Paul Jacobs is on a roll. Yesterday’s post about the sweeping change addressed some impressive radio initiatives in the face of the disruption that is impacting the media business. In today’s follow-up, Paul continues his discourse about the “climate change” that is occurring down the hall in the radio sales sector of most stations and clusters. Dress warmly. – FJ

Paul Jacobs is on a roll. Yesterday’s post about the sweeping change addressed some impressive radio initiatives in the face of the disruption that is impacting the media business. In today’s follow-up, Paul continues his discourse about the “climate change” that is occurring down the hall in the radio sales sector of most stations and clusters. Dress warmly. – FJ

Yesterday, I talked about the “climate change” sweeping radio – new innovation, digital initiatives, and a rapidly changing mindset that is beginning to take hold in markets big and small.

But then there’s the sales side of the equation, a department I know only too well.

Like many of you, my knee-jerk reaction to the restructuring of Clear Channel’s sales architecture, leading to the firings of hundreds of sellers was typically cynical and suspicious. My first response was to question their motives, and lament another painful round of industry layoffs and downsizing.

But after further consideration, it may very well be another example of bold experimentation that should be carefully examined. While it’s never a good thing when industry professionals lose their jobs, the climate is changing in revenue creation across the entire media sector. Clear Channel may very well be admitting they can no longer levitate the same structure that’s been in place for decades during these changing times. A room full of salespeople where everyone’s not truly productive, visionary, and connected to these wider industry changes may, in fact, go the way of cart machines and the “Birthday Game.”

Ironically, the release of Nielsen’s Catalina Solutions study (that Clear Channel helped roll out) “crack the code” when it comes to proving the ROI of radio advertising. But it will take smart, savvy storytellers in the sales department to bring that study to life, make the case, and optimize those findings.

Like the weather, the advertising climate is changing, too. The RAB and other industry experts project that revenue for radio will be flat or up slightly over the next several years. At the same time, industry analyst Gordon Borrell notes that digital revenue for radio was up 15% in 2013, and is projected to increase 22% this year, with the average radio station generating $166,490 in digital dollars – a paltry 3% of overall revenues. The swamis at BIA Kelsey prophesize that by 2017, digital ad spending will jump over 27% in local markets.

Like the weather, the advertising climate is changing, too. The RAB and other industry experts project that revenue for radio will be flat or up slightly over the next several years. At the same time, industry analyst Gordon Borrell notes that digital revenue for radio was up 15% in 2013, and is projected to increase 22% this year, with the average radio station generating $166,490 in digital dollars – a paltry 3% of overall revenues. The swamis at BIA Kelsey prophesize that by 2017, digital ad spending will jump over 27% in local markets.

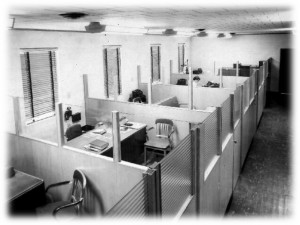

Yet, as it stands today, when we walk into too many radio stations, the sales departments appear to be structured along traditional lines. Virtually all of their resources from managers to salespeople are concentrated on the chunk of the business that isn’t growing. It is often about cubicles of salespeople managing account lists of “radio” advertisers, talking to “radio” media buyers who are utilizing “radio” ratings.

It’s pretty easy to predict the results, as the RAB and others are reporting.

And since only a small percentage of the local sales staff has the skill set necessary to effectively position and market non-radio assets, perhaps a refocusing of resources, training, structure, and leadership should be considered by more companies than just Clear Channel.

In other words, the advertising climate has changed, but in most cases, the radio station sales structure is too often very 1985.

That’s why Clear Channel’s move needs to be watched and evaluated carefully. While other broadcasters cannot leverage assets like Katz or iHeartRadio, it doesn’t take a meteorologist to know that allocating the majority of a station’s (or a cluster’s) sales focus to an area of flat growth makes little sense.

Concurrently, there is growing discussion about automated media buying. While radio sellers still play a key role in this process, the potential exists for automation to further decrease the need for a full complement of salespeople, focused on radio revenue generation moving forward.

Every other department inside radio stations has undergone sweeping change – some painful and some invigorating. Dollars are shifting to digital, and there’s no evidence that trend is going to abate.

Focusing primarily on advertisers with a “radio budget” is a no-growth strategy. Ramping up digital sales and solutions is where the growth is now, and will be down the road. Sales managers who spend their time predicting where the radio market will be in 2015 are missing sources of new dollars and new clients. And sellers trained to put together bar night promotions and hit the CPP goal are going to keep recycling from station to station, because their income isn’t going to increase.

Look outside and check the radio barometer. The pressure points have changed. Radio needs to adjust quickly. Instead of simply hiring and firing weak and ineffective sellers of radio, why not go out and find, train, and grow effective digital sellers and managers?

The industry’s innovation on the programming and content side of the building is taking flight. Now it’s time for sales to earn a seat at that table. Because we can’t effectively have one without the other.

Climate change in radio shouldn’t be a forecast for a cold and stormy outcome.

That said, anybody want to buy a used snow blower from a frigid Michigan winter?

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- The Revolution Will Not Be Monetized - December 30, 2024

- What Kind Of Team Do You Want To Be? - October 4, 2024

“…the advertising climate has changed, but in most cases, the radio station sales structure is too often very 1985.”

So has the listening environment, but in most cases, the radio station programming structure is also very 1985, but with 1/3 the number of people that were there in back ’85.

I appreciate Paul’s highlighting of the strong players in radio reinvention, but can’t help but be struck by a couple of things. First, if yesterday’s examples are the best. most impactful responses to “climate change”, radio is tilting at digital windmills. They struck me as the equivalent of citing three local power plants experimenting with natural gas and a neighbor driving a Tesla as examples of addressing climate change head on. All were good and worth doing, but if these are the “show winners”, radio isn’t IMO, dealing with a rapidly changing environment enough to have any measurable impact on listening or revenue.

As for the sales aspect, I’ll let Clear Channel’s mass firings and their impact play out and speak for themselves over time. Is there anyone who has looked at the numbers who doesn’t know that Clear Channel will go through some sort of bankruptcy when that big balloon comes due in 2016? The key players just want to be able to say they tried everything when that happens. Many of us have been there before and its really all anyone can do.

As for radio’s digital efforts…radio doesn’t really have a meaningful digital platform. There isn’t enough media value to warrant a huge sales commitment because you can’t really solve many client problems with a crappy website (how far can promotion pics from 2012 and babe of the day pics take you?) and an app that lets you listen to a poorly processed live terrestrial stream with awkward cut ins at every stop set. And from what I can see, that’s the extent of most radio cluster’s digital efforts. I don’t think even the best digital sellers can dress that up enough to impact revenue meaningfully.

When the product is basically still 1985, its not surprising or even wrong for the sales structure to reflect it. Whatever anyone feels about the real “climate change”, if radio is facing something of global, game changing magnitude, it hasn’t reacted appropriately.

I wonder if this climate change series underscored how “day late and dollar short” radio’s reaction to “climate change” has been more than highlight the results of its effort.

You can’t reach the stars by standing on a couch…

Bob, I appreciate the cynicism and frustration throughout your comment. As you know, I have a huge supply of those same emotions. But I think you also have to recognize the changes that are being made – albeit many are late. Radio is turning the digital corner in terms of overall usage. Maybe a lot of listening is driven by habit, especially be Gen X and older audiences, but consumers are finding radio on digital platforms. Clearly, the industry has been held back by its own reluctance, but a big factor has been the measurement piece. As we’ve stated umpteen times in this space, it is difficult to monetize what you can’t measure. Hopefully, a corner is being turned. Thanks as always for taking the industry – and us – to task.

For the record, I didn’t intend to take you, Paul or Jacobs Media to task here. You are the only vendors to radio that I know of who are willing to take the industry to task and hold their feet to the fire with respect to digital applications and overall strategy. And you bring solutions like DASH to the table rather than just criticize. Its telling that none of radio’s CEOs thought DASH was important enough to attend. As Cleveland sports fans repeat all too regularly, “…maybe next year…”

Thoughts for the kudos, but just saying that both David Field and Peter Smyth were in attendance and keynoted. We hope to add more this year. We appreciate the passion, Bob.

Kudos to them both for having the vision to participate at the level they did. And I stand humbly corrected 🙂

Bob,

Well thought-out and passionate, and I expected nothing less.

The point of these two posts was to point out that radio isn’t standing still in some areas, but is lagging behind in others. Too often we see viable programming, digital, and event strategies go unsold. Too often we see programming research and staff budgets cut because a station with good ratings isn’t hitting their number.

So while we can discuss the quality of some of these efforts (and would probably agree more often than not), nothing matters until we have a sales philosophy and structure that can take advantage of it.

And I’m not defending Clear Channel (you know me better than that). Nor am I suggesting that other broadcasters follow suit. I am suggesting that we should give strong consideration to re-allocating our resources, so instead of 10 radio salespeople, maybe we reduce that number to 7 and replace them with a digital sales structure.

And at worst, maybe we can move the needle.

Thanks, as always for great comments.

I would feel a lot better if the “innovations” referenced yesterday in Part 1 were producing the Digital Products needed to capture more of the shifting revenue talked about here in Part 2,

Who is doing research & development into new digital products and businesses that can leverage the broadcast arm to kickstart it’s growth? (HD/Next dont count as they are overlays on the existing the business which will not drive substantial digital rev growth)

Certainly some groups must be producing something more than website slots for banner ads and in stream spot replacements?

Yes?

Jeff,

You make great points, which is why yesterday we listed several independent companies who are doing what you suggest. Radio needs to up its digital game – CPM’s for banner ads are pennies. The big wins will come from creating digital products and digital content that’s relevant and appealing to the audience, but also that can be monetized.

There’s no silver bullet. Hopefully conversations like this will stir things up and many will start thinking about the way we’re going about things differently.

No question on a need to up radio’s digital game; but what we see are efforts to do it on radio’s terms, with little effort, and to hold the expense.

Paul, your relationship with jacAPPS gives you first hand knowledge on this: It’s not “how” much change but the velocity of change which cause most problems. When this “speed of change” is met with half-hearted attempts to show radio is “digital,” the product is poorly received and little revenue will be generated. Then, radio people point to how digital doesn’t work.

Radio needs to lose its broadcast perspective. Realize that, by coupling with digital, more money can be made from reaching fewer people when you focus on “who” is reached. You can do this through audio ads as well banner ads.

From a campaign I managed, over 1 year’s time we:

Dropped monthly impressions by 13.5 million

Drove Cost per Conversion down – $303.99 to $35.74

Reduced monthly campaign cost of $6,080 by 33.5% ($4,038)

Less money was spent. More product was sold. 33.3% fewer people sampled the product. (But, with the broadcast mindset being absent, they were the right people to reach.) A matrix outlining this campaign is at https://audiographics.com/gallery/month-2-month.htm

New media dollars – in many cases – are made from post-campaign analysis, or providing mid-campaign ROI assessments to improve response.

Analyzing data is the key. Look at the wide variety of tools Google AdWords (or Microsoft Ad Center) supplies as they hold the hand of advertisers. (Does radio have a place where it instructs local advertisers in the best ways use radio for advertising? I’ll save you the time searching. It does not. Though, the industry does have many places shouting 93% of Americans listen to radio each week – it doesn’t matter anymore.)

To stay with the “velocity of change” requires constant studying and revamping what you’ve built. Unfortunately, what radio is doing barely answers this call. Cutting staff farther is not helping. Unless, staff who understand digital is brought in to replace those cut loose.

Ken, great observations.

I think we can agree that it’s challenging for legacy businesses to reinvent themselves quickly, and radio is no exception. For 8 decades, we’ve been structured and focused a certain way, while competitors (Google, Pandora, etc.) have a single focus and start with a clear mission with no heritage to dispense with.

But that’s no excuse. When I look at the projections for digital revenue, coupled with the power to create new types of solutions for advertisers, I salivate. As importantly, this breaks the grip that ad agency media buyers who control radio dollars has on our industry.

Your comment about the importance of data is also significant. The advertising world is rapidly moving to mass customization and data-driven structures. Yet, radio’s digital platforms currently aren’t designed this way in many cases – they’re designed to push out information.

While the radio industry could really use an infusion of capital for R&D, it also needs to invest in changing its orientation, because once we truly understand the power of digital platforms, and then augment them with our traditional business platform and leverage the cume, we can be unstoppable.

In a related story, I found it interesting that the NAB and FCC ruled digital radio is not a threat yet to traditional radio in local markets. I think that ruling makes total sense and also highlights the greatest area for potential growth. Digital locally. I think that is certainly something to ponder.

Gary, we are in total agreement. It’s inevitable that listening and other forms of engagement with radio stations is going to gravitate to digital platforms and delivery systems. Why should radio be any different than all other media. So the opportunity is to embrace it, and restructure the approach, people, and assets to actually take advantage of this.

Digital isn’t a threat to radio. They are an opportunity.

Amen… Good stuff .. Can’t wait to see what they do. Pittmans a great forward thinking operator ..

I’ll buy the blower if it’s bob seegars used one 🙂

Good article I remember the seminars you used to give to us at the peak in denver a decade ago back in my marketing director days

It’s an app world now

Best

Fc

Fc

Frank, thanks for touching base and for the kind comments. All the best.

Thanks, Frank. Believe me, Bob’s got his own snow plowing service.

Great to hear from you and thanks for the comment.