For the past two days, JacoBLOG has engaged radio programmers and air talent – that is, content creators – in topics that generated much discussion, comments, on this site and in social media.

Brand uniqueness and the perils of too much talk are sure-fire conversation starters in radio because done well, they can generate competitive ratings. When they’re botched or overlooked, most stations under-perform and often disappear altogether.

And then there’s the sales side. And that’s the end of the building (when it’s occupied, that is) we’re focused on in today’s post. After decades of consistently high revenues, radio broadcasters have faced major challenges when it comes down to generating sales, and in many cases, profits. That suggests the radio broadcasting business model – like everything else these days – requires analysis, scrutiny, and innovative solutions.

And then there’s the sales side. And that’s the end of the building (when it’s occupied, that is) we’re focused on in today’s post. After decades of consistently high revenues, radio broadcasters have faced major challenges when it comes down to generating sales, and in many cases, profits. That suggests the radio broadcasting business model – like everything else these days – requires analysis, scrutiny, and innovative solutions.

And that’s my cue to get out of the way, and hand the keyboard over to my brother Paul, the guy in our company who’s had his eye on the sales ball since joining the company nearly three decades ago.

Way back when Grunge was in vogue, Paul convinced me that every programming consultancy would one day need a sales/marketing specialist. It’s one thing to enjoy great ratings; even back then, those elusive power ratios often tell the story of a station that punches above its weight as well as brands that never seem to live up to their potential. – FJ

“It has been my experience that folks who have no vices have very few virtues” – Abraham Lincoln

Well, given what’s happening in American culture these days, people have no shortage of vices, so there must be lots of virtue out there.

In the world of radio broadcasting, we can use all the virtue we can get – and vices may be the road to prosperity – or ruin.

Let’s go back a few short months ago to the days and weeks leading up to the election. Thanks to the hottest of presidential races and many statewide and local contests of interest, political ad spending reached all-time highs. Let’s not forget to give a round of applause to our extremely divided electorate, another reason why the dollars kept flowing.

And as we covered here in JacoBLOG during those frantic days of crazy money campaign spending, radio ended up getting an outsized share of revenue from the political arena, specific campaigns and lots of PACs. The end result for many stations and their parent companies, was a better-than-expected Q4 as a springboard into a more hopeful 2021.

Political ad spend was up in virtually all sectors, including chasing Latino and African American voters. To that point, Entravision announced yesterday its total take from the 2020 election was an astonishingly good $28 million – a 67% increase from 2012’s level of $17 million. The reaction from the company’s CEO, Walter Ulloa, was “really surprised” by this fortunate boost in political advertising on his television and radio properties. I’m sure his peers shared his elation but also being caught off guard by this robust ad spend.

Political ad spend was up in virtually all sectors, including chasing Latino and African American voters. To that point, Entravision announced yesterday its total take from the 2020 election was an astonishingly good $28 million – a 67% increase from 2012’s level of $17 million. The reaction from the company’s CEO, Walter Ulloa, was “really surprised” by this fortunate boost in political advertising on his television and radio properties. I’m sure his peers shared his elation but also being caught off guard by this robust ad spend.

Most other broadcasters cleaned up, too. Entercom reported $32 million in political revenue for 2020 – and a whopping $19 million in Q4. That was bolstered by their ownership of Atlanta radio stations in the period leading up to those Georgia Senate races that were decided in early January.

This reversal of fortune for radio’s 2020 performance couldn’t have come at a better time after experiencing The. Worst. Year. Ever. up to that point. But that doesn’t change the consternation and concern about how 2021 will play out. Analysts from all walks of life are expecting a COVID snapback – a broad-based recovery that should bode well for all media – including radio broadcasters.

One of the long-lasting costs of the pandemic will be the loss of a large number of local retail businesses. While mega-retailers like Target, Walmart, Amazon and others were able to turbocharge their businesses thanks to well-established e-commerce platforms, smaller retailers who were dependent on building store traffic suffered. Many aren’t coming back. Just take a drive through a strip mall or downtown area, and they are dotted with empty stores where once-burgeoning retail businesses once existed.

And of course, many of those businesses used to advertise on the radio.

Throughout 2020, one of the most frequent questions I heard from our clients as we were collectively trying to sort through the confusing early days of the pandemic was this one:

“What categories are spending money?”

Last spring, it was primarily home improvement, HVAC, hardware stores, electronics stores, and other businesses that could make living and working from home more pleasant. Gone were events, shopping malls, concerts, and the traditional core radio advertisers. Stations were looking for a lifeline, and there wasn’t one.

Fast-forward to today, and while it definitely feels like there’s a recovery underway, that same question remains.

And that’s why we could be entering a period where weed and wagering come to radio’s rescue. At least for now.

That brings up an interesting set of circumstances – revenue from perhaps unlikely or new platforms – both based around some of those vices that Lincoln opined about.

A couple of years ago, Fred and I were in Las Vegas for CES, and couldn’t believe how the outdoor advertising landscape had radically changed in the eight months after the NAB Show in April.

in the eight months after the NAB Show in April.

Usually, the billboards blaring Cirque du Soleil, David Copperfield, Siegfried & Roy, and lots of strip clubs dominated the skyline. But this time around, there was a distinct advertising shift.

We couldn’t believe how many ads we saw on billboards and taxis for legal pot. It seemed like this deluge of cannabis-infused advertising seemed to take place virtually overnight. We joked at the time we should buy stock in outdoor companies, because they were enjoying an amazing windfall.

We would have been smarter to have invested in weed futures.

Of course, for radio broadcasters here in the U.S., the road to selling ads for legal marijuana is fraught with peril. There is ambiguous “guidance” from the FCC, and like legality in general, the states will all have their say. The RAB has tackled this issue, and I’m linking their resources here.

The rules on advertising vary wildly state-by-state and there are federal issues as well, so we strongly suggest checking with your legal counsel before doing anything so you don’t get busted 😊.

But given what we saw in Las Vegas with outdoor advertising, it’s only a matter of time before the floodgates open. When they do, it could be party time for the radio industry.

And here’s a fun fact: radio listeners smoke pot.

And here’s a fun fact: radio listeners smoke pot.

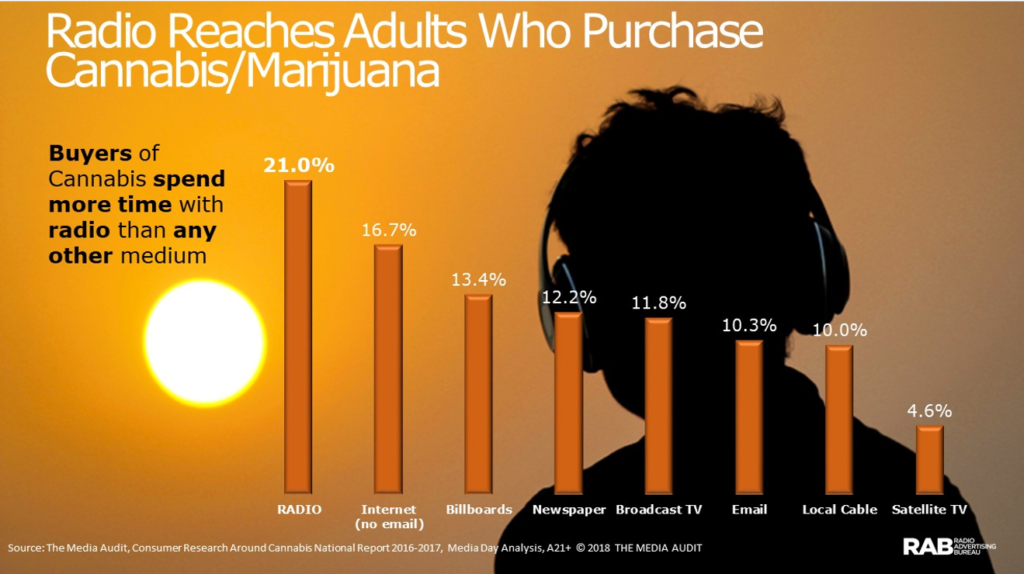

According to the 2018 Media Audit (left), buyers of marijuana spend more time listening to the radio than any other medium – my hunch it’s Classic Rock stations that still play a lot of Pink Floyd, but that’s just me. But at least radio has a strong qualitative pitch.

(I always knew the psychographic sell – or is it psychedelic – would come in handy.)

And let’s not forget about our other vice – gambling. Talk about an industry that has a lot of upside.

Last week, I was listening to a local radio station and heard an amazing stopset, comprised of three gambling websites and the Michigan Lottery (so much![]() for advertiser separation).

for advertiser separation).

And then I turned on the TV to watch a Pistons game and the broadcast was littered with sports betting companies, including the casinos (MGM Grand and Golden Nugget) and platforms like Fan Duel and DraftKings, all asking me if I wanted to bet on who will make the next dunk, the shooting percentage of the visiting team, the over/under on the game, and other arcane ways of separating me from my money.

Finally, there were the ads encouraging me to play Blackjack on my phone with the local casino once the game ended.

Obviously, sports betting and online gaming have come to Michigan in a big way. In fact, in the ten days after its launch in late January, Legal Sports Reports says $115 million was spent (and probably lost) on these betting platforms.

Reports says $115 million was spent (and probably lost) on these betting platforms.

Here in “The Mitten,” we can also play casino games and slots on some of these apps, so you can only imagine how much money is being spent on advertising them.

All this competition for “betting bucks” means more marketing, and broadcast radio is already jockeying for position.

So is radio’s financial future tied to long stopsets loaded with ads for bogarting and betting?

Should we start running sponsored promotions at 4:20? Weed Wednesdays? Fantasy Sports Fridays? Two Joints For Tuesday (with Sublime as the soundtrack)?

During this moment in time, radio broadcasters should grab every one of these dollars it can. But the larger lesson is that the industry can no longer depend on its old business model of local retail ad revenue if it wants to do more than just gasp to the next quarter.

Gambling and pot dollars (along with the political windfall some markets just experienced) are “steroids” – they pump things up for a while but eventually wear off.

And watch out for those side effects.

The radio broadcasting industry needs to come to grips with the reality that local ad revenue was heading downward pre-pandemic, and there’s no evidence it’s going to rebound quickly when COVID is in the rear-view mirror. And while dollars from politics, gambling, and pot are welcome new carloads of cash, let’s not forget the dot.com bubble in the late ’90s and other short-term windfalls the radio broadcasting industry has experienced – until those markets were saturated or crashed.

But here’s where virtue comes in.

No industry is as better positioned to pivot and adapt as radio, and we’re seeing it in so many forms. Radio companies are creating or buying their own digital advertising agencies.

Some are purchasing eSports teams (Beasley’s Houston Outlaws), streaming companies (iHeart’s Triton Digital), and podcast companies by the pound (Entercom purchased Podcorn yesterday for north of $22 million).

And in keeping with the theme of today’s post, Urban One is going into the casino business. They’re opening ONE, a casino complex in the Richmond, Virginia, area. As CEO Alfred Liggins summed up the deal, “We stand ready to work with the city. Our proposal can’t be matched.”

Each of these moves is a clear statement from these once radio-centric companies that diversification is key to long-term revenue growth. The business model for radio is changing as you read this post.

So our advice to radio is to scoop up as many gambling and marijuana ads as it (legally) can. But recognize them for what they are – a feel-good salve but something that ultimately doesn’t heal.

A long-term revenue strategy – and perhaps a revamped, rejuvenated, and reimagined business model for what could be a the Roaring 2020s – is a tough task many radio companies need to face, sooner rather than later.

That’s a lot to think about.

What’s the over/under for radio revenue for 2021?

Rather than wagering on it, let’s work to make it happen.

- For Radio, Will It Be Christmas In April (And Hopefully, May)? - April 21, 2025

- The Revolution Will Not Be Monetized - December 30, 2024

- What Kind Of Team Do You Want To Be? - October 4, 2024

I suspect at least one reason radio is favored by cannabis consumers is that many who partake do so in order to enhance the experience of being passive. If you’re in that state, what’s easier than just turning on your favorite radio station and letting it play on? And on and on.

Hence my reference to Pink Floyd in the post, John. What better music is there to lay back and enjoy?

Thanks for reading our blog.