jacAPPS President Paul Jacobs has seen and learned a lot since the launch of the company back in 2008. The company’s 800 apps that have been developed for brands worldwide serve as digital Petri dishes for learning about the mobile space and how consumers are adapting to faster, more feature-filled smartphones. In today’s post, he take a hard look at key issues facing radio in its efforts to ‘go mobile.'”

At jacAPPS, one of the most frequently asked questions from clients is, “How do we monetize our mobile apps?”

It’s the right question, but I continue to be befuddled by the way that some radio groups have approached the answer to the most explosive media development in decades – mobile apps on smartphones.

Let’s take a step back. Over the past several years, the smartest people inside and outside of our business have concluded that “being local” is the antidote to digital and beating back pure-play competitors like Pandora and Slacker. No argument from us, but that’s where the dissonance sets in, because at a time when focusing on the local market from both a content and revenue perspective is essential to the industry’s future, why have some of radio’s biggest group owners shied away from locally branded mobile apps in lieu of a centralized approach?

Let’s take a step back. Over the past several years, the smartest people inside and outside of our business have concluded that “being local” is the antidote to digital and beating back pure-play competitors like Pandora and Slacker. No argument from us, but that’s where the dissonance sets in, because at a time when focusing on the local market from both a content and revenue perspective is essential to the industry’s future, why have some of radio’s biggest group owners shied away from locally branded mobile apps in lieu of a centralized approach?

When we go back almost five years ago when Apple’s App Store was launched, it was obvious (to us) that Steve Jobs was giving every brand a major opportunity to grab presence on that digital beachfront property known as the iPhone. General Motors may have its own app, but there are also (in some cases, multiple) apps for their big brands – Cadillac, Chevy, Buick, GMC, OnStar and others.

And when we first put together our own business plan, we looked to radio’s biggest companies as the most obvious sources of revenue for jacAPPS. Big corporations, digital departments, great brands = major app clients. We were wrong.

When it became clear that some broadcasters would opt for single massive, aggregated app that housed all their stations, it seemed like a lost opportunity for three reasons:

- It denies their greatest brands (and fans) the chance to have their own apps.

- It assumes that radio station apps be essentially limited to a streaming function, devoid of personalities, videos, blogs, games, and other features that make brands unique.

- It limits available inventory to just the national app, rather than providing revenue generation opportunities locally.

Our Techsurveys clearly tell us that true fans prefer their favorite stations have their own apps rather than be catalogued in with hundreds or thousands of other stations. Partisans will tell you that the best brands – like Z100, KROQ, KBCO, and scores of others – deserve their own app.

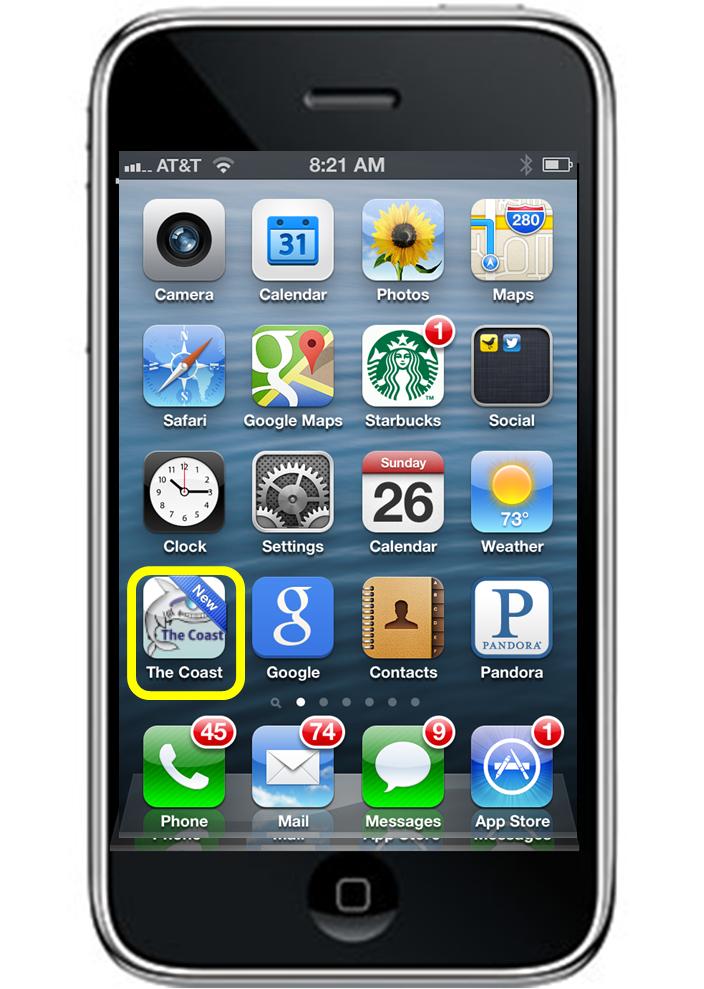

We learned this early on when independently owned KOZT – The Coast in Mendocino – became one of our first jacAPPS clients. When we first downloaded their app and saw a small market station’s app alongside Google, Facebook, Pandora, and iFart, we saw the future of radio in the mobile space.

But from a corporate perspective, mega apps make lots of sense and are clearly driving revenue growth because of their size and scale. They allow their respective companies to aggregate all of the traffic and deliver big boxcar numbers to large national advertisers. But too often, the revenue generated is from the lowest-CPM portion of the mobile revenue pie – banner ads and in-stream ad insertion. This is why the expression, “Trading media dollars for digital dimes” has become popular . . . and true. By taking a “selling by the pound” approach, the biggest players in radio are pulling in the cheapest dollars available.

Worse, their local sales staffs are handcuffed in their attempts to attract Main Street dollars for station apps – because they don’t have one. They’re left to sell “old school” spots, banner ads on their websites, live reads, and remotes at a time when advertisers are rapidly gravitating to digital.

A recent article in Inside Radio provided data that should make every broadcaster nervous. We’ve written repeatedly in this blog and in client memoranda about the importance of the automotive category to radio as its primary listening location as well as its top advertising category. Borrell and Associates’ EVP Kip Cassino is quoted while talking about an upcoming report his firm is readying for release:

“Half of the big six automakers have decided to turn their marketing programs around and go far more into digital than they have in the past. The race to shift dollars to digital, and especially mobile, is the result of rapid changes in car buyer behavior. People are increasingly researching what models they’re interested in on desktops and smartphones.”

This certainly makes the case for why each great radio brand needs its own local mobile strategy. Just as the automakers themselves and individual dealers have launched their own apps, so should every radio company rethink and retool its mobile strategy.

And here’s the other shoe…

If we take a look at the other side of the radio mobile spectrum – Pandora – we learn a great deal about where the mobile space for media is going. Many think of Pandora as a national pure-play platform. Not so fast. Here’s what CEO Joe Kennedy said recently on his investor call regarding Pandora’s plans to ramp up revenue:

“A second important macro trend affecting the business is the attraction of local advertising to digital channels. And because mobile is well suited for local advertising, this segment of our business is growing quickly. A recent report from BIA/Kelsey forecasted a seven-fold rise in mobile local media by 2017 to 9.1 billion from 1.2 billion in 2012, a nearly 50% compound annual growth rate. Our strong listener presence in local radio ad markets combined with our mobile advertising capabilities has accelerated our opportunities to grow our local advertising dollars. Pandora is number one in terms of listening in most local radio markets and we have deployed ad sales people in 28 of the top 40 local markets, to further capture our share of the relevant advertising budgets.”

So, as the biggest players in radio have stayed away from providing local mobile solutions to advertisers, the biggest pure-play audio provider is shifting its focus to local dollars because of a projected seven-fold rise in mobile local media over the next five years.

The good news is that this isn’t a universal strategy for the radio industry. Smaller companies such as Hubbard, Federated, and South Central have created their own versions of digital solutions agencies as separate businesses designed to leverage their expertise in digital, social, and mobile for local advertisers. Entercom, Greater Media, and others have put their emphasis on local mobile revenue and have had some success. And we speak with many other broadcasters every week who read these same metrics. More and more, we are encountering radio companies that have gotten the message that it’s time to provide client solutions and create new revenue through station apps or from the creation of additional single purpose apps that cater to various audience or market segments.

This isn’t about FM chips in cellphones. That’s another tactic that has little application to this conversation. While it may provide a seamless way for consumers to utilize their phones to access local radio stations, it has little to do with the bigger idea of mobile revenue generation. Providing mobile ubiquity, apps that are fun, useful, and simple, and that allow station reps to make money – that’s our emphasis at jacAPPS and Jacobs Media.

This is s a paramount issue about radio’s future. It’s time to ask important questions about radio’s mobile relationship as the industry dives deeper into this space.

Five years into the mobile app revolution, our streams appear to have crossed. The greatest local medium ever is overly focused on a global corporate strategy at a time when a true national competitor is putting its chips on local.

Because that’s where the growth is.

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- The Revolution Will Not Be Monetized - December 30, 2024

- What Kind Of Team Do You Want To Be? - October 4, 2024

Leave a Reply