it’s true. Radio has its hidden strengths—hidden because few people see past the historical model of broadcasting. It takes polite, but in-your-face, stories like this one to create the shift in thinking radio needs.

Jay, thanks for the comment and glad tidings. One of the nice things about being in our position is that we can sometimes see a broader playing field. Despite its strengths and advantages, radio has numerous challenges. Some are easy to recognize because they are direct competitors like SiriusXM. Other, like the decline in retailers due to Amazon, are a little fuzzier. Glad we were able to shine a light on this problem, and hopefully smart people in our business will grab this and run with it. Radio is well-positioned for the future, as long as it doesn’t hold on too tightly to the past.

Great post, Paul. I would add one more threat to the list: Ourselves.

To the points and recommendations you made, if we DON’T make the necessary adjustments to how our sales teams approach revenue development that 10.5% share of local revenue will quickly shrink to single digits…and worse. I will be sharing this with my sales managers.

Dennis, you make an important point, but maybe things are turning. You might have read our post from earlier this week on the vibe at NAB and our perception that there is heightened interest from many people we spoke with – including CEO’s and other leaders – in making some necessary shifts. https://jacobsmedia.com/radio-nab/

It was an energetic event, and the level of discussion was high – lots of big thoughts. We walked away encouraged.

Well thought out

Thanks, Brent.

Paul, as usual, you’re “on it”. This is so clear it’s scary…but in a good way! Thanks for your work on this and many other important topics.

Thanks, Jack. Some days, there’s so much going on it’s hard to see things clearly. On others, the problem is right in front of us. This one struck a chord when I wrote it, and obviously connected with a lot of people like you. Hopefully, this will motivate us to start expanding our vision to grow the business despite the changing business landscape.